Question: please do in excel and show how you got the answer in excel Below is financial informantion for 2020 for the Carry Corp. The company

please do in excel and show how you got the answer in excel

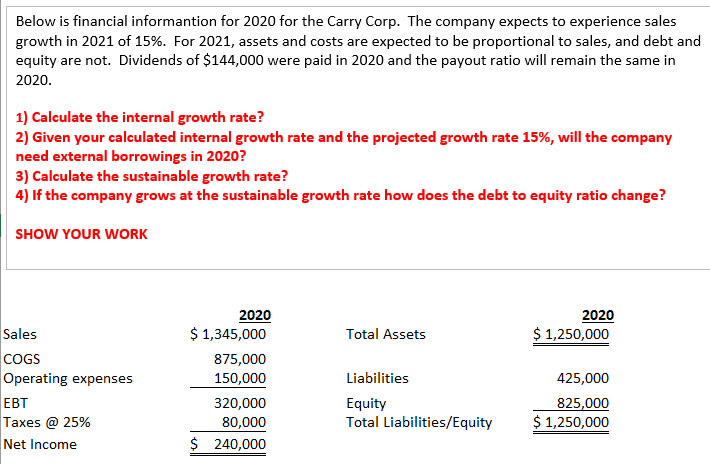

Below is financial informantion for 2020 for the Carry Corp. The company expects to experience sales growth in 2021 of 15%. For 2021, assets and costs are expected to be proportional to sales, and debt and equity are not. Dividends of $144,000 were paid in 2020 and the payout ratio will remain the same in 2020. 1) Calculate the internal growth rate? 2) Given your calculated internal growth rate and the projected growth rate 15%, will the company need external borrowings in 2020? 3) Calculate the sustainable growth rate? 4) If the company grows at the sustainable growth rate how does the debt to equity ratio change? SHOW YOUR WORK Total Assets 2020 $ 1,250,000 Sales COGS Operating expenses EBT Taxes @ 25% Net Income 2020 $ 1,345,000 875,000 150,000 320,000 80,000 $ 240,000 Liabilities Equity Total Liabilities/Equity 425,000 825,000 $ 1,250,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts