Question: please do in excel and show how you got the answer in excel Pear Inc. has $300 million of bonds at par value outstanding. The

please do in excel and show how you got the answer in excel

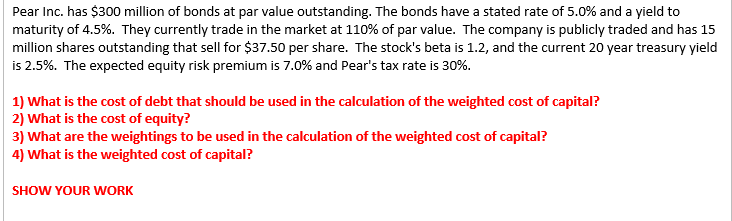

Pear Inc. has $300 million of bonds at par value outstanding. The bonds have a stated rate of 5.0% and a yield to maturity of 4.5%. They currently trade in the market at 110% of par value. The company is publicly traded and has 15 million shares outstanding that sell for $37.50 per share. The stock's beta is 1.2, and the current 20 year treasury yield is 2.5%. The expected equity risk premium is 7.0% and Pear's tax rate is 30%. 1) What is the cost of debt that should be used in the calculation of the weighted cost of capital? 2) What is the cost of equity? 3) What are the weightings to be used in the calculation of the weighted cost of capital? 4) What is the weighted cost of capital? SHOW YOUR WORK

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts