Question: please do in excel spreadsheet alone formula label number. Page > of 3 Homework #8 Dividend Policy 1. (40 points) The firm below intends to

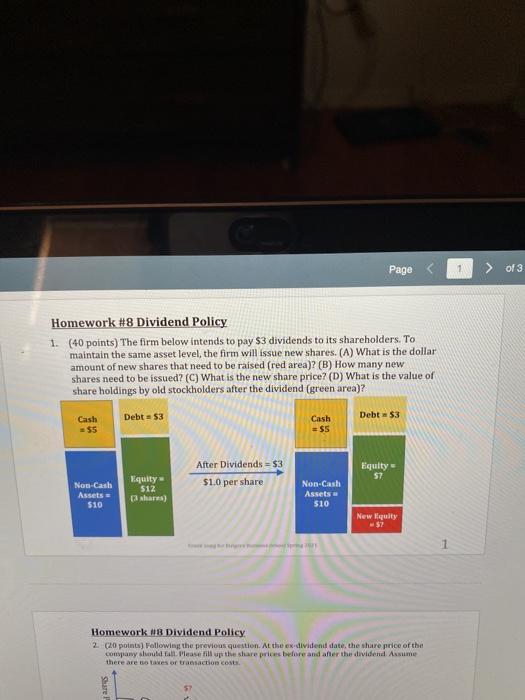

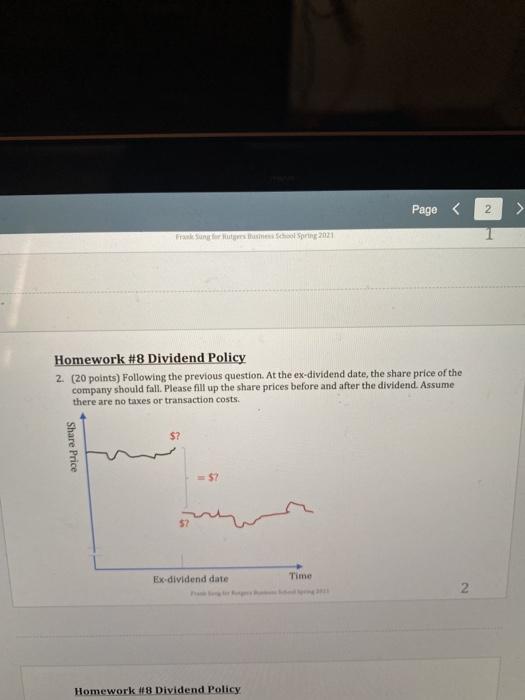

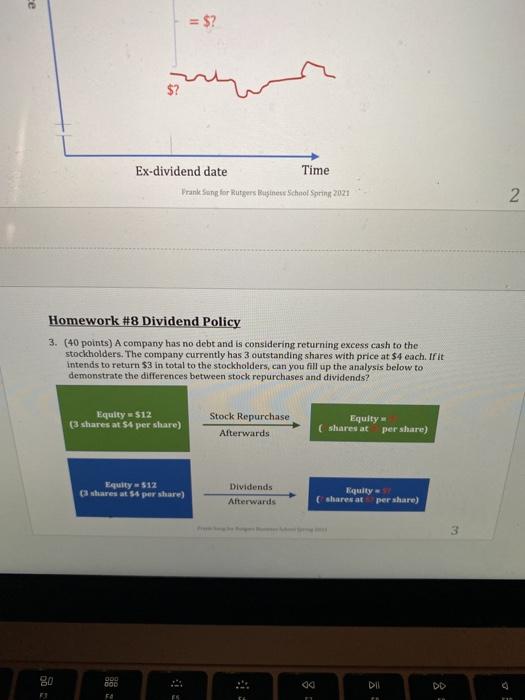

Page > of 3 Homework #8 Dividend Policy 1. (40 points) The firm below intends to pay $3 dividends to its shareholders. To maintain the same asset level, the firm will issue new shares. (A) What is the dollar amount of new shares that need to be raised (red area)? (B) How many new shares need to be issued? (C) What is the new share price? (D) What is the value of share holdings by old stockholders after the dividend (green area)? Cash Debt = $3 Cash Debt $3 =$S After Dividends $3 $1.0 per share Equity 57 Equity Non-Cash Assets $10 512 Non-Cash Assets $10 New quity - 1 Homework #8 Dividend Policy 2. (20 points) Following the previous question. At the ex dividend date the share price or the company should all. Please fill up the share prices before and after the dividend Assume there are so taxes or transaction costs. SF ce = $? $? Ex-dividend date Time Prank Song for Rutgers Business School Spring 2021 2 Homework #8 Dividend Policy 3. (40 points) A company has no debt and is considering returning excess cash to the stockholders. The company currently has 3 outstanding shares with price at $4 each. If it intends to return $3 in total to the stockholders, can you fill up the analysis below to demonstrate the differences between stock repurchases and dividends? Equity $12 (3 shares at S4 per share) Stock Repurchase Afterwards Equity (shares at per share) Equity 512 (3 shares at $4 per sbare) Dividends Afterwards Equity (shares at pershare) 3 200 DOD od

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts