Question: Please do in Excel. Thank you Three mutually exclusive earth-moving pieces of equipment are being considered for several large building projects in India over the

Please do in Excel. Thank you

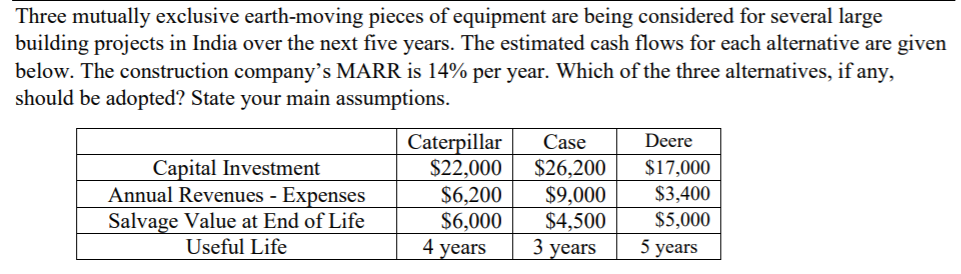

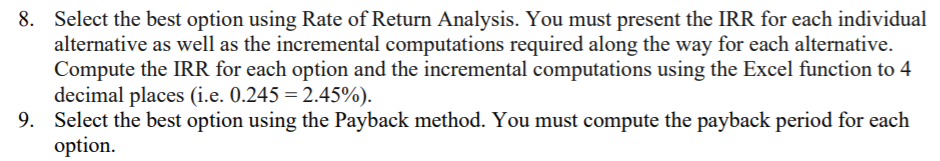

Three mutually exclusive earth-moving pieces of equipment are being considered for several large building projects in India over the next five years. The estimated cash flows for each alternative are given below. The construction company's MARR is 14% per year. Which of the three alternatives, if any, should be adopted? State your main assumptions. Capital Investment Annual Revenues - Expenses Salvage Value at End of Life Useful Life Caterpillar $22,000 $6,200 $6,000 4 years Case $26,200 $9,000 $4,500 3 years Deere $17,000 $3,400 $5,000 5 years 8. Select the best option using Rate of Return Analysis. You must present the IRR for each individual alternative as well as the incremental computations required along the way for each alternative. Compute the IRR for each option and the incremental computations using the Excel function to 4 decimal places (i.e. 0.245 = 2.45%). 9. Select the best option using the Payback method. You must compute the payback period for each option. Three mutually exclusive earth-moving pieces of equipment are being considered for several large building projects in India over the next five years. The estimated cash flows for each alternative are given below. The construction company's MARR is 14% per year. Which of the three alternatives, if any, should be adopted? State your main assumptions. Capital Investment Annual Revenues - Expenses Salvage Value at End of Life Useful Life Caterpillar $22,000 $6,200 $6,000 4 years Case $26,200 $9,000 $4,500 3 years Deere $17,000 $3,400 $5,000 5 years 8. Select the best option using Rate of Return Analysis. You must present the IRR for each individual alternative as well as the incremental computations required along the way for each alternative. Compute the IRR for each option and the incremental computations using the Excel function to 4 decimal places (i.e. 0.245 = 2.45%). 9. Select the best option using the Payback method. You must compute the payback period for each option

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts