Question: please do it accurately donot copy paste and donot use chat gpt also give supporting examples for all parts do all parts with examples -

please do it accurately donot copy paste and donot use chat gpt also give supporting examples for all parts

do all parts with examples

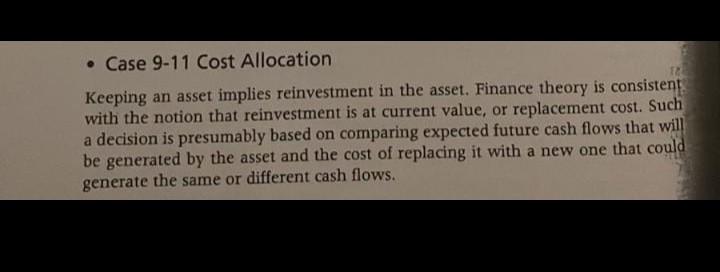

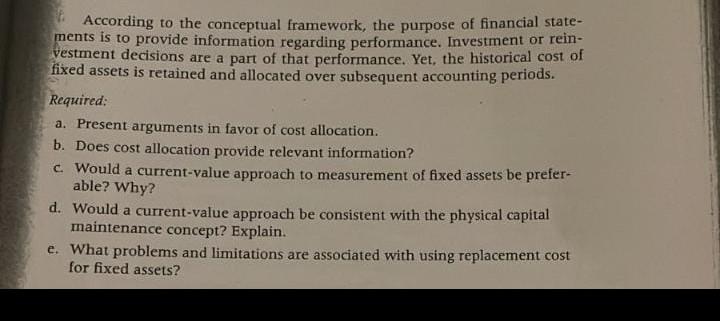

- Case 9-11 Cost Allocation Keeping an asset implies reinvestment in the asset. Finance theory is consistent with the notion that reinvestment is at current value, or replacement cost. Such a decision is presumably based on comparing expected future cash flows that will be generated by the asset and the cost of replacing it with a new one that could generate the same or different cash flows. (f) According to the conceptual framework, the purpose of financial statements is to provide information regarding performance. Investment or reinvestment decisions are a part of that performance. Yet, the historical cost of fixed assets is retained and allocated over subsequent accounting periods. Required: a. Present arguments in favor of cost allocation. b. Does cost allocation provide relevant information? c. Would a current-value approach to measurement of fixed assets be preferable? Why? d. Would a current-value approach be consistent with the physical capital maintenance concept? Explain. e. What problems and limitations are associated with using replacement cost for fixed assets

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts