Question: please do it all and send back in excel form if possible Portfolio Modeling Exercise due 10/26 Step 1 = select 10 stocks to perform

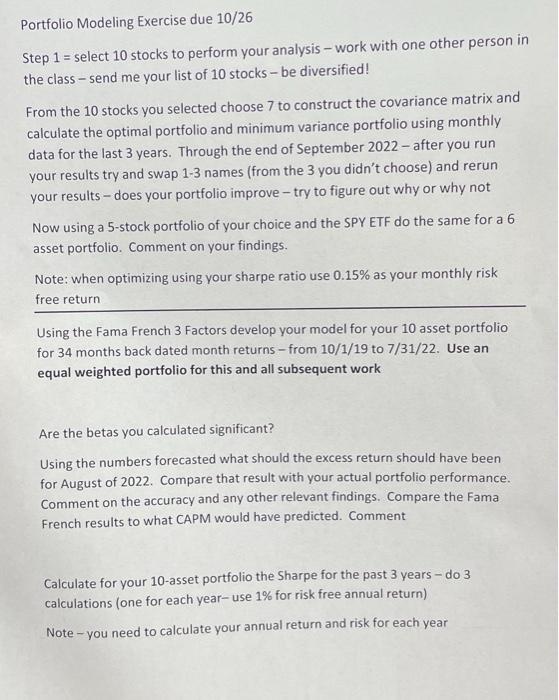

Portfolio Modeling Exercise due 10/26 Step 1 = select 10 stocks to perform your analysis - work with one other person in the class - send me your list of 10 stocks - be diversified! From the 10 stocks you selected choose 7 to construct the covariance matrix and calculate the optimal portfolio and minimum variance portfolio using monthly data for the last 3 years. Through the end of September 2022 - after you run your results try and swap 1-3 names (from the 3 you didn't choose) and rerun your results - does your portfolio improve - try to figure out why or why not Now using a 5-stock portfolio of your choice and the SPY ETF do the same for a 6 asset portfolio. Comment on your findings. Note: when optimizing using your sharpe ratio use 0.15% as your monthly risk free return Using the Fama French 3 Factors develop your model for your 10 asset portfolio for 34 months back dated month returns - from 10/1/19 to 7/31/22. Use an equal weighted portfolio for this and all subsequent work Are the betas you calculated significant? Using the numbers forecasted what should the excess return should have been for August of 2022. Compare that result with your actual portfolio performance. Comment on the accuracy and any other relevant findings. Compare the Fama French results to what CAPM would have predicted. Comment Calculate for your 10-asset portfolio the Sharpe for the past 3 years - do 3 calculations (one for each year-use 1% for risk free annual return) Note - you need to calculate your annual return and risk for each year Portfolio Modeling Exercise due 10/26 Step 1 = select 10 stocks to perform your analysis - work with one other person in the class - send me your list of 10 stocks - be diversified! From the 10 stocks you selected choose 7 to construct the covariance matrix and calculate the optimal portfolio and minimum variance portfolio using monthly data for the last 3 years. Through the end of September 2022 - after you run your results try and swap 1-3 names (from the 3 you didn't choose) and rerun your results - does your portfolio improve - try to figure out why or why not Now using a 5-stock portfolio of your choice and the SPY ETF do the same for a 6 asset portfolio. Comment on your findings. Note: when optimizing using your sharpe ratio use 0.15% as your monthly risk free return Using the Fama French 3 Factors develop your model for your 10 asset portfolio for 34 months back dated month returns - from 10/1/19 to 7/31/22. Use an equal weighted portfolio for this and all subsequent work Are the betas you calculated significant? Using the numbers forecasted what should the excess return should have been for August of 2022. Compare that result with your actual portfolio performance. Comment on the accuracy and any other relevant findings. Compare the Fama French results to what CAPM would have predicted. Comment Calculate for your 10-asset portfolio the Sharpe for the past 3 years - do 3 calculations (one for each year-use 1% for risk free annual return) Note - you need to calculate your annual return and risk for each year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts