Question: Please Do it as per IFRS format P15.12A ( LO6) AP Three different lease transactions are presented below for Manitoba Enterprises. Assume that all lease

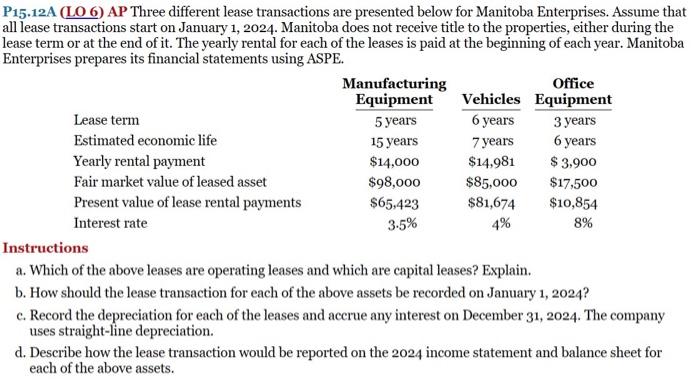

P15.12A ( LO6) AP Three different lease transactions are presented below for Manitoba Enterprises. Assume that all lease transactions start on January 1, 2024. Manitoba does not receive title to the properties, either during the lease term or at the end of it. The yearly rental for each of the leases is paid at the beginning of each year. Manitoba Enterprises prepares its financial statements using ASPE. Instructions a. Which of the above leases are operating leases and which are capital leases? Explain. b. How should the lease transaction for each of the above assets be recorded on January 1,2024 ? c. Record the depreciation for each of the leases and accrue any interest on December 31,2024 . The company uses straight-line depreciation. d. Describe how the lease transaction would be reported on the 2024 income statement and balance sheet for each of the above assets

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts