Question: please do it as soon as possible -n 1 ed Suppose you purchased the 3-year Air Canada bond with a coupon rate of 10% p.a.

please do it as soon as possible

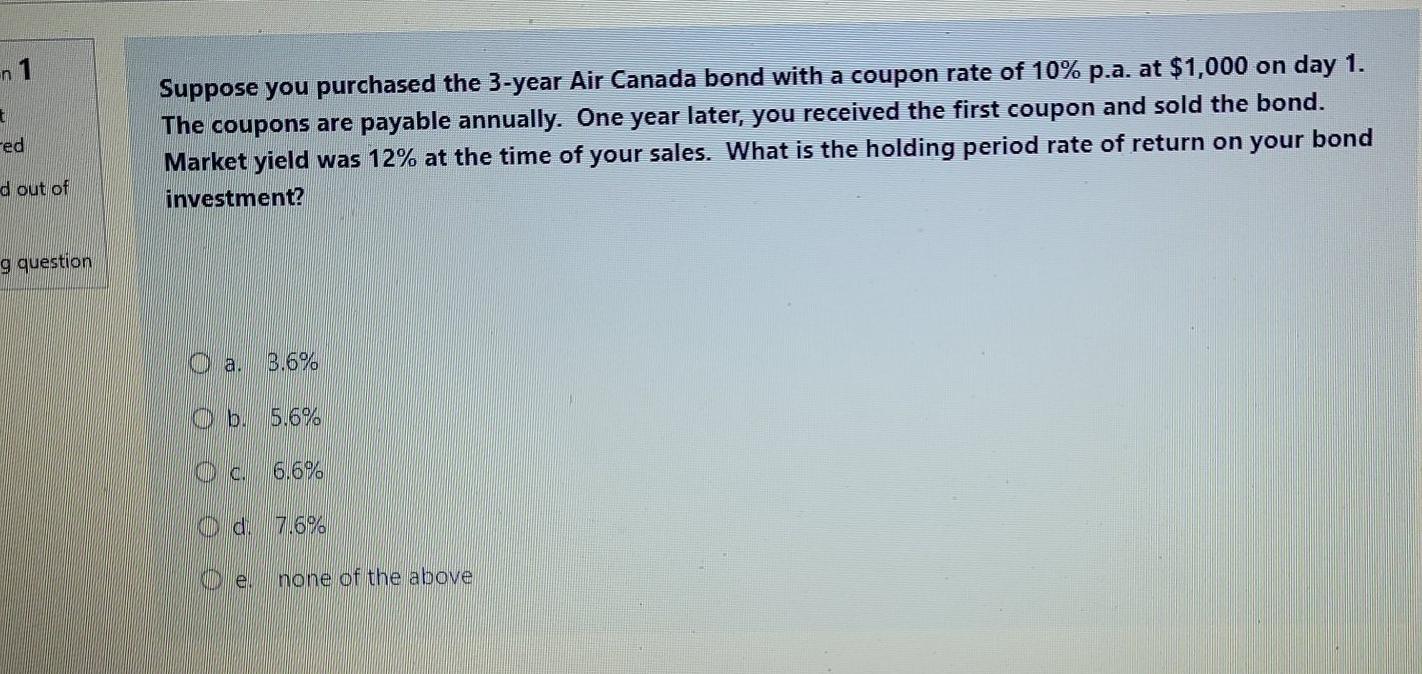

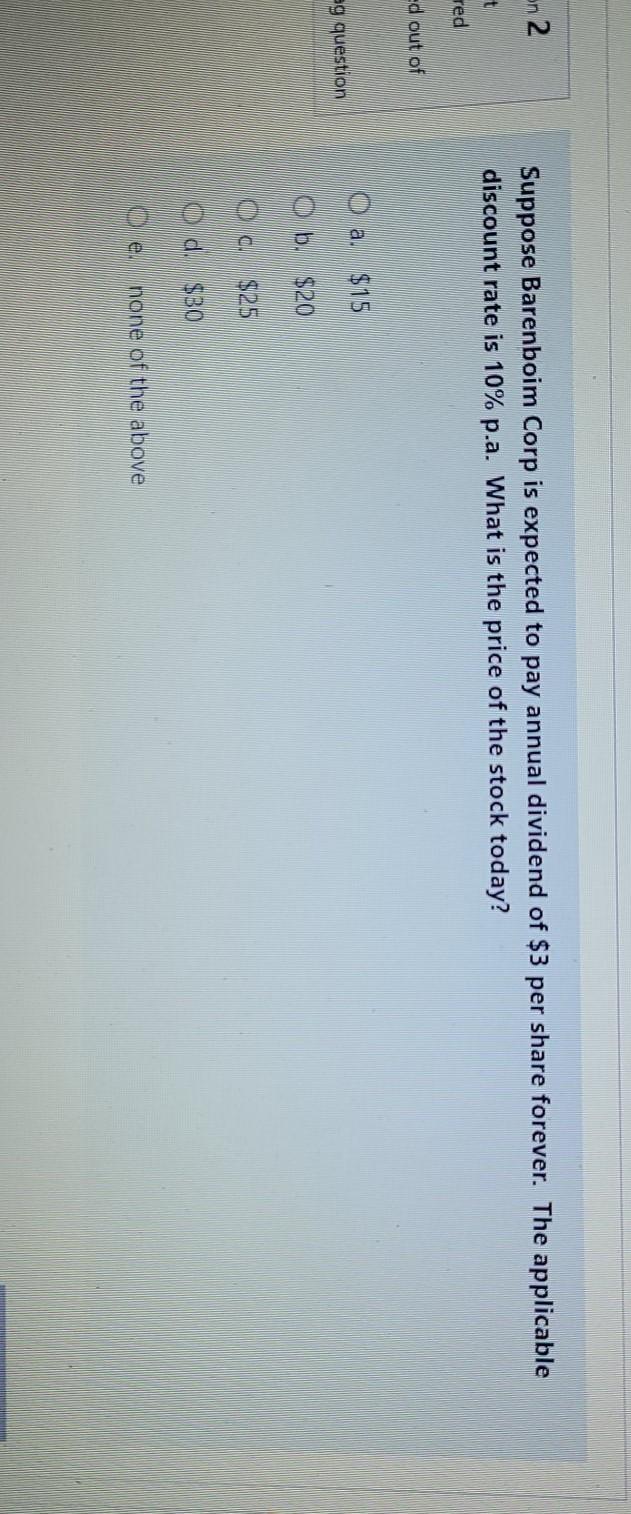

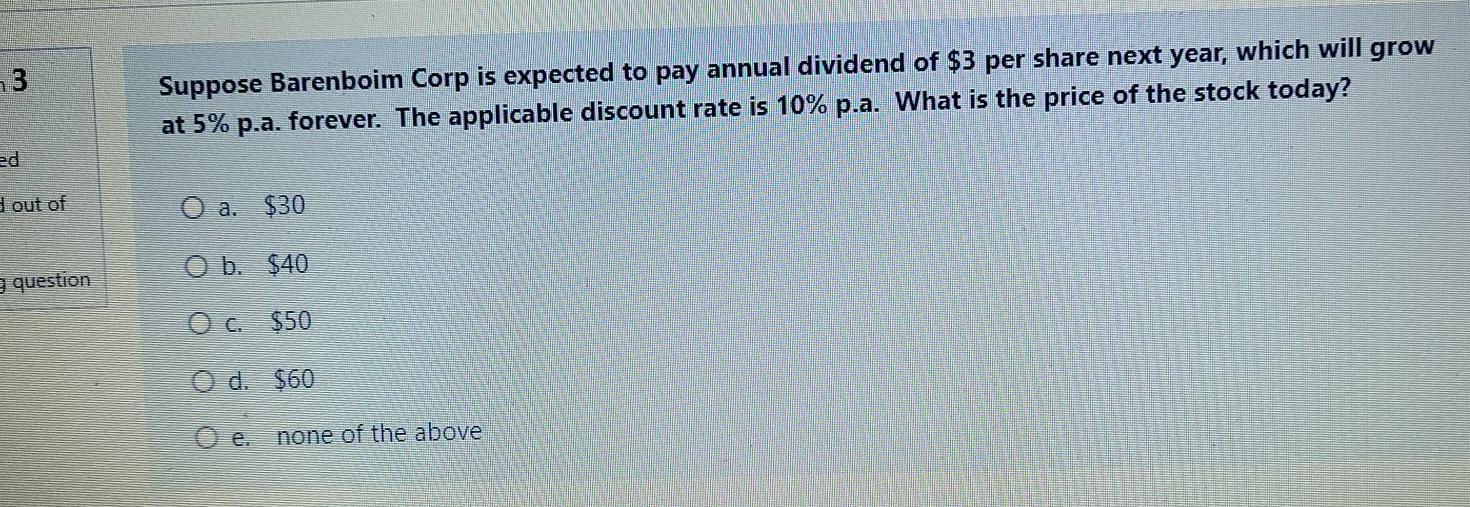

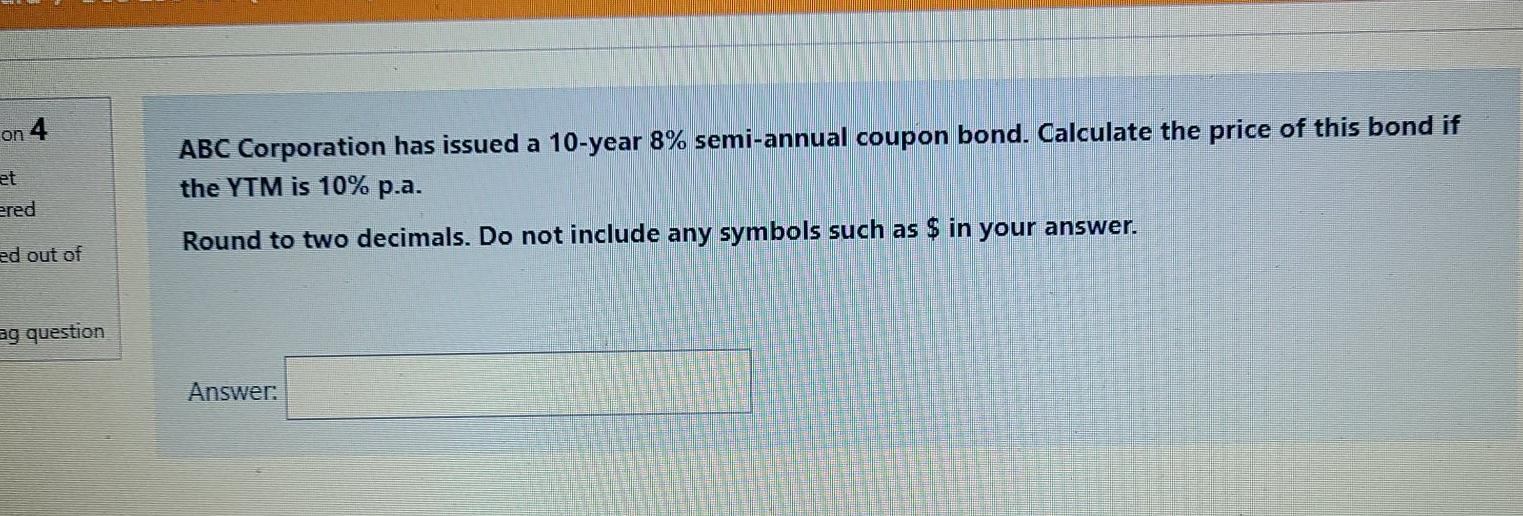

-n 1 ed Suppose you purchased the 3-year Air Canada bond with a coupon rate of 10% p.a. at $1,000 on day 1. The coupons are payable annually. One year later, you received the first coupon and sold the bond. Market yield was 12% at the time of your sales. What is the holding period rate of return on your bond investment? d out of g question O a. 8.6% ob. 5.6% OC. 6.6% d 7.6% el none of the above on 2 Suppose Barenboim Corp is expected to pay annual dividend of $3 per share forever. The applicable discount rate is 10% p.a. What is the price of the stock today? t red ed out of a $15 eg question b $20 0 0 0 0 0 $25 C d SBO le none of the above 13 Suppose Barenboim Corp is expected to pay annual dividend of $3 per share next year, which will grow at 5% p.a. forever. The applicable discount rate is 10% p.a. What is the price of the stock today? ed out of O a. $30 O b. $40 g question O c. $50 O d. $60 O e. none of the above on 4 ABC Corporation has issued a 10-year 8% semi-annual coupon bond. Calculate the price of this bond if the YTM is 10% p.a. et ered Round to two decimals. Do not include any symbols such as $ in your answer. ed out of ag

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts