Question: Please do it as soon as possible thanks Mr. Gates recently deceased left an estate in the United States with the following information. The estate

Please do it as soon as possible thanks

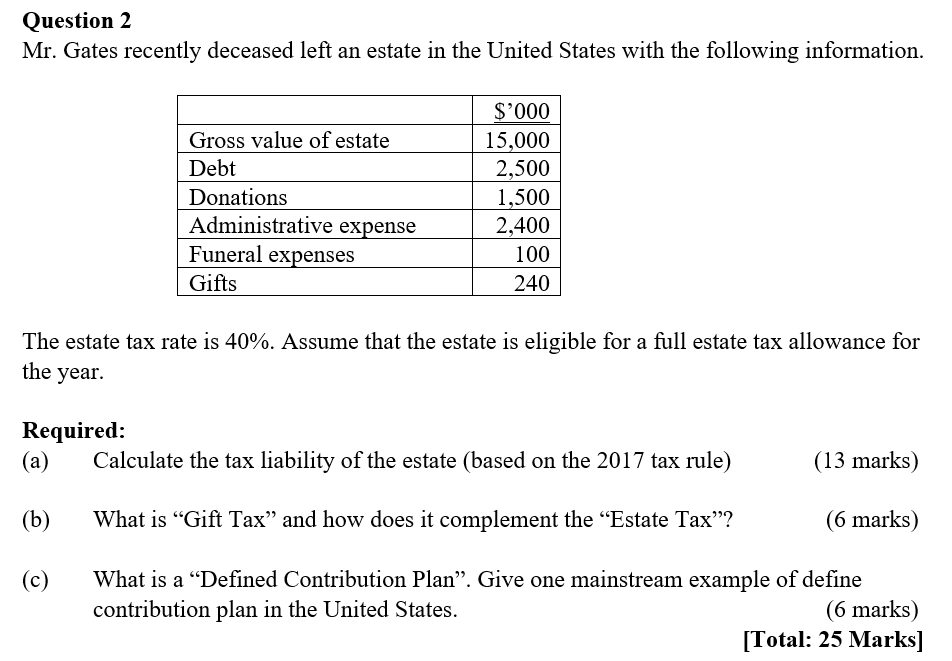

Mr. Gates recently deceased left an estate in the United States with the following information. The estate tax rate is 40%. Assume that the estate is eligible for a full estate tax allowance for the year. Required: (a) Calculate the tax liability of the estate (based on the 2017 tax rule) (13 marks) (b) What is "Gift Tax" and how does it complement the "Estate Tax"? (6 marks) (c) What is a "Defined Contribution Plan". Give one mainstream example of define contribution plan in the United States. (6 marks) [Total: 25 Marks] Mr. Gates recently deceased left an estate in the United States with the following information. The estate tax rate is 40%. Assume that the estate is eligible for a full estate tax allowance for the year. Required: (a) Calculate the tax liability of the estate (based on the 2017 tax rule) (13 marks) (b) What is "Gift Tax" and how does it complement the "Estate Tax"? (6 marks) (c) What is a "Defined Contribution Plan". Give one mainstream example of define contribution plan in the United States. (6 marks) [Total: 25 Marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts