Question: please do it as soon as possible x A - T Normal No Spacing Heading 1 Heading 2 Title Sele Font 15 Paragraph Styles 15

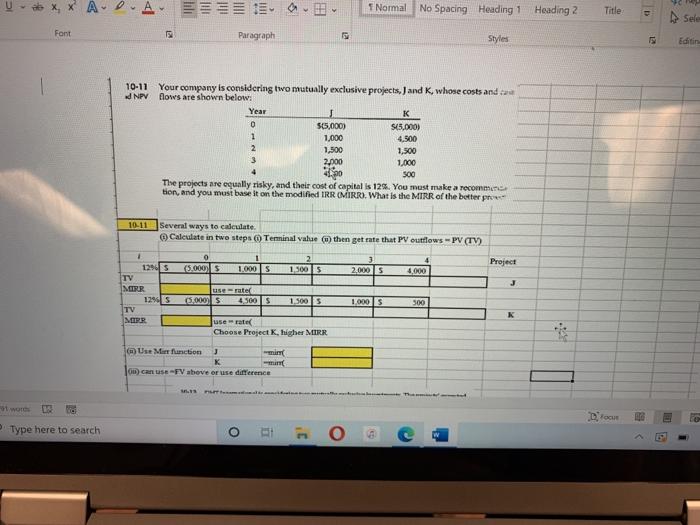

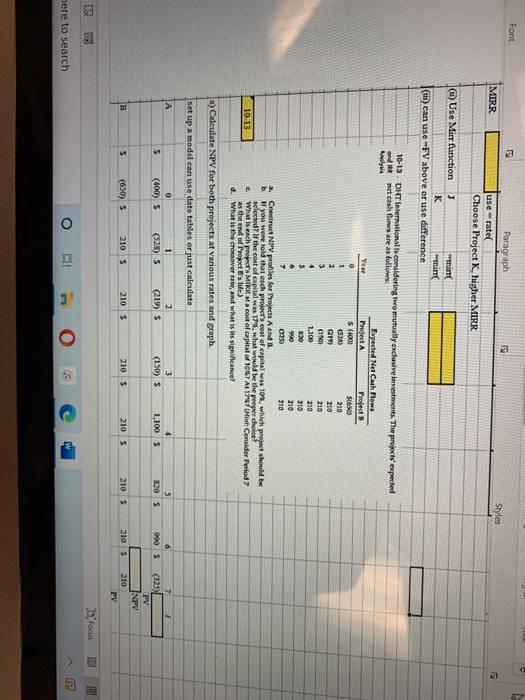

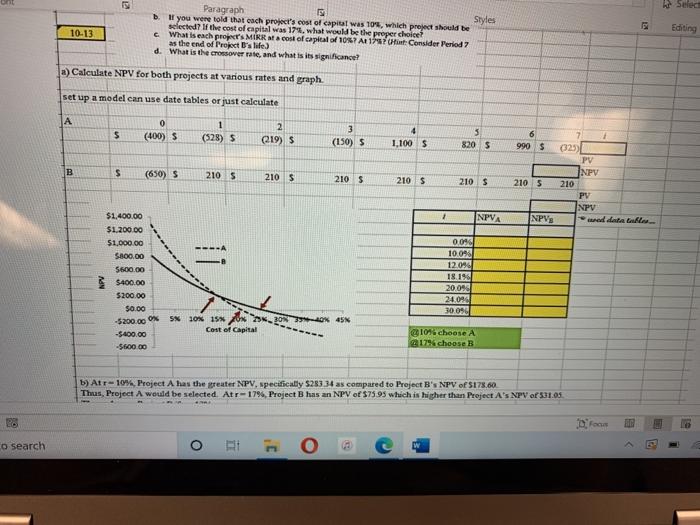

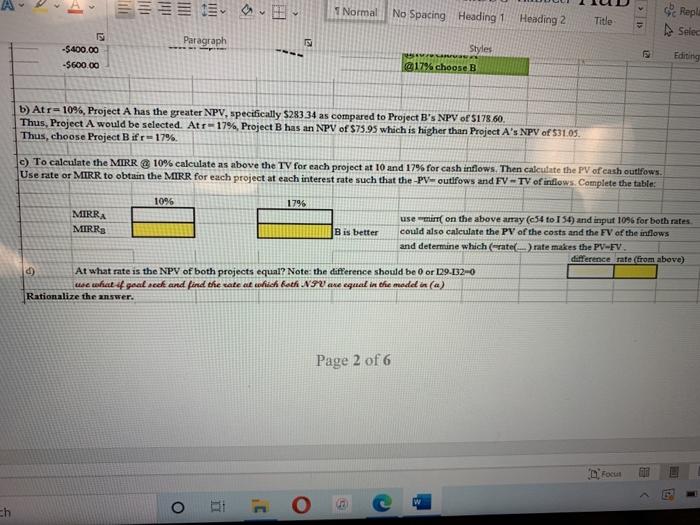

x A - T Normal No Spacing Heading 1 Heading 2 Title Sele Font 15 Paragraph Styles 15 10-11 Your company is considering two mutually exclusive projects, J and K, whose costs and d NPV flows are shown below: Year K 0 55,000) $63,000) 1 1,000 4.500 2 1,500 1,500 3 2.000 1,000 4 4.20 500 The projects are equally risky, and their cost of capital is 129. You must make a recommend tion, and you must base it on the modified IRR MIRRI. What is the MIRR of the better pro 10-11 Several ways to calculate Calendate in two steps Terminal value then getrate that PV outflows PV (TV) 0 5.000 2 13005 Project 1.000 S 2.000 4.000 J 1290 TV MERR 129 S TV MIRR userater 4.500 5 5.000 1.500 5 1.000 5 500 K userate Choose Project K, higher MIRR Ust Murr function X 00) can use TV above or use difference Type here to search o 3 Font MIRR Styles Paragraph userate Choose Project K higher MIRR m) Use Mirr function J thing K hint (is) can use FV above or use difference 10-13 DHT International is considering two mutually exclusive investments. The projects' expected and RR net cash flows are as follows: Alys Espected Net Cash Flow Year Project A Proje O 5 (100 SOOD 52 210 0219 210 so 210 1,100 210 20 210 9920 210 0250 210 Construct NPV profiles for Projects A and B you were told that each project's cost of capital was 105, which project should be selected? If the cost of capital was 17, what would be the proper choice c What is each pro' MIKR acon of capital of 105TAL1 Consider Period as the end of Project B's life) d. What is the crossover rate, and what is its significance? 10-13 a) Calculate NPV for both projects at various rates and graph set up a model can use date tables or just calculate A 5 (400) 5 1 (528) 5 3 (150) S (219) S 5 820 S 1,100 S 6 990 $ 0 625) PV NPV 210 PV B 5 (650) 5 210 $ 210 S 210 5 210 5 210 5 210 5 DI Focia here to search O A Seled Paragraph Styles you were told that each project's cost of capital was 10, which project should be selected? If the cost of capital was 17. what would be the proper choice? What is each prope's MIKRS cost of capital of 1047 A 17 Hunt: Consider Period 7 as the end of Project B's life) d. What is the crossover rate, and what is its significance? Editing 10-13 a) Calculate NPV for both projects at various rates and graph. set up a model can use date tables or just calculate A $ 0 (400) 5 1 (528) 5 2 (219) S 3 (150) $ 1.100 S 3 820 S 990 $ B $ (650) 5 PV NPV 210 $ 210 S 210 $ 210 $ 210 $ 210 5 210 PV NPV wed data ako NPVA NPV's $1,400.00 $1.200.00 $1,000.00 S.800.00 5600.00 400.00 009 10.096 12.09 18.196 20.096 24.096 30.094 $200.00 $0.00 -$200.00 OX -S400.00 -560000 5% 10% 15% 20% 30% 45% Cost of Capital 109 choose A 17% choose B b) Atr-10%, Project A has the greater NPV, specifically $283 34 as compared to Project B's NPV of $178,60 Thus, Project A would be selected. Atr-17% Project B has an NPV of S7595 which is higher than Project A's NPV of $31.05 29 19 o search o o w > : Normal No Spacing Heading 1 Heading 2 Title Raple

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts