Question: please do it ASAP... I'll give you up thumb definitely Question 1: (a) The following information relates to the activities of Pilot plc: Statements of

please do it ASAP... I'll give you up thumb definitely

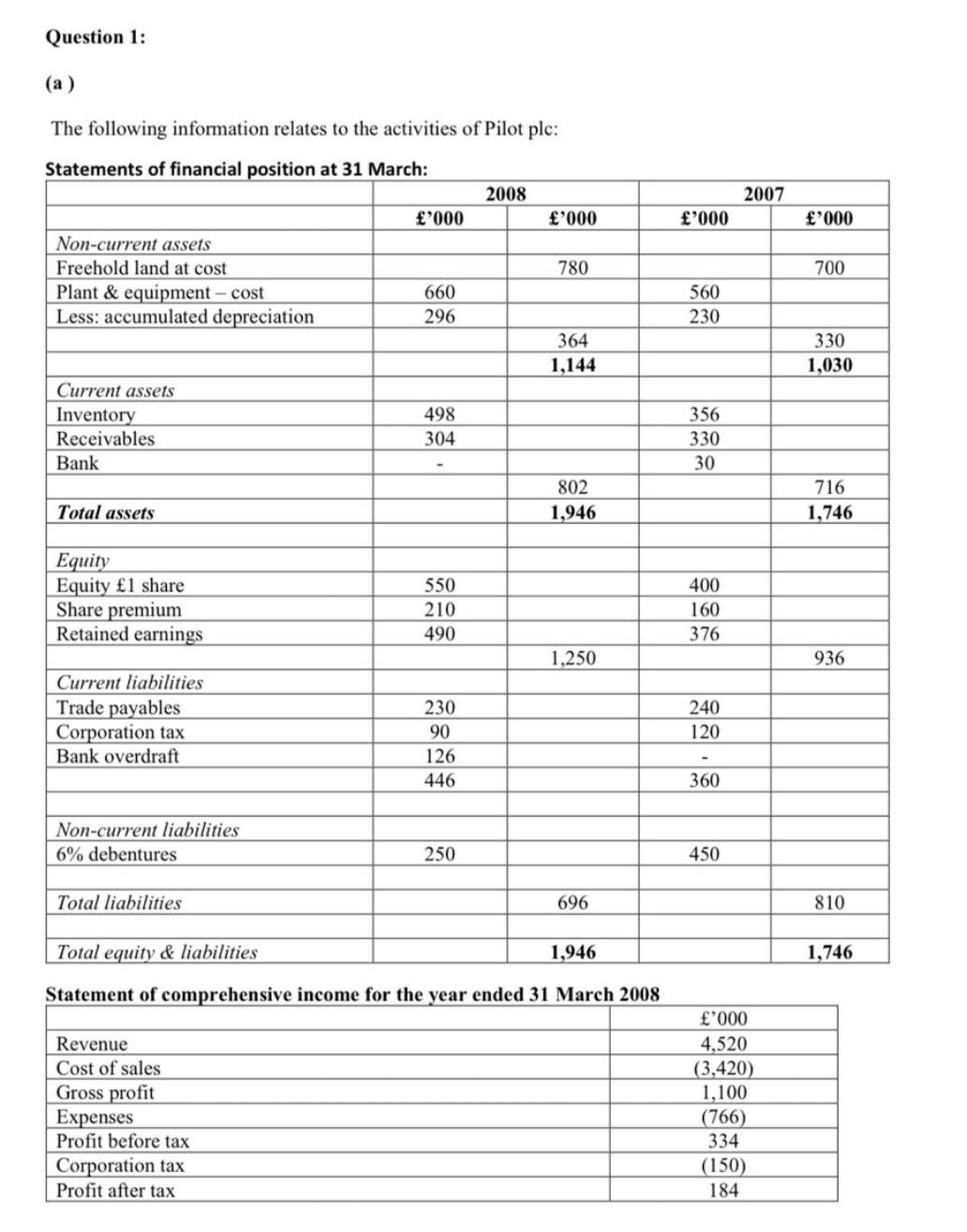

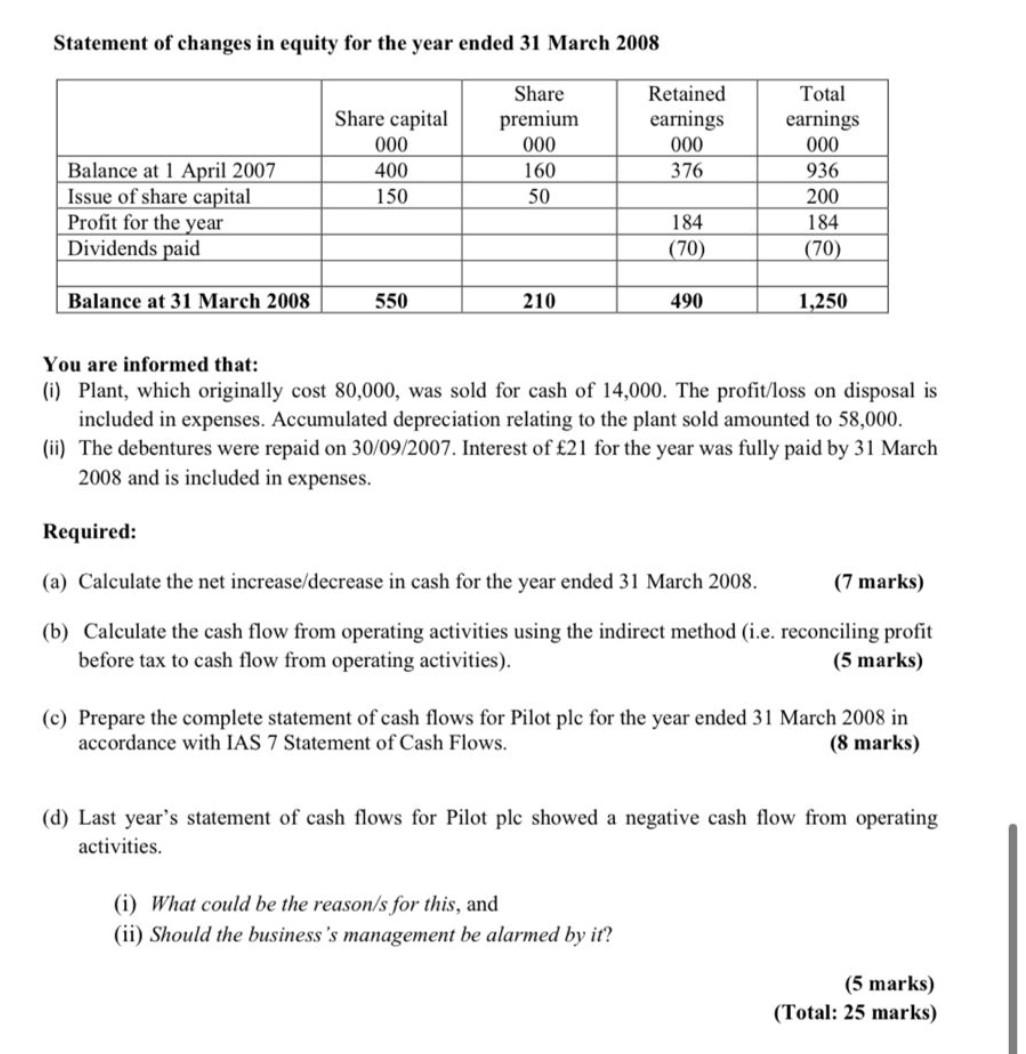

Question 1: (a) The following information relates to the activities of Pilot plc: Statements of financial position at 31 March: 2008 '000 '000 Non-current assets Freehold land at cost Plant & equipment - cost 660 560 Less: accumulated depreciation 296 230 Current assets Inventory 498 356 Receivables 304 330 Bank 30 Total assets Equity Equity 1 share 550 400 Share premium 210 160 Retained earnings 490 376 Current liabilities Trade payables 230 240 Corporation tax 90 120 Bank overdraft 126 446 360 Non-current liabilities 6% debentures 250 450 Total liabilities 696 Total equity & liabilities 1,946 Statement of comprehensive income for the year ended 31 March 2008 Revenue Cost of sales Gross profit Expenses Profit before tax Corporation tax Profit after tax '000 780 364 1,144 802 1,946 1,250 2007 '000 4,520 (3,420) 1,100 (766) 334 (150) 184 '000 700 330 1,030 716 1,746 936 810 1,746 Statement of changes in equity for the year ended 31 March 2008 Share Retained Share capital Total earnings premium earnings 000 000 000 000 Balance at 1 April 2007 400 160 376 936 Issue of share capital 150 50 200 184 184 Profit for the year Dividends paid (70) (70) Balance at 31 March 2008 550 210 490 1,250 You are informed that: (i) Plant, which originally cost 80,000, was sold for cash of 14,000. The profit/loss on disposal is included in expenses. Accumulated depreciation relating to the plant sold amounted to 58,000. (ii) The debentures were repaid on 30/09/2007. Interest of 21 for the year was fully paid by 31 March 2008 and is included in expenses. Required: (a) Calculate the net increase/decrease in cash for the year ended 31 March 2008. (7 marks) (b) Calculate the cash flow from operating activities using the indirect method (i.e. reconciling profit before tax to cash flow from operating activities). (5 marks) (c) Prepare the complete statement of cash flows for Pilot ple for the year ended 31 March 2008 in accordance with IAS 7 Statement of Cash Flows. (8 marks) (d) Last year's statement of cash flows for Pilot plc showed a negative cash flow from operating activities. (i) What could be the reason/s for this, and (ii) Should the business's management be alarmed by it? (5 marks) (Total: 25 marks) Question 1: (a) The following information relates to the activities of Pilot plc: Statements of financial position at 31 March: 2008 '000 '000 Non-current assets Freehold land at cost Plant & equipment - cost 660 560 Less: accumulated depreciation 296 230 Current assets Inventory 498 356 Receivables 304 330 Bank 30 Total assets Equity Equity 1 share 550 400 Share premium 210 160 Retained earnings 490 376 Current liabilities Trade payables 230 240 Corporation tax 90 120 Bank overdraft 126 446 360 Non-current liabilities 6% debentures 250 450 Total liabilities 696 Total equity & liabilities 1,946 Statement of comprehensive income for the year ended 31 March 2008 Revenue Cost of sales Gross profit Expenses Profit before tax Corporation tax Profit after tax '000 780 364 1,144 802 1,946 1,250 2007 '000 4,520 (3,420) 1,100 (766) 334 (150) 184 '000 700 330 1,030 716 1,746 936 810 1,746 Statement of changes in equity for the year ended 31 March 2008 Share Retained Share capital Total earnings premium earnings 000 000 000 000 Balance at 1 April 2007 400 160 376 936 Issue of share capital 150 50 200 184 184 Profit for the year Dividends paid (70) (70) Balance at 31 March 2008 550 210 490 1,250 You are informed that: (i) Plant, which originally cost 80,000, was sold for cash of 14,000. The profit/loss on disposal is included in expenses. Accumulated depreciation relating to the plant sold amounted to 58,000. (ii) The debentures were repaid on 30/09/2007. Interest of 21 for the year was fully paid by 31 March 2008 and is included in expenses. Required: (a) Calculate the net increase/decrease in cash for the year ended 31 March 2008. (7 marks) (b) Calculate the cash flow from operating activities using the indirect method (i.e. reconciling profit before tax to cash flow from operating activities). (5 marks) (c) Prepare the complete statement of cash flows for Pilot ple for the year ended 31 March 2008 in accordance with IAS 7 Statement of Cash Flows. (8 marks) (d) Last year's statement of cash flows for Pilot plc showed a negative cash flow from operating activities. (i) What could be the reason/s for this, and (ii) Should the business's management be alarmed by it? (5 marks) (Total: 25 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts