Question: please do it ASAP with full detailed solution... I'll give you up thumb definitely 4 Spirit Corporation reported the following payroll-related costs for the month

please do it ASAP with full detailed solution... I'll give you up thumb definitely

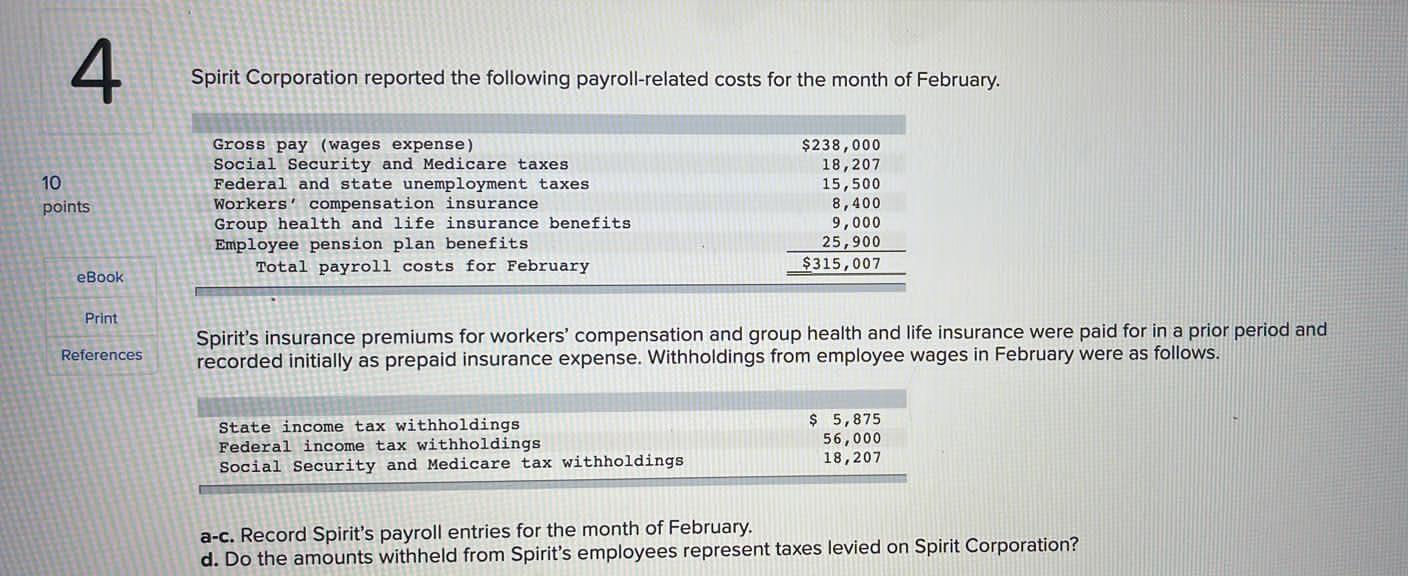

4 Spirit Corporation reported the following payroll-related costs for the month of February 10 points Gross pay (wages expense) Social Security and Medicare taxes Federal and state unemployment taxes Workers' compensation insurance Group health and life insurance benefits Employee pension plan benefits Total payroll costs for February $238,000 18,207 15,500 8,400 9,000 25,900 $315,007 eBook Print References Spirit's insurance premiums for workers' compensation and group health and life insurance were paid for in a prior period and recorded initially as prepaid insurance expense. Withholdings from employee wages in February were as follows. State income tax withholdings Federal income tax withholdings Social Security and Medicare tax withholdings $ 5,875 56,000 18,207 a-c. Record Spirit's payroll entries for the month of February. d. Do the amounts withheld from Spirit's employees represent taxes levied on Spirit Corporation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts