Question: Please do it ASAP With probability 0.3 your firm will be worth 50M (that is, the cash flows to unlevered equity is 50M) next year,

Please do it ASAP

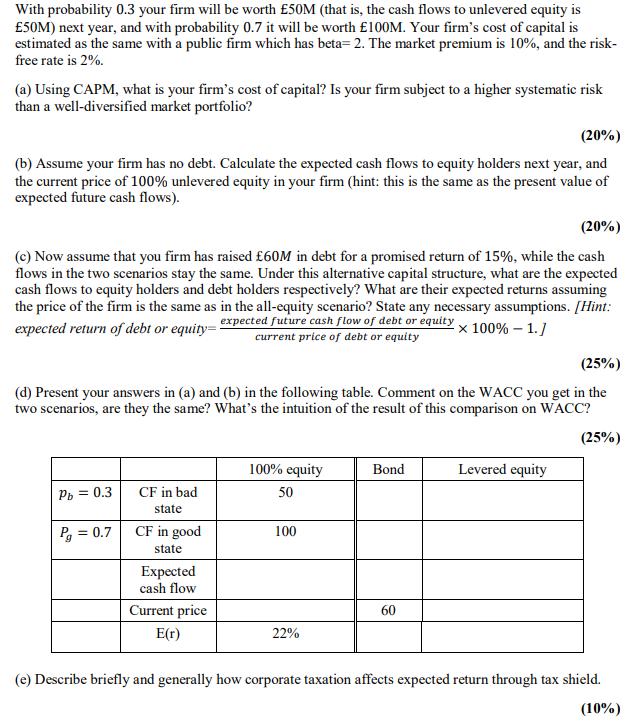

With probability 0.3 your firm will be worth 50M (that is, the cash flows to unlevered equity is 50M) next year, and with probability 0.7 it will be worth 100M. Your firm's cost of capital is estimated as the same with a public firm which has beta= 2. The market premium is 10%, and the risk- free rate is 2%. (a) Using CAPM, what is your firm's cost of capital? Is your firm subject to a higher systematic risk than a well-diversified market portfolio? (20%) (6) Assume your firm has no debt. Calculate the expected cash flows to equity holders next year, and the current price of 100% unlevered equity in your firm (hint: this is the same as the present value of expected future cash flows). (20%) (c) Now assume that you firm has raised 60M in debt for a promised return of 15%, while the cash flows in the two scenarios stay the same. Under this alternative capital structure, what are the expected cash flows to equity holders and debt holders respectively? What are their expected returns assuming the price of the firm is the same as in the all-equity scenario? State any necessary assumptions. (Hint: expected return of debt or equity= expected future cash flow of debt or equity x 100% - 1.] current price of debt or equity (25%) (d) Present your answers in (a) and (b) in the following table. Comment on the WACC you get in the two scenarios, are they the same? What's the intuition of the result of this comparison on WACC? (25%) Bond Levered equity 100% equity 50 Pb = 0.3 P, = 0.7 100 CF in bad state CF in good state Expected cash flow Current price E(r) 60 22% (e) Describe briefly and generally how corporate taxation affects expected return through tax shield. (10%)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts