Question: ** PLEASE DO IT BY HAND NO EXCEL SOLUTIONS ** A financial analyst from Barclays made the following forecast for a Large-Cap Health-care firm XYZ

** PLEASE DO IT BY HAND NO EXCEL SOLUTIONS **

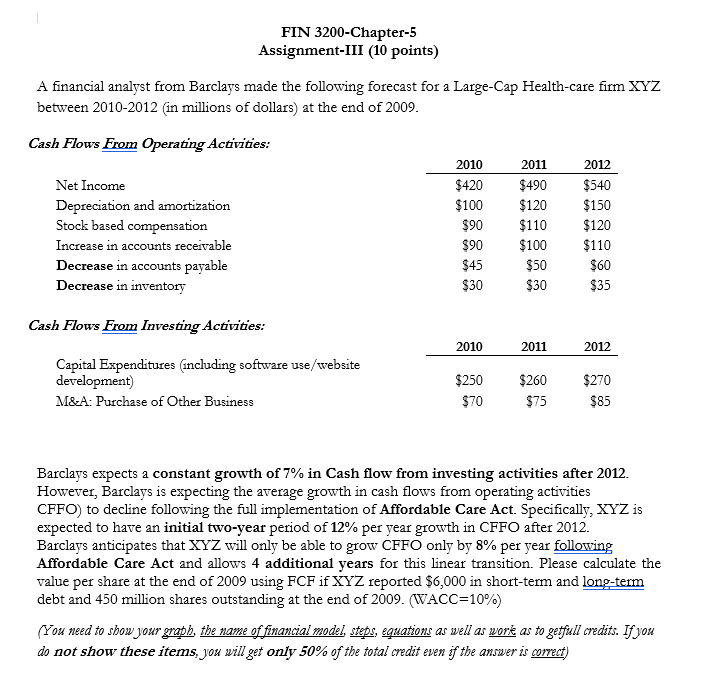

A financial analyst from Barclays made the following forecast for a Large-Cap Health-care firm XYZ between 2010-2012 (in millions of dollars) at the end of 2009. Cash Flows From Operating Activities: Net Income Depreciation and amortization Stock based compensation Increase in accounts receivable Decrease in accounts payable Decrease in inventory C Barclays expects a constant growth of 7% in Cash flow from investing activities after 2012. However, Barclays is expecting the average growth in cash flows from operating activities CFFO) to decline following the full implementation of Affordable Care Act. Specifically, XYZ is expected to have an initial two-year period of 12% per year growth in CFFO after 2012. Barclays anticipates that XYZ will only be able to grow CFFO only by 8% per year following Affordable Care Act and allows 4 additional years for this linear transition. Please calculate the value per share at the end of 2009 using FCF if XYZ reported $6,000 in short-term and long-term debt and 450 million shares outstanding at the end of 2009 . (WACC=10\%) (You need to show your grapb, the name of financial model, steps, equations as well as wore as to getfull credits. If you do not show these items, you will get only 50% of the total credit even if the answer is correct) A financial analyst from Barclays made the following forecast for a Large-Cap Health-care firm XYZ between 2010-2012 (in millions of dollars) at the end of 2009. Cash Flows From Operating Activities: Net Income Depreciation and amortization Stock based compensation Increase in accounts receivable Decrease in accounts payable Decrease in inventory C Barclays expects a constant growth of 7% in Cash flow from investing activities after 2012. However, Barclays is expecting the average growth in cash flows from operating activities CFFO) to decline following the full implementation of Affordable Care Act. Specifically, XYZ is expected to have an initial two-year period of 12% per year growth in CFFO after 2012. Barclays anticipates that XYZ will only be able to grow CFFO only by 8% per year following Affordable Care Act and allows 4 additional years for this linear transition. Please calculate the value per share at the end of 2009 using FCF if XYZ reported $6,000 in short-term and long-term debt and 450 million shares outstanding at the end of 2009 . (WACC=10\%) (You need to show your grapb, the name of financial model, steps, equations as well as wore as to getfull credits. If you do not show these items, you will get only 50% of the total credit even if the answer is correct)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts