Question: please do it carefully, I will give you a like. Assume the average annual expected health care costs per person are distributed as follows: Case

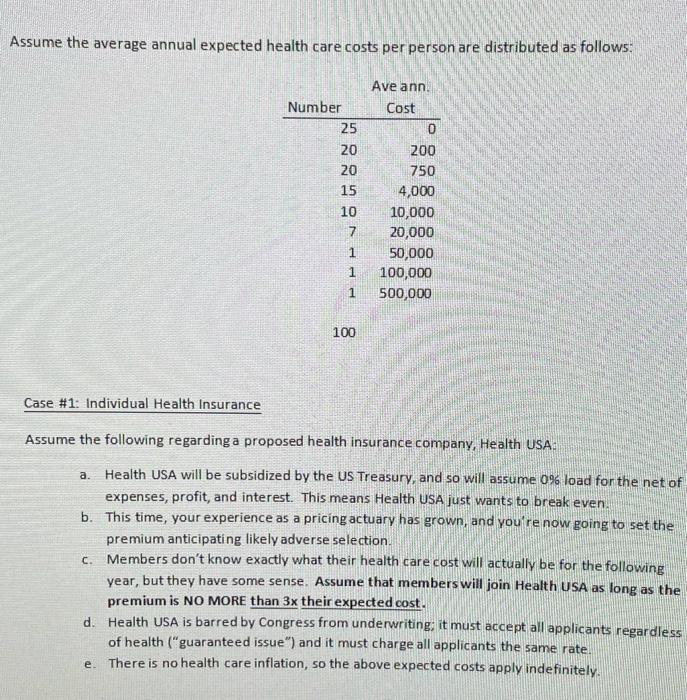

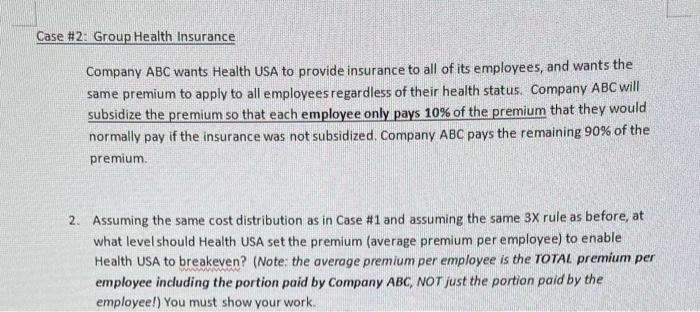

Assume the average annual expected health care costs per person are distributed as follows: Case \#1: Individual Health Insurance Assume the following regarding a proposed health insurance company, Health USA: a. Health USA will be subsidized by the US Treasury, and so will assume 0% load for the net of expenses, profit, and interest. This means Health USA just wants to break even. b. This time, your experience as a pricing actuary has grown, and you're now going to set the premium anticipating likely adverse selection. c. Members don't know exactly what their health care cost will actually be for the following year, but they have some sense. Assume that members will join Health USA as long as the premium is NO MORE than 3x their expected cost. d. Health USA is barred by Congress from underwriting; it must accept all applicants regardless of health ("guaranteed issue") and it must charge all applicants the same rate. e. There is no health care inflation, so the above expected costs apply indefinitely. \#2: Group Health Insurance Company ABC wants Health USA to provide insurance to all of its employees, and wants the same premium to apply to all employees regardless of their health status. Company ABC will subsidize the premium so that each employee only pays 10% of the premium that they would normally pay if the insurance was not subsidized. Company ABC pays the remaining 90% of the premium. 2. Assuming the same cost distribution as in Case #1 and assuming the same 3 rule as before, at what level should Health USA set the premium (average premium per employee) to enable Health USA to breakeven? (Note: the average premium per employee is the TOTAL premium per employee including the portion paid by Company ABC, NOT just the portion paid by the employee!) You must show your work. Assume the average annual expected health care costs per person are distributed as follows: Case \#1: Individual Health Insurance Assume the following regarding a proposed health insurance company, Health USA: a. Health USA will be subsidized by the US Treasury, and so will assume 0% load for the net of expenses, profit, and interest. This means Health USA just wants to break even. b. This time, your experience as a pricing actuary has grown, and you're now going to set the premium anticipating likely adverse selection. c. Members don't know exactly what their health care cost will actually be for the following year, but they have some sense. Assume that members will join Health USA as long as the premium is NO MORE than 3x their expected cost. d. Health USA is barred by Congress from underwriting; it must accept all applicants regardless of health ("guaranteed issue") and it must charge all applicants the same rate. e. There is no health care inflation, so the above expected costs apply indefinitely. \#2: Group Health Insurance Company ABC wants Health USA to provide insurance to all of its employees, and wants the same premium to apply to all employees regardless of their health status. Company ABC will subsidize the premium so that each employee only pays 10% of the premium that they would normally pay if the insurance was not subsidized. Company ABC pays the remaining 90% of the premium. 2. Assuming the same cost distribution as in Case #1 and assuming the same 3 rule as before, at what level should Health USA set the premium (average premium per employee) to enable Health USA to breakeven? (Note: the average premium per employee is the TOTAL premium per employee including the portion paid by Company ABC, NOT just the portion paid by the employee!) You must show your work

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts