Question: please do it correctly will upvote 8. A speculator takes a long position in a futures contract on a commodity on November 1, 2012 to

please do it correctly will upvote

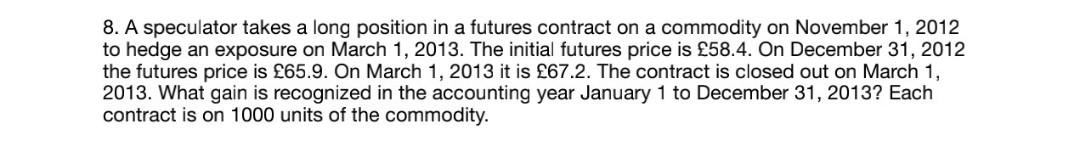

8. A speculator takes a long position in a futures contract on a commodity on November 1, 2012 to hedge an exposure on March 1, 2013. The initial futures price is 58.4. On December 31, 2012 the futures price is 65.9. On March 1, 2013 it is 67.2. The contract is closed out on March 1, 2013. What gain is recognized in the accounting year January 1 to December 31, 2013? Each contract is on 1000 units of the commodity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts