Question: please do it correctly will upvote (b) Explain in detail, using examples where possible, under what circumstances are (a) a short hedge and (b) a

please do it correctly will upvote

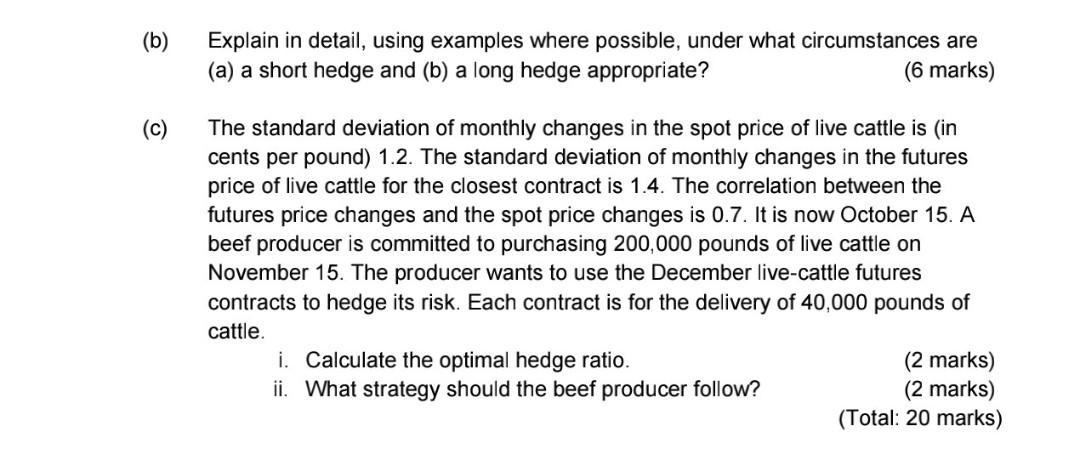

(b) Explain in detail, using examples where possible, under what circumstances are (a) a short hedge and (b) a long hedge appropriate? (6 marks) (c) The standard deviation of monthly changes in the spot price of live cattle is (in cents per pound) 1.2. The standard deviation of monthly changes in the futures price of live cattle for the closest contract is 1.4. The correlation between the futures price changes and the spot price changes is 0.7. It is now October 15. A beef producer is committed to purchasing 200,000 pounds of live cattle on November 15. The producer wants to use the December live-cattle futures contracts to hedge its risk. Each contract is for the delivery of 40,000 pounds of cattle. i. Calculate the optimal hedge ratio. (2 marks) (2 marks) ii. What strategy should the beef producer follow? (Total: 20 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts