Question: please do it correctly will upvote B2 Part(a) Explain the three methods that commercial banks use to obtain funds, in order to meet their liquidity

please do it correctly will upvote

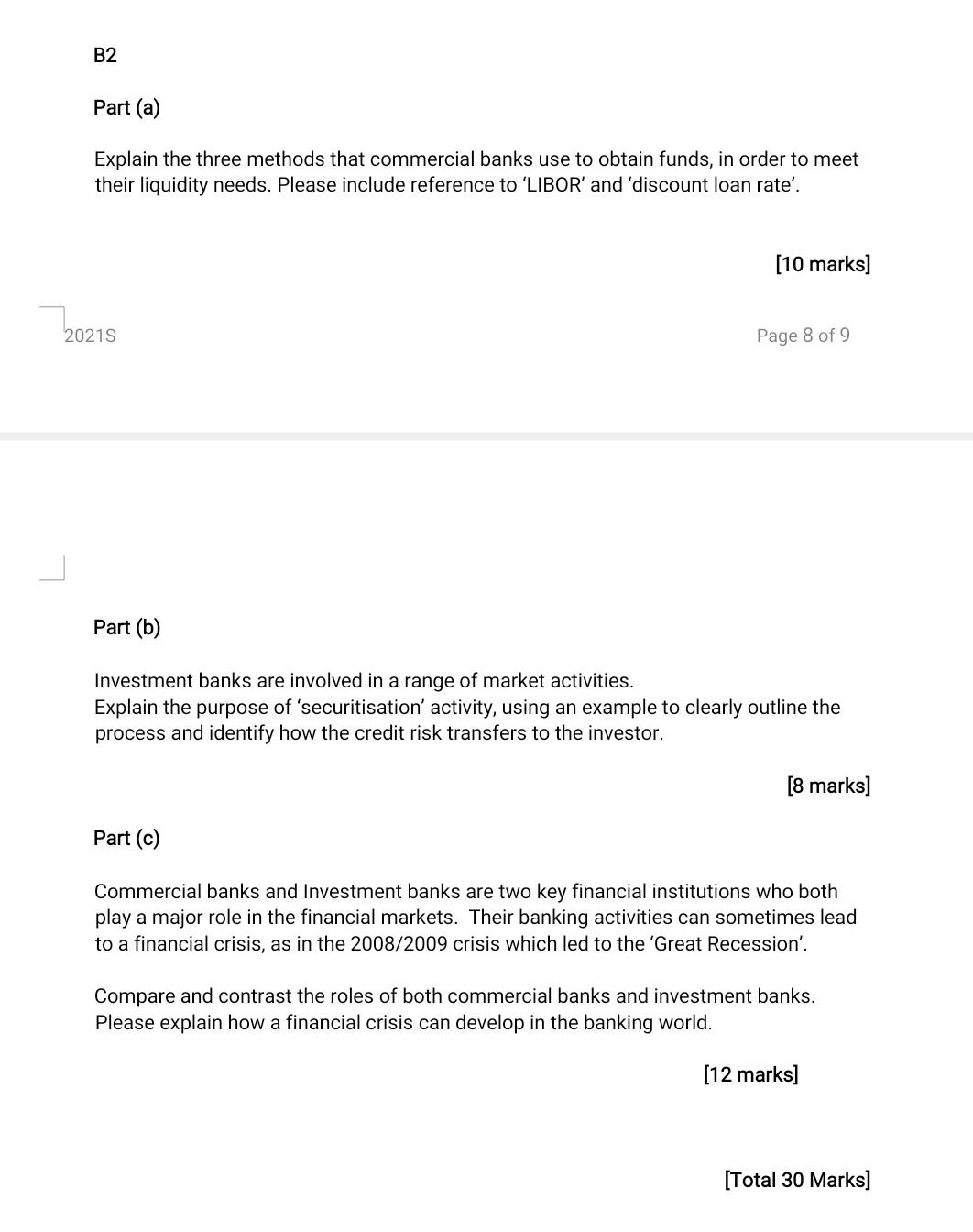

B2 Part(a) Explain the three methods that commercial banks use to obtain funds, in order to meet their liquidity needs. Please include reference to 'LIBOR' and 'discount loan rate'. (10 marks) 20215 Page 8 of 9 Part (b) Investment banks are involved in a range of market activities. Explain the purpose of 'securitisation' activity, using an example to clearly outline the process and identify how the credit risk transfers to the investor. [8 marks] Part (c) Commercial banks and Investment banks are two key financial institutions who both play a major role in the financial markets. Their banking activities can sometimes lead to a financial crisis, as in the 2008/2009 crisis which led to the 'Great Recession'. Compare and contrast the roles of both commercial banks and investment banks. Please explain how a financial crisis can develop in the banking world. (12 marks] [Total 30 Marks] B2 Part(a) Explain the three methods that commercial banks use to obtain funds, in order to meet their liquidity needs. Please include reference to 'LIBOR' and 'discount loan rate'. (10 marks) 20215 Page 8 of 9 Part (b) Investment banks are involved in a range of market activities. Explain the purpose of 'securitisation' activity, using an example to clearly outline the process and identify how the credit risk transfers to the investor. [8 marks] Part (c) Commercial banks and Investment banks are two key financial institutions who both play a major role in the financial markets. Their banking activities can sometimes lead to a financial crisis, as in the 2008/2009 crisis which led to the 'Great Recession'. Compare and contrast the roles of both commercial banks and investment banks. Please explain how a financial crisis can develop in the banking world. (12 marks] [Total 30 Marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts