Question: please do it correctly will upvote Extra Credit Activity Ratio Analysis Project Ratio Analysis . Select two companies. Complete all the 20 ratios provided in

please do it correctly will upvote

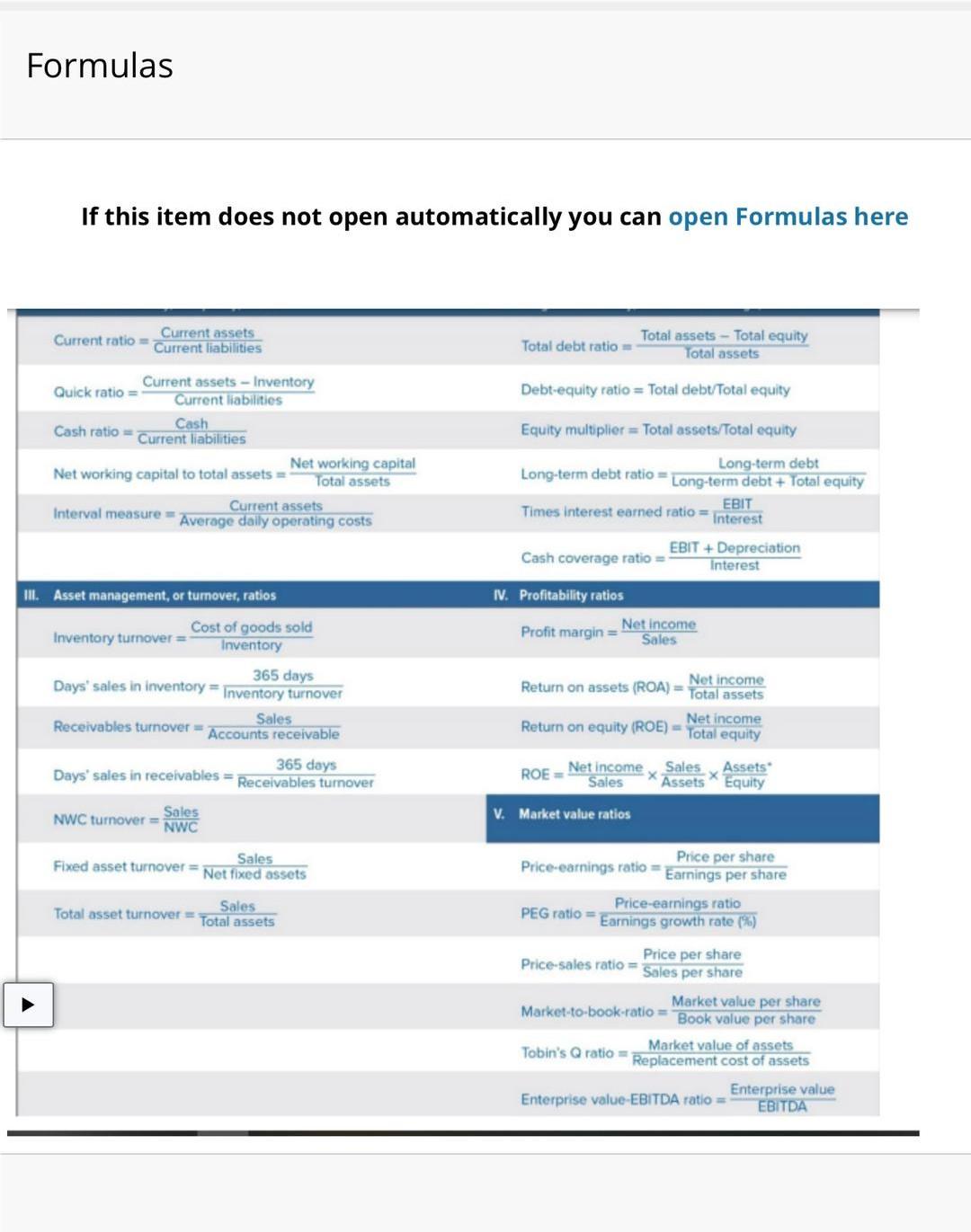

Extra Credit Activity Ratio Analysis Project Ratio Analysis . Select two companies. Complete all the 20 ratios provided in the formula Sheet. Compare both company's ratios. Interperate all the ratios. You are to explain what these ratios mean for example if the current ratio is 1.2 then it means that the company has 1.2 dollars worth of current assets available to pay liabilities worth $1. Write a conclusion of your overall analysis. Give recommendations for both the companies, where they need to improve and how they can improve. Formulas If this item does not open automatically you can open Formulas here Current ratio Current assets Current liabilities Total debt ratio Total assets - Total equity Total assets Debt-equity ratio = Total debt/Total equity Current assets - Inventory Quick ratio = Current liabilities Cash Cash ratio = Current liabilities Net working capital Net working capital to total assets = Total assets Current assets Interval measure Average daily operating costs Equity multiplier = Total assets/Total equity Long-term debt Long-term debt ratio - Long-term debt + Total equity - Times interest earned ratio = Interest EBIT EBIT + Depreciation Cash coverage ratio = Interest IV. Profitability ratios II. Asset management, or turnover, ratios Profit margin = Net income Sales Cost of goods sold Inventory turnover= Inventory 365 days Days' sales in inventory = Inventory turnover Sales Receivables turnover = Accounts receivable 365 days Days' sales in receivables = Receivables turnover Net income Return on assets (ROA) = Total assets Net income Return on equity (ROE) - Total equity ROE Net income Sales Sales Assets Assets Equity NWC turnover = Sales V. Market value ratios Sales Fixed asset turnover = Net fixed assets Sales Total asset turnover = Total assets Price per share Price-earnings ratio = Earnings per share Price-earnings ratio PEG ratio = Earnings growth rate (*) Price per share Price-sales ratio = Sales per share Market value per share Market-to-book-ratio = Book value per share Market value of assets Tobin's ratio = Replacement cost of assets Enterprise value Enterprise value-EBITDA ratio = EBITDA Extra Credit Activity Ratio Analysis Project Ratio Analysis . Select two companies. Complete all the 20 ratios provided in the formula Sheet. Compare both company's ratios. Interperate all the ratios. You are to explain what these ratios mean for example if the current ratio is 1.2 then it means that the company has 1.2 dollars worth of current assets available to pay liabilities worth $1. Write a conclusion of your overall analysis. Give recommendations for both the companies, where they need to improve and how they can improve. Formulas If this item does not open automatically you can open Formulas here Current ratio Current assets Current liabilities Total debt ratio Total assets - Total equity Total assets Debt-equity ratio = Total debt/Total equity Current assets - Inventory Quick ratio = Current liabilities Cash Cash ratio = Current liabilities Net working capital Net working capital to total assets = Total assets Current assets Interval measure Average daily operating costs Equity multiplier = Total assets/Total equity Long-term debt Long-term debt ratio - Long-term debt + Total equity - Times interest earned ratio = Interest EBIT EBIT + Depreciation Cash coverage ratio = Interest IV. Profitability ratios II. Asset management, or turnover, ratios Profit margin = Net income Sales Cost of goods sold Inventory turnover= Inventory 365 days Days' sales in inventory = Inventory turnover Sales Receivables turnover = Accounts receivable 365 days Days' sales in receivables = Receivables turnover Net income Return on assets (ROA) = Total assets Net income Return on equity (ROE) - Total equity ROE Net income Sales Sales Assets Assets Equity NWC turnover = Sales V. Market value ratios Sales Fixed asset turnover = Net fixed assets Sales Total asset turnover = Total assets Price per share Price-earnings ratio = Earnings per share Price-earnings ratio PEG ratio = Earnings growth rate (*) Price per share Price-sales ratio = Sales per share Market value per share Market-to-book-ratio = Book value per share Market value of assets Tobin's ratio = Replacement cost of assets Enterprise value Enterprise value-EBITDA ratio = EBITDA

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts