Question: please do it correctly will upvote Question 3. (Total 15 marks) XYZ Ltd is proposing to change its capital structure and has asked you for

please do it correctly will upvote

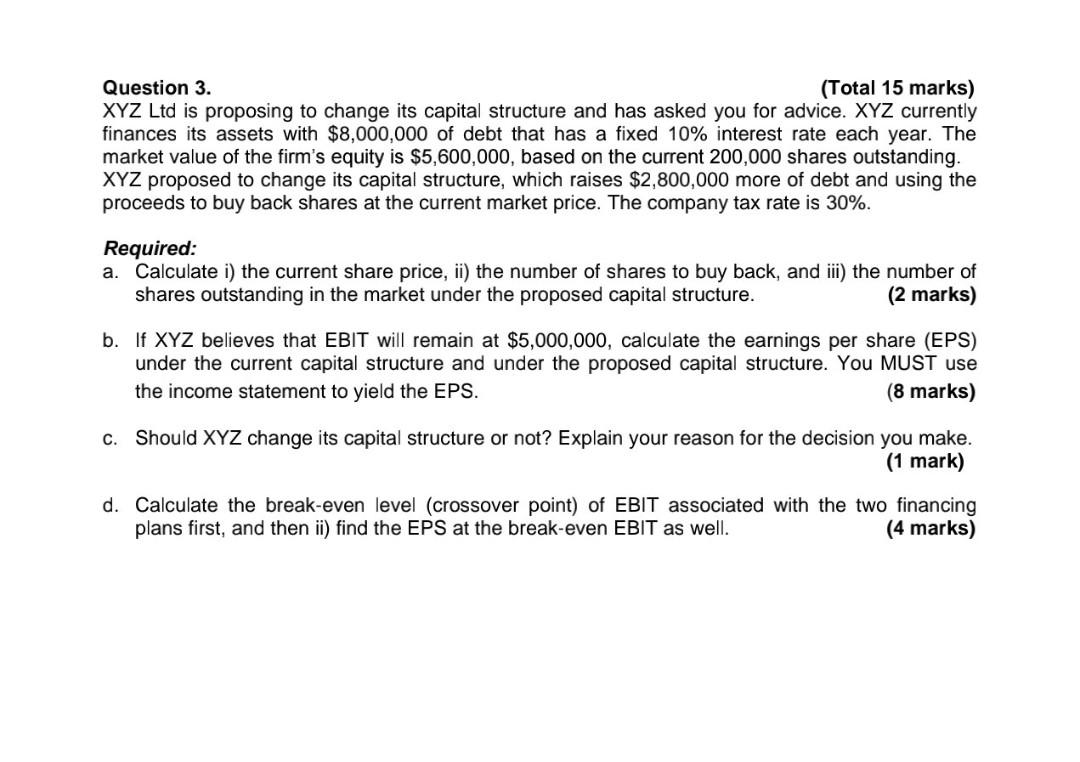

Question 3. (Total 15 marks) XYZ Ltd is proposing to change its capital structure and has asked you for advice. XYZ currently finances its assets with $8,000,000 of debt that has a fixed 10% interest rate each year. The market value of the firm's equity is $5,600,000, based on the current 200,000 shares outstanding. XYZ proposed to change its capital structure, which raises $2,800,000 more of debt and using the proceeds to buy back shares at the current market price. The company tax rate is 30%. Required: a. Calculate i) the current share price, ii) the number of shares to buy back, and iii) the number of shares outstanding in the market under the proposed capital structure. (2 marks) b. If XYZ believes that EBIT will remain at $5,000,000, calculate the earnings per share (EPS) under the current capital structure and under the proposed capital structure. You MUST use the income statement to yield the EPS. (8 marks) c. Should XYZ change its capital structure or not? Explain your reason for the decision you make. mark) d. Calculate the break-even level (crossover point) of EBIT associated with the two financing plans first, and then ii) find the EPS at the break-even EBIT as well. (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts