Question: please do it correctly will upvote Use the following information for Questions 5 through 8 Rogers has 48 million shares of common stock outstanding. The

please do it correctly will upvote

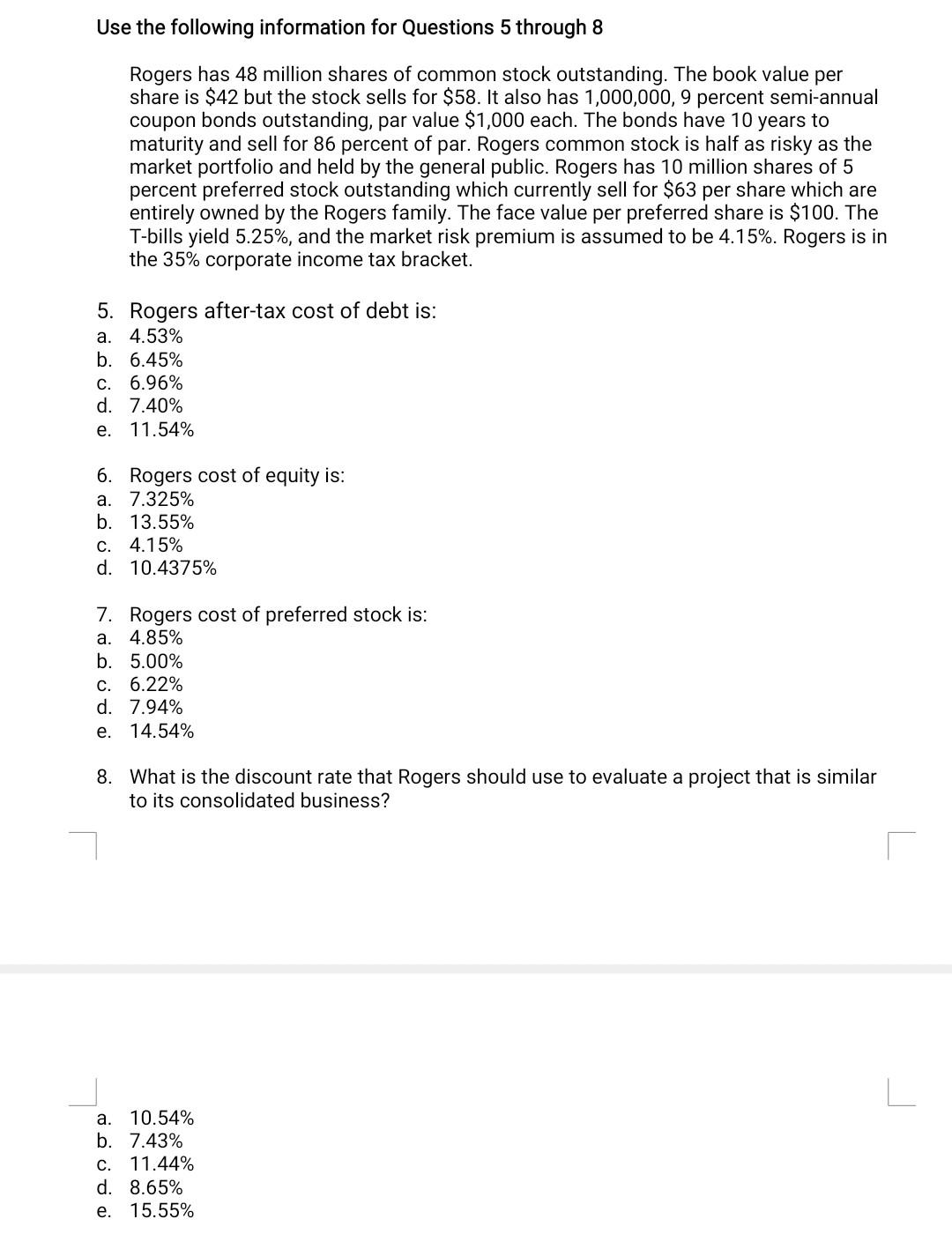

Use the following information for Questions 5 through 8 Rogers has 48 million shares of common stock outstanding. The book value per share is $42 but the stock sells for $58. It also has 1,000,000, 9 percent semi-annual coupon bonds outstanding, par value $1,000 each. The bonds have 10 years to maturity and sell for 86 percent of par. Rogers common stock is half as risky as the market portfolio and held by the general public. Rogers has 10 million shares of 5 percent preferred stock outstanding which currently sell for $63 per share which are entirely owned by the Rogers family. The face value per preferred share is $100. The T-bills yield 5.25%, and the market risk premium is assumed to be 4.15%. Rogers is in the 35% corporate income tax bracket. 5. Rogers after-tax cost of debt is: a. 4.53% b. 6.45% C. 6.96% d. 7.40% e. 11.54% 6. Rogers cost of equity is: a. 7.325% b. 13.55% C. 4.15% d. 10.4375% 7. Rogers cost of preferred stock is: a. 4.85% b. 5.00% C. 6.22% d. 7.94% e. 14.54% 8. What is the discount rate that Rogers should use to evaluate a project that is similar to its consolidated business? a. 10.54% b. 7.43% c. 11.44% d. 8.65% e. 15.55%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts