Question: Please do it for 2nd and 3rd year as said in requirements Andy Quincy Associates acquired $7,530,000 par value, 8%, 20-year bonds on their date

Please do it for 2nd and 3rd year as said in requirements

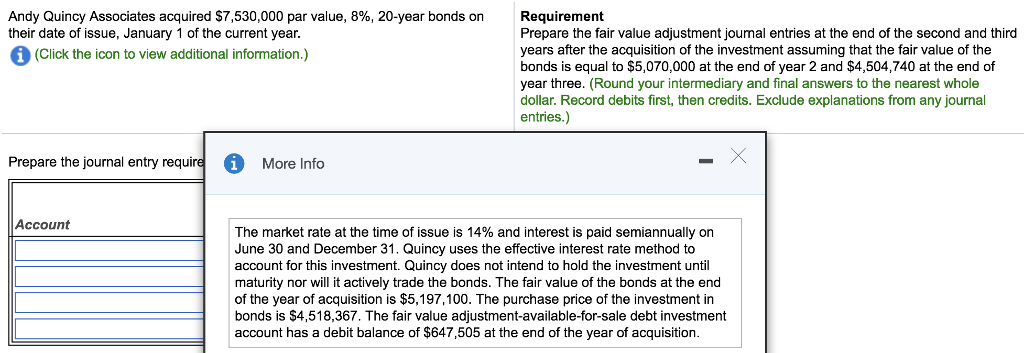

Andy Quincy Associates acquired $7,530,000 par value, 8%, 20-year bonds on their date of issue, January 1 of the current year. Requirement Prepare the fair value adjustment joumal entries at the end of the second and third years after the acquisition of the investment assuming that the fair value of the bonds is equal to $5,070,000 at the end of year 2 and $4,504,740 at the end of year three. (Round your intermediary and final answers to the nearest whole dollar. Record debits first, then credits. Exclude explanations from any journal entries.) (Click the icon to view additional information.) Prepare the journal entry require More Info Account The market rate at the time of issue is 14% and interest is paid semiannually on June 30 and December 31. Quincy uses the effective interest rate method to account for this investment. Quincy does not intend to hold the investment until maturity nor will it actively trade the bonds. The fair value of the bonds at the end of the year of acquisition is $5,197,100. The purchase price of the investment in bonds is $4,518,367. The fair value adjustment-available-for-sale debt investment account has a debit balance of $647,505 at the end of the year of acquisition

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts