Question: please do it in 10 minutes will upvote 3 points In a capital budgeting project's cash flow analysis, are omitted because they are reflected in

please do it in 10 minutes will upvote

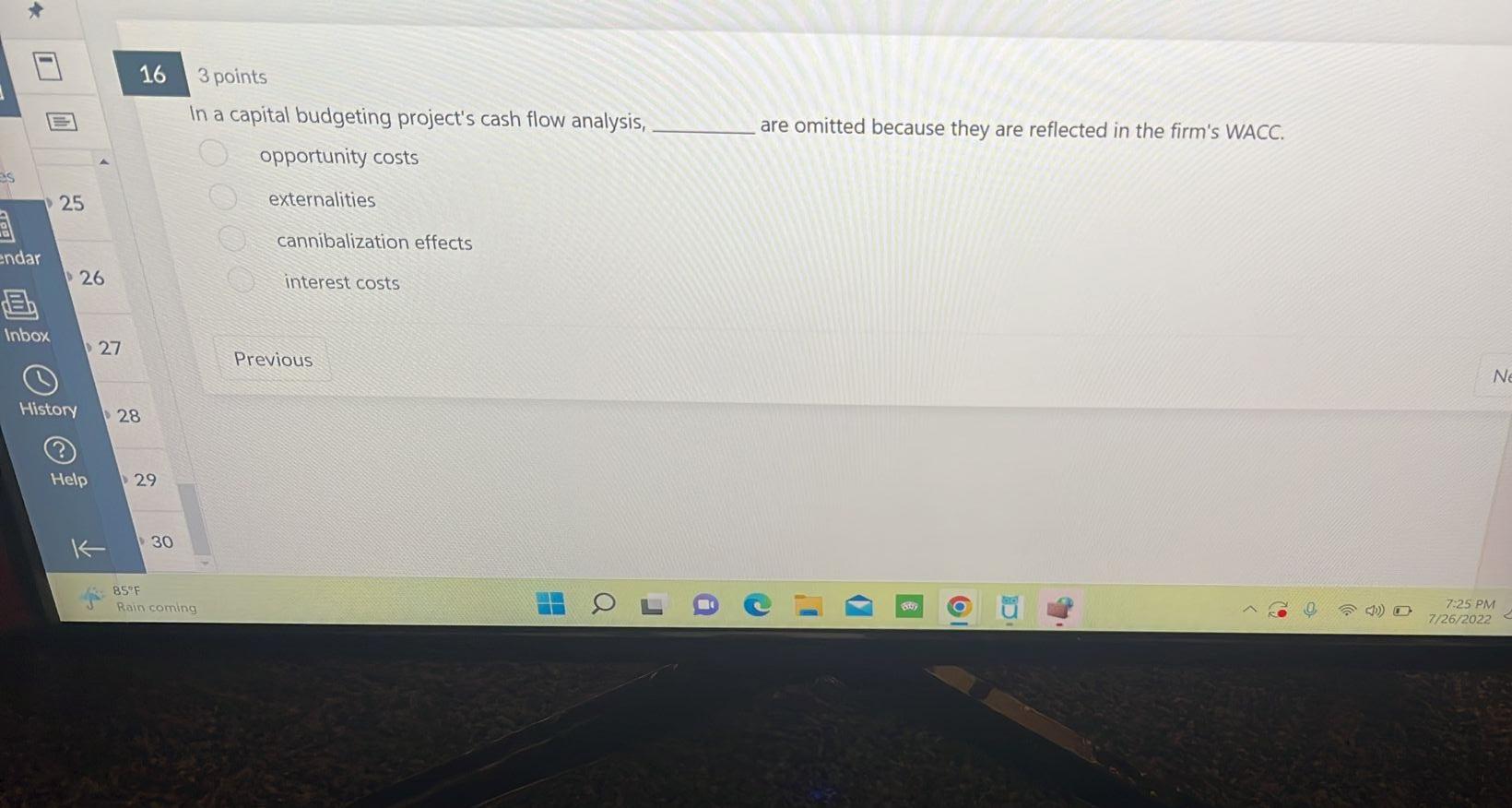

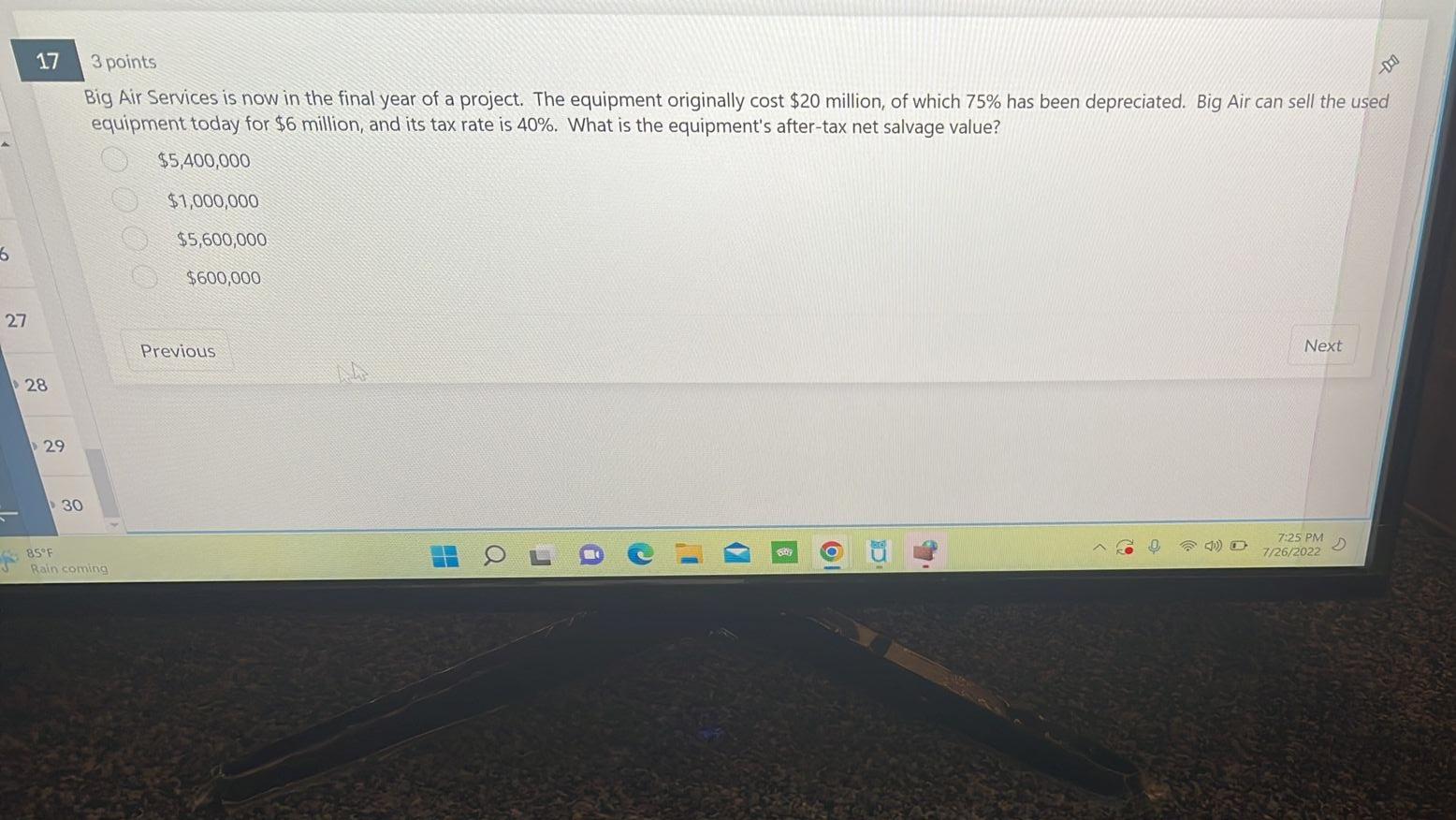

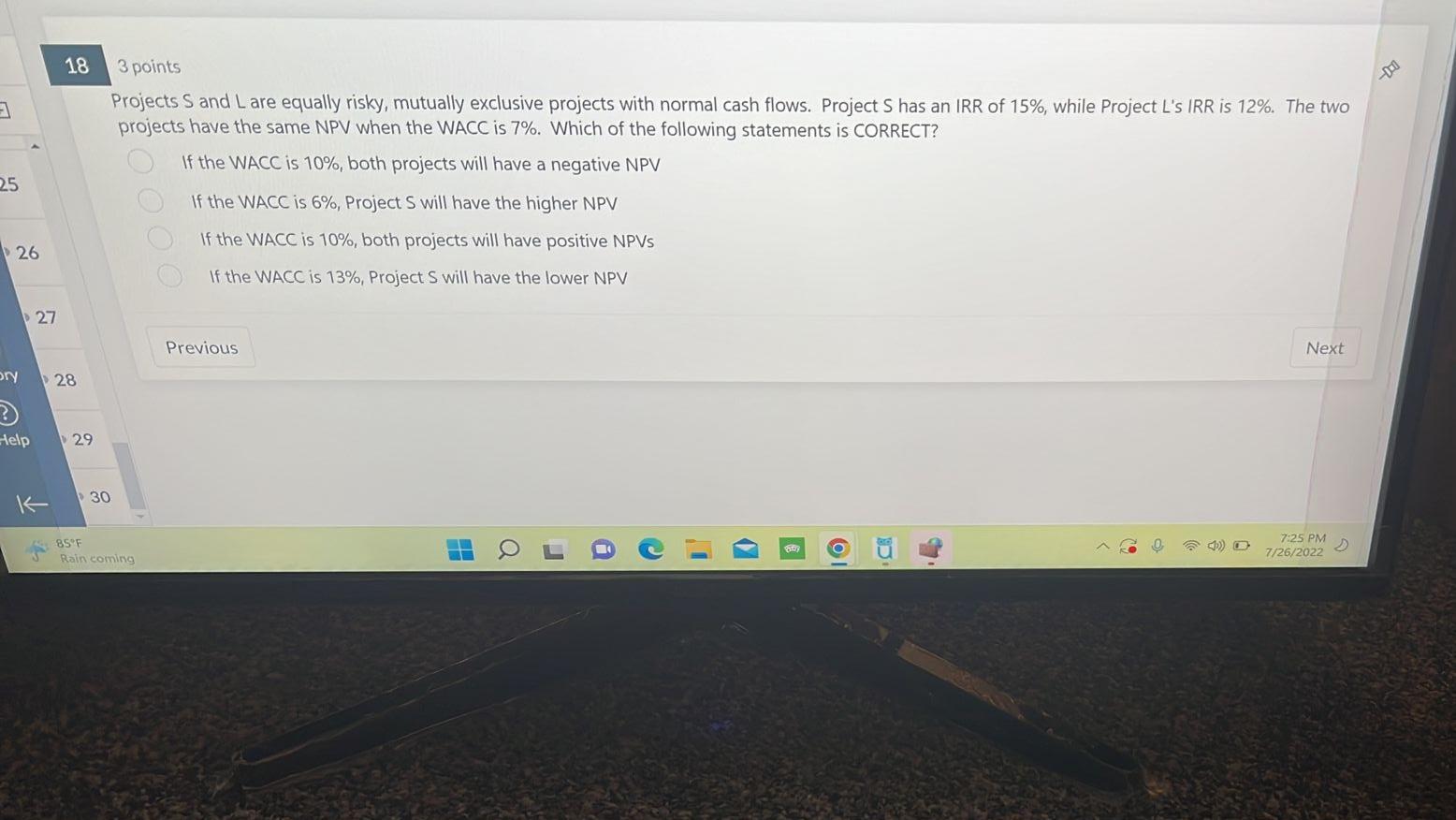

3 points In a capital budgeting project's cash flow analysis, are omitted because they are reflected in the firm's WACC. opportunity costs externalities cannibalization effects interest costs Big Air Services is now in the final year of a project. The equipment originally cost $20 million, of which 75% has been depreciated. Big Air can sell the used equipment today for $6 million, and its tax rate is 40%. What is the equipment's after-tax net salvage value? $5,400,000 $1,000,000 $5,600,000 $600,000 Projects S and L are equally risky, mutually exclusive projects with normal cash flows. Project S has an IRR of 15%, while Project L's IRR is 12%. The two projects have the same NPV when the WACC is 7%. Which of the following statements is CORRECT? If the WACC is 10%, both projects will have a negative NPV If the WACC is 6%, Project S will have the higher NPV If the WACC is 10%, both projects will have positive NPVS If the WACC is 13%, Project S will have the lower NPV

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts