Question: please do it in 10 minutes will upvote part C A stock index is computed as the price weighted average of three stocks, A, B

please do it in 10 minutes will upvote part C

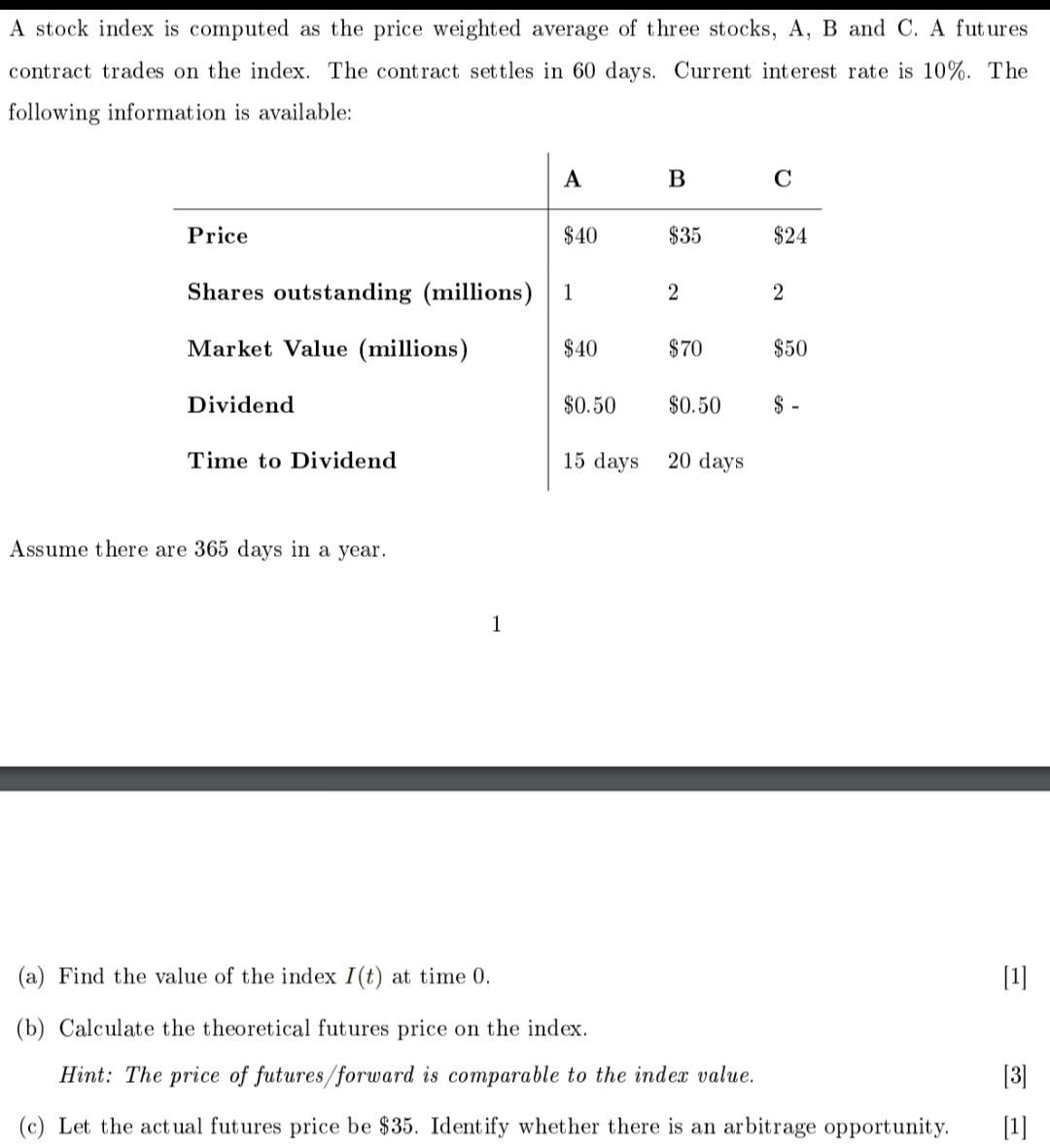

A stock index is computed as the price weighted average of three stocks, A, B and C. A futures contract trades on the index. The contract settles in 60 days. Current interest rate is 10%. The following information is available: A B c Price $40 $35 $24 Shares outstanding (millions) 1 N 2 Market Value (millions) $40 $70 $50 Dividend $0.50 $0.50 $ Time to Dividend 15 days 20 days Assume there are 365 days in a year. 1 (a) Find the value of the index I(t) at time 0. [1] (b) Calculate the theoretical futures price on the index. Hint: The price of futures/forward is comparable to the index value. [3] (c) Let the actual futures price be $35. Identify whether there is an arbitrage opportunity. [1] A stock index is computed as the price weighted average of three stocks, A, B and C. A futures contract trades on the index. The contract settles in 60 days. Current interest rate is 10%. The following information is available: A B c Price $40 $35 $24 Shares outstanding (millions) 1 N 2 Market Value (millions) $40 $70 $50 Dividend $0.50 $0.50 $ Time to Dividend 15 days 20 days Assume there are 365 days in a year. 1 (a) Find the value of the index I(t) at time 0. [1] (b) Calculate the theoretical futures price on the index. Hint: The price of futures/forward is comparable to the index value. [3] (c) Let the actual futures price be $35. Identify whether there is an arbitrage opportunity. [1]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts