Question: please do it in 10 minutes will upvote Please answer Problems 1-4 in Excel and solve each problem in separate worksheets. Problem 5 must be

please do it in 10 minutes will upvote

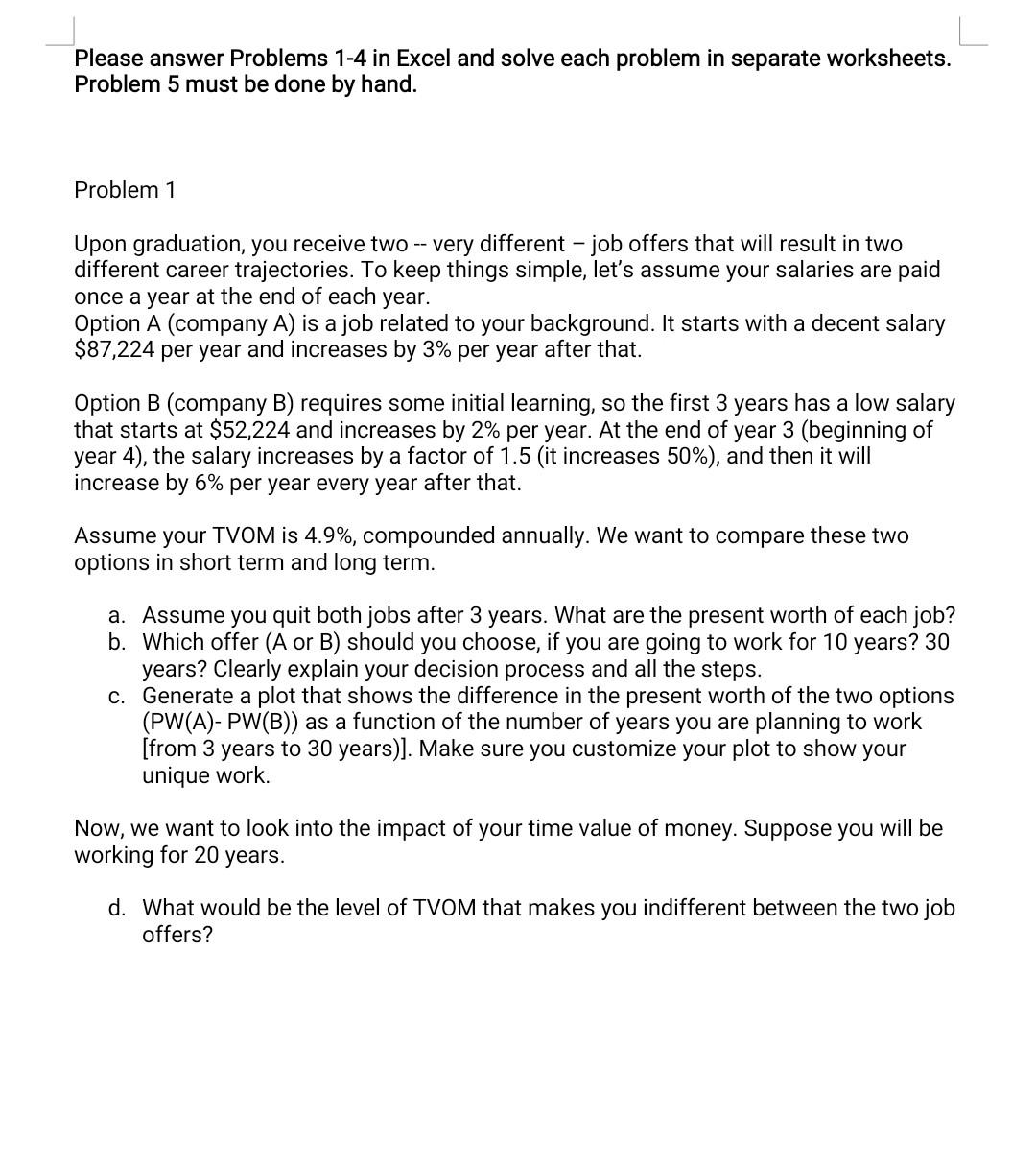

Please answer Problems 1-4 in Excel and solve each problem in separate worksheets. Problem 5 must be done by hand. Problem 1 Upon graduation, you receive two -- very different - job offers that will result in two different career trajectories. To keep things simple, let's assume your salaries are paid once a year at the end of each year. Option A (company A) is a job related to your background. It starts with a decent salary $87,224 per year and increases by 3% per year after that. Option B (company B) requires some initial learning, so the first 3 years has a low salary that starts at $52,224 and increases by 2% per year. At the end of year 3 (beginning of year 4), the salary increases by a factor of 1.5 (it increases 50%), and then it will increase by 6% per year every year after that. Assume your TVOM is 4.9%, compounded annually. We want to compare these two options in short term and long term. a. Assume you quit both jobs after 3 years. What are the present worth of each job? b. Which offer (A or B) should you choose, if you are going to work for 10 years? 30 years? Clearly explain your decision process and all the steps. c. Generate a plot that shows the difference in the present worth of the two options (PW(A)- PW(B)) as a function of the number of years you are planning to work [from 3 years to 30 years)]. Make sure you customize your plot to show your unique work. Now, we want to look into the impact of your time value of money. Suppose you will be working for 20 years. d. What would be the level of TVOM that makes you indifferent between the two job offers

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts