Question: please do it in 10 minutes will upvote Question 3: Sally Wood Sally runs her own business selling toys and makes up accounts to 31

please do it in 10 minutes will upvote

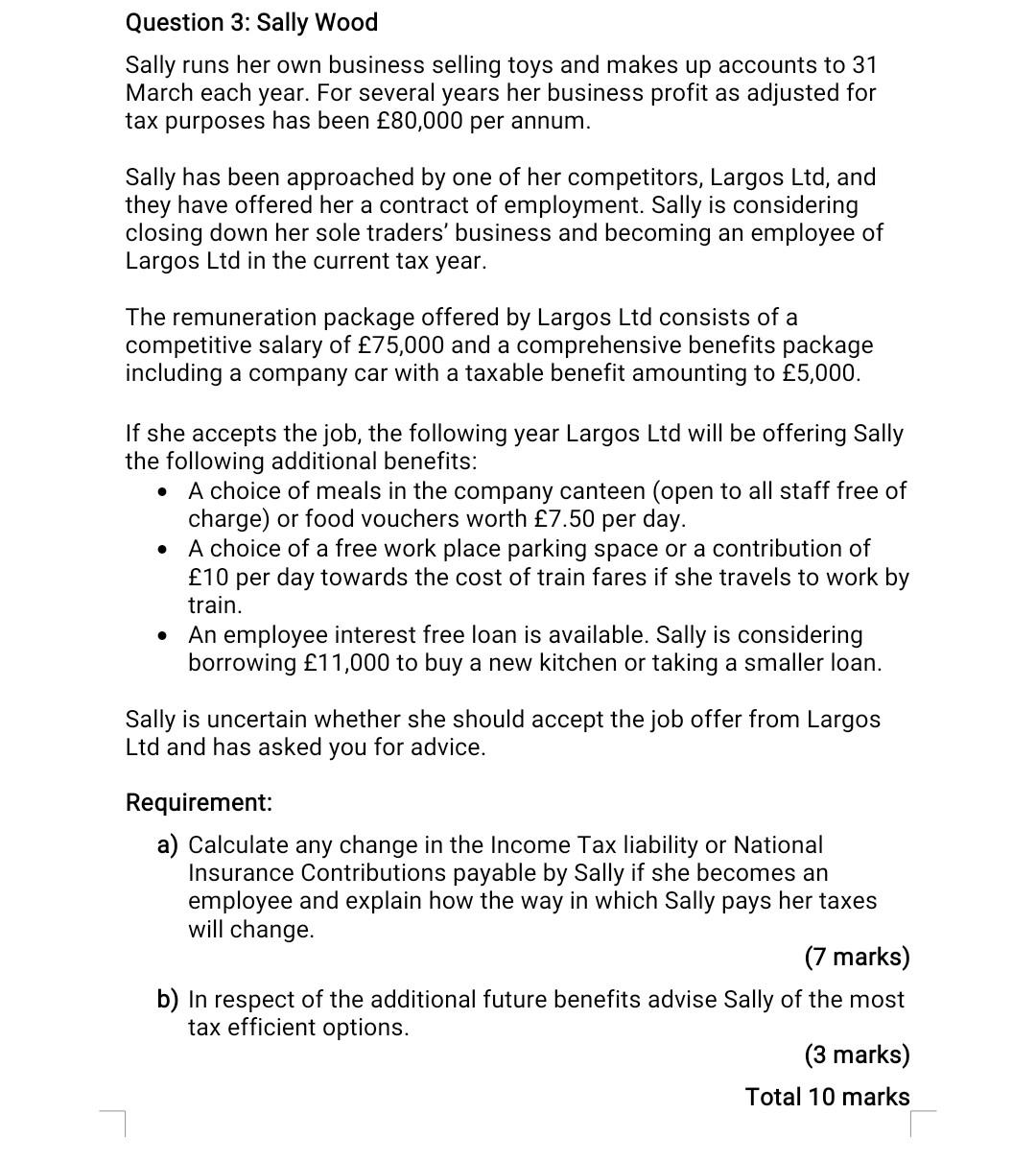

Question 3: Sally Wood Sally runs her own business selling toys and makes up accounts to 31 March each year. For several years her business profit as adjusted for tax purposes has been 80,000 per annum. Sally has been approached by one of her competitors, Largos Ltd, and they have offered her a contract of employment. Sally is considering closing down her sole traders' business and becoming an employee of Largos Ltd in the current tax year. The remuneration package offered by Largos Ltd consists of a competitive salary of 75,000 and a comprehensive benefits package including a company car with a taxable benefit amounting to 5,000. If she accepts the job, the following year Largos Ltd will be offering Sally the following additional benefits: - A choice of meals in the company canteen (open to all staff free of charge) or food vouchers worth 7.50 per day. - A choice of a free work place parking space or a contribution of 10 per day towards the cost of train fares if she travels to work by train. - An employee interest free loan is available. Sally is considering borrowing 11,000 to buy a new kitchen or taking a smaller loan. Sally is uncertain whether she should accept the job offer from Largos Ltd and has asked you for advice. Requirement: a) Calculate any change in the Income Tax liability or National Insurance Contributions payable by Sally if she becomes an employee and explain how the way in which Sally pays her taxes will change. (7 marks) b) In respect of the additional future benefits advise Sally of the most tax efficient options. (3 marks) Total 10 marks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts