Question: please do it in 10 minutes will upvote Question 3 Not yet answered The statement that stock prices follow a random walk implies that: 1)

please do it in 10 minutes will upvote

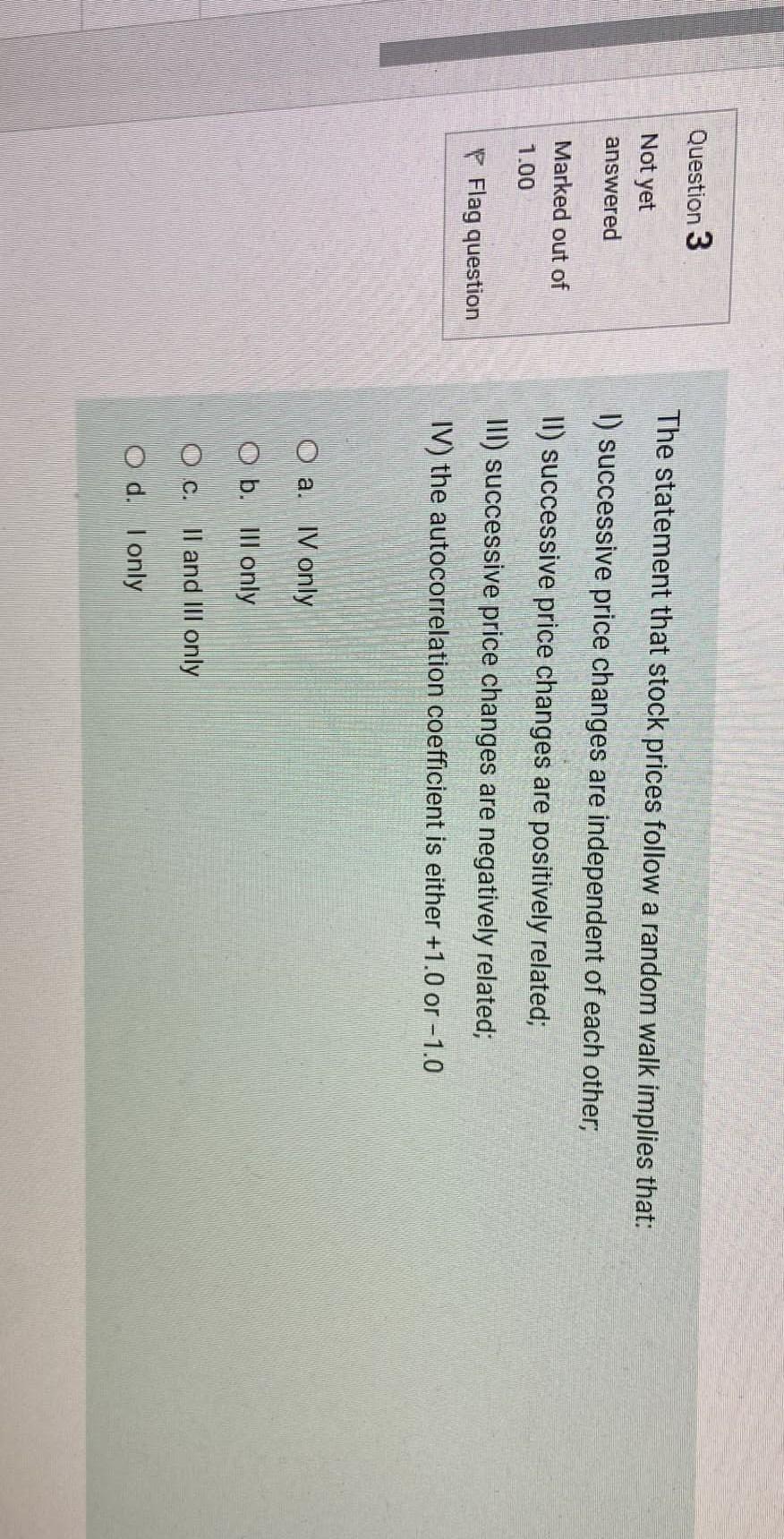

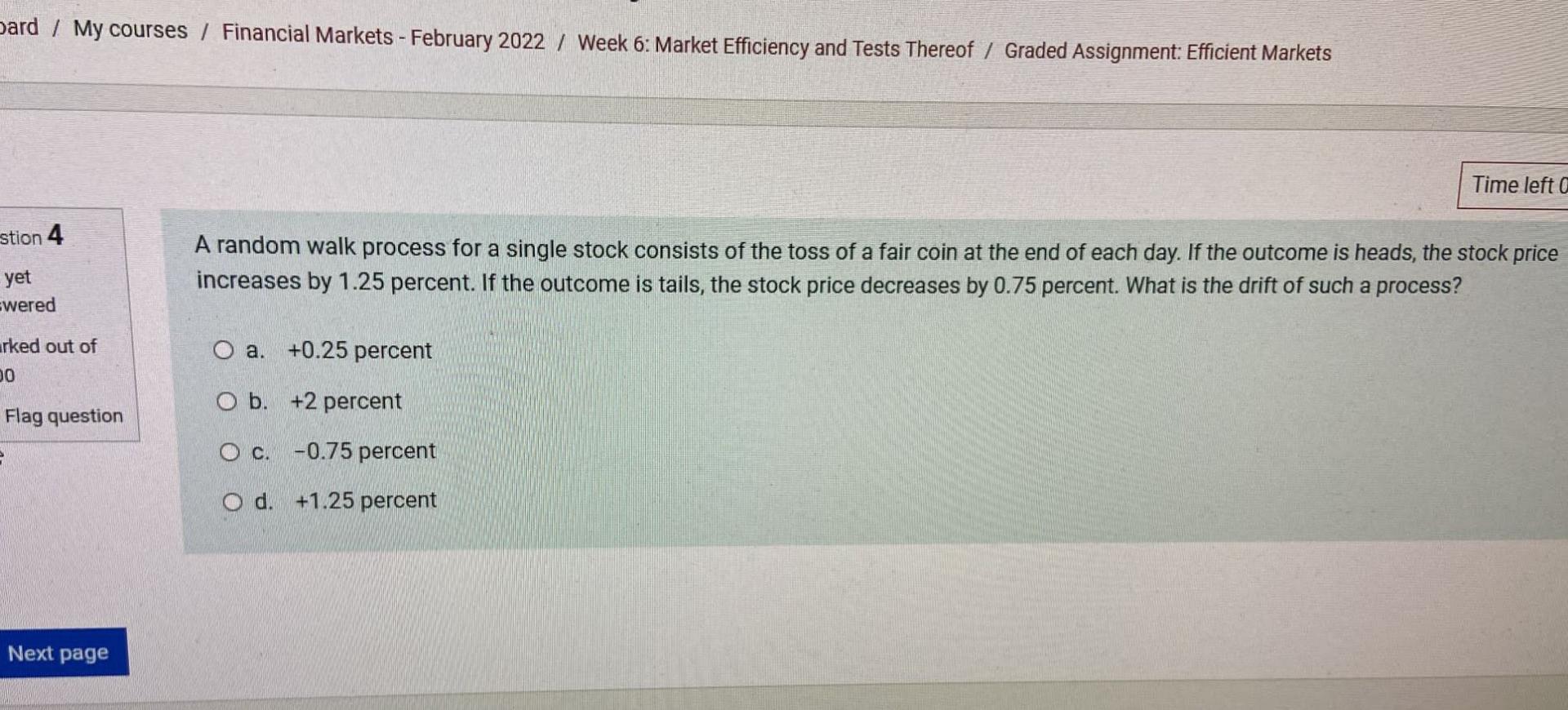

Question 3 Not yet answered The statement that stock prices follow a random walk implies that: 1) successive price changes are independent of each other, II) successive price changes are positively related; Marked out of 1.00 III) successive price changes are negatively related; Flag question IV) the autocorrelation coefficient is either +1.0 or -1.0 a. IV only O b. III only oc. II and III only O d. I only Dard / My courses / Financial Markets - February 2022 / Week 6: Market Efficiency and Tests Thereof / Graded Assignment: Efficient Markets Time left stion 4 A random walk process for a single stock consists of the toss of a fair coin at the end of each day. If the outcome is heads, the stock price increases by 1.25 percent. If the outcome is tails, the stock price decreases by 0.75 percent. What is the drift of such a process? yet Ewered rked out of 20 O a. +0.25 percent O b. +2 percent Flag question O c. -0.75 percent O d. +1.25 percent Next page

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts