Question: please do it in 10 minutes will upvote Which method of evaluating capital budget projects is generally regarded to be the best single method? Discounted

please do it in 10 minutes will upvote

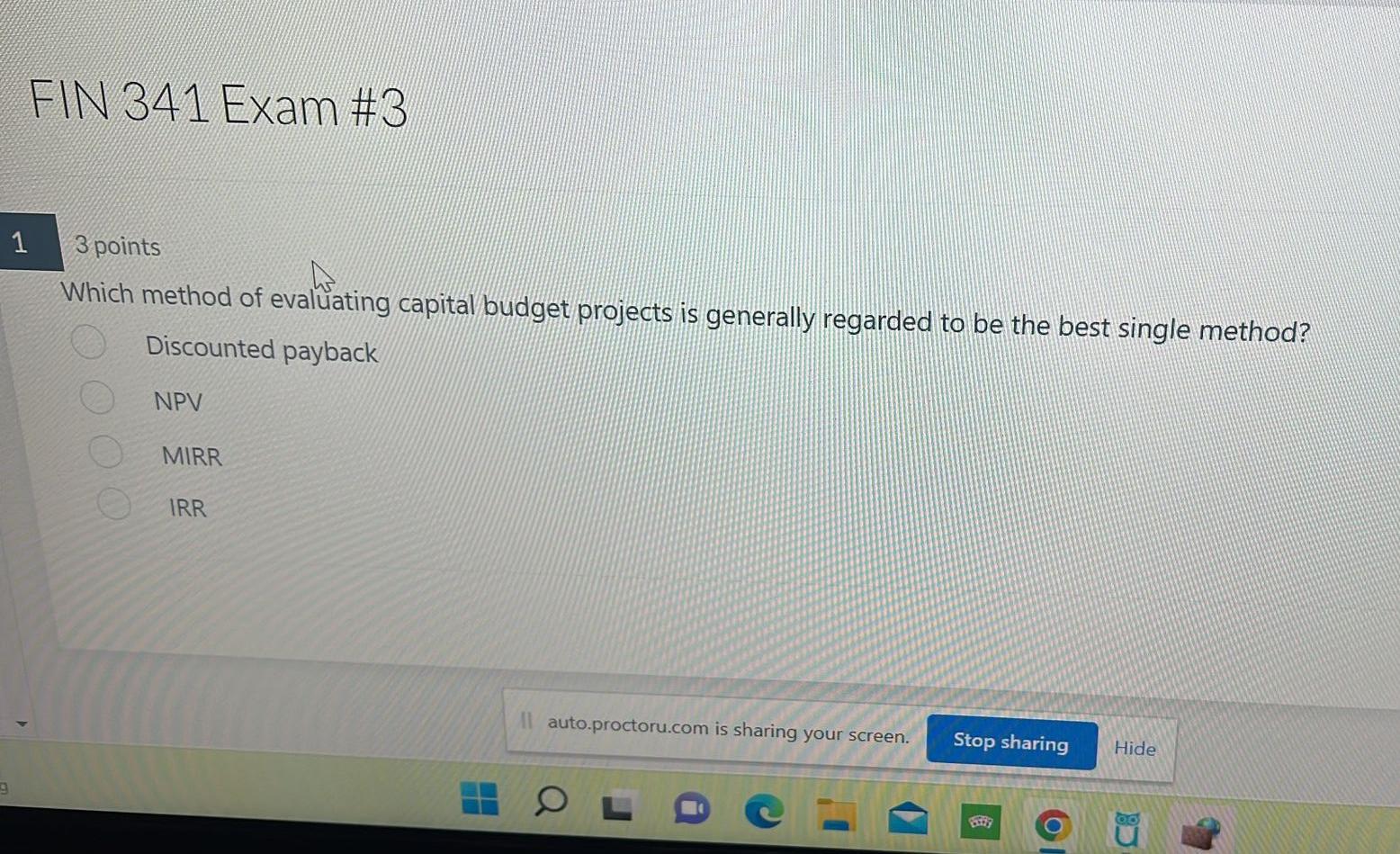

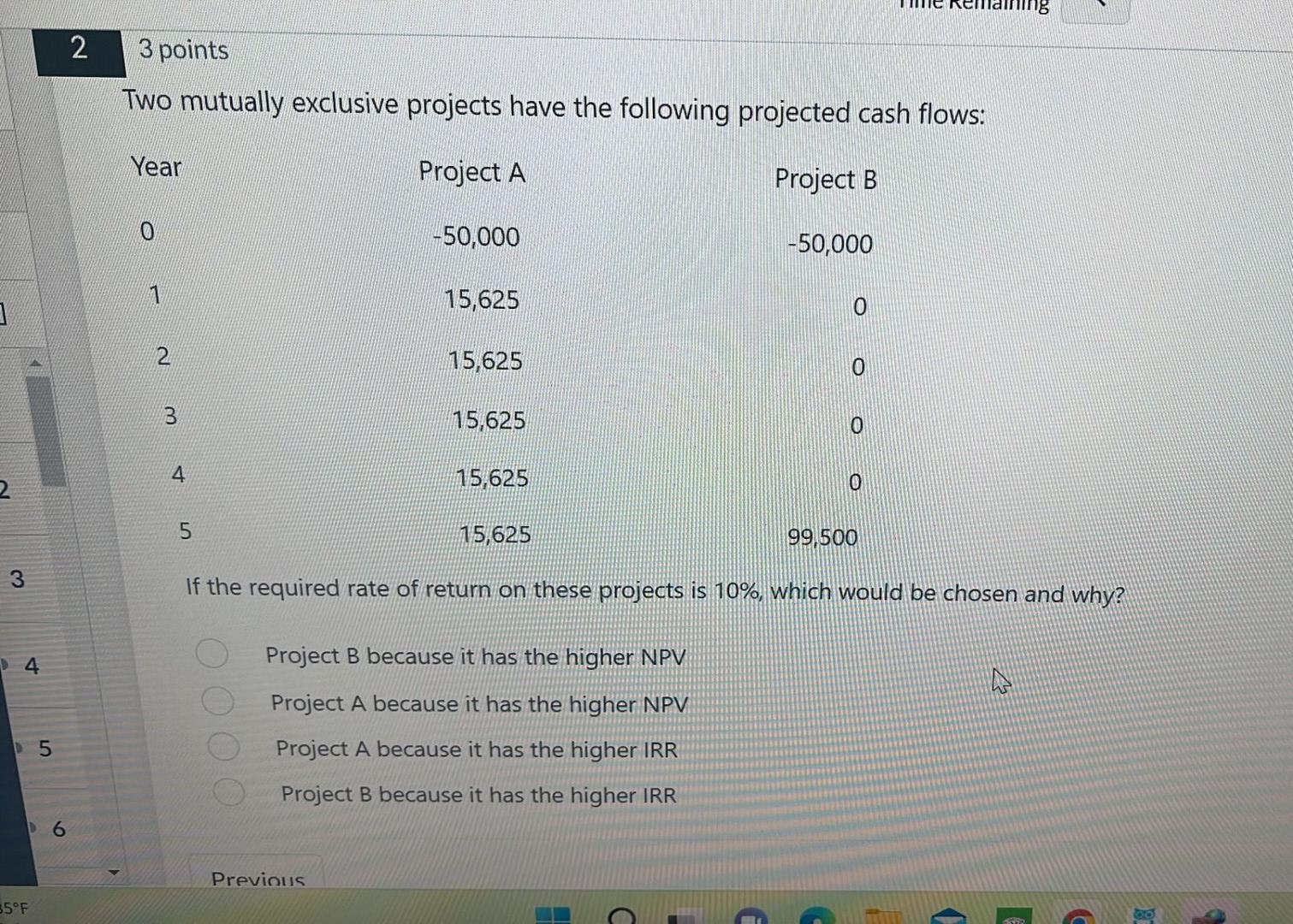

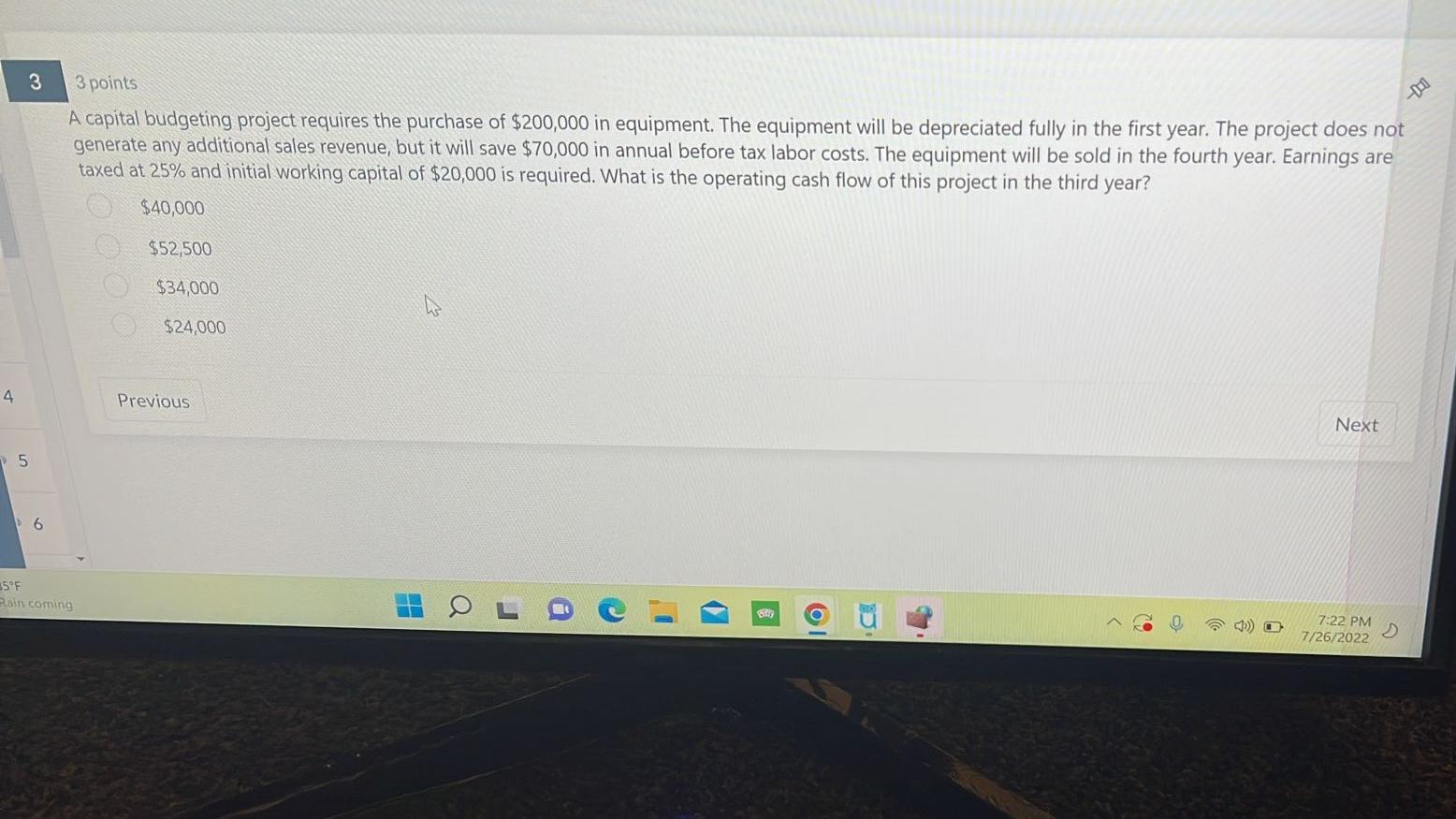

Which method of evaluating capital budget projects is generally regarded to be the best single method? Discounted payback NPV MIRR IRR Two mutually exclusive projects have the following projected cash flows: If the required rate of return on these projects is 10%, which would be chosen and why? Project B because it has the higher NPV Project A because it has the higher NPV Project A because it has the higher IRR Project B because it has the higher IRR A capital budgeting project requires the purchase of $200,000 in equipment. The equipment will be depreciated fully in the first year. The project does not generate any additional sales revenue, but it will save $70,000 in annual before tax labor costs. The equipment will be sold in the fourth year. Earnings are taxed at 25% and initial working capital of $20,000 is required. What is the operating cash flow of this project in the third year? $40,000 $52,500 $34,000 $24,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts