Question: please do it in 30 minutes please please please urgently... I'll give you up thumb definitely 1. You are asked to prepare for the Accounting

please do it in 30 minutes please please please urgently... I'll give you up thumb definitely

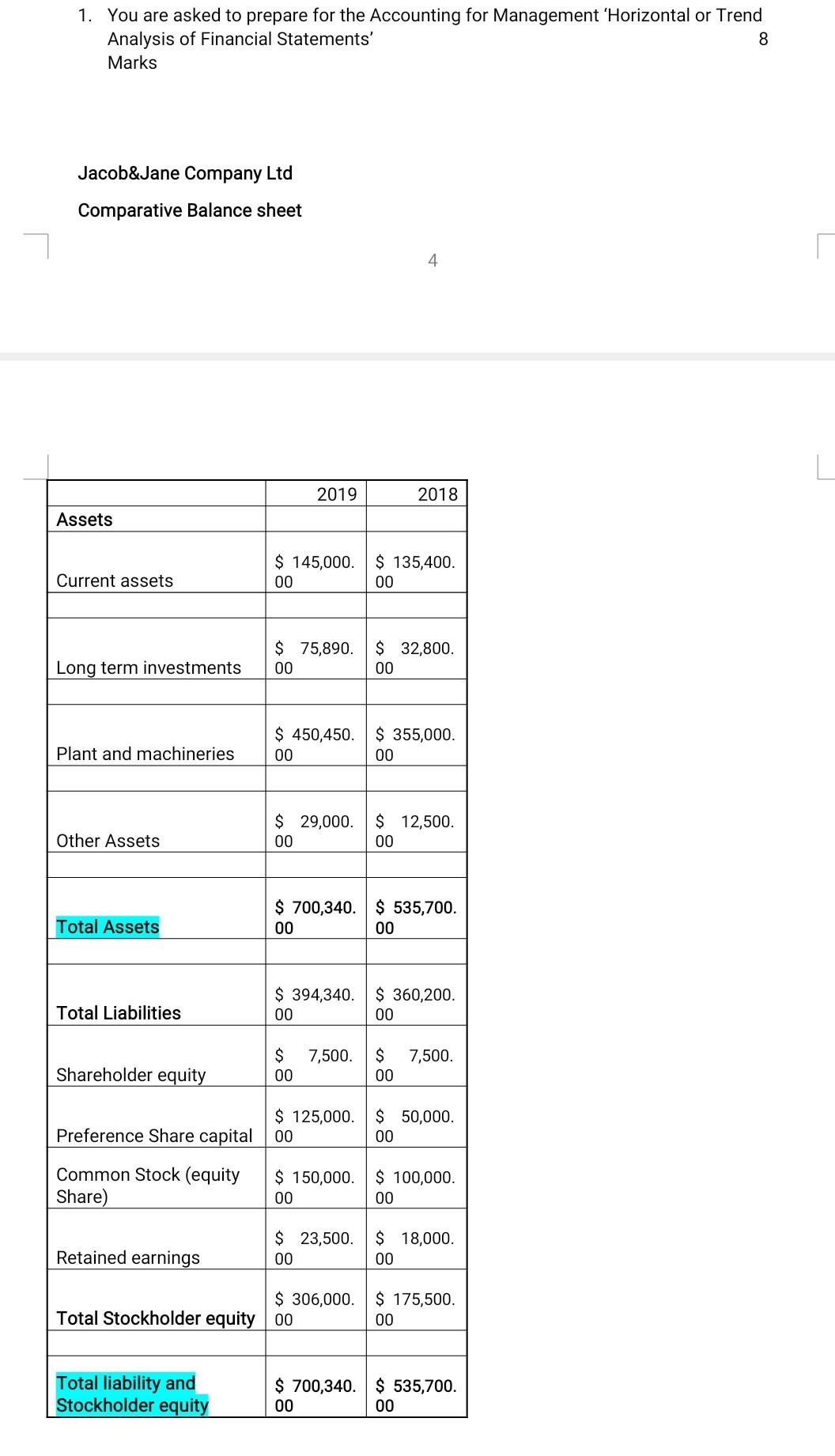

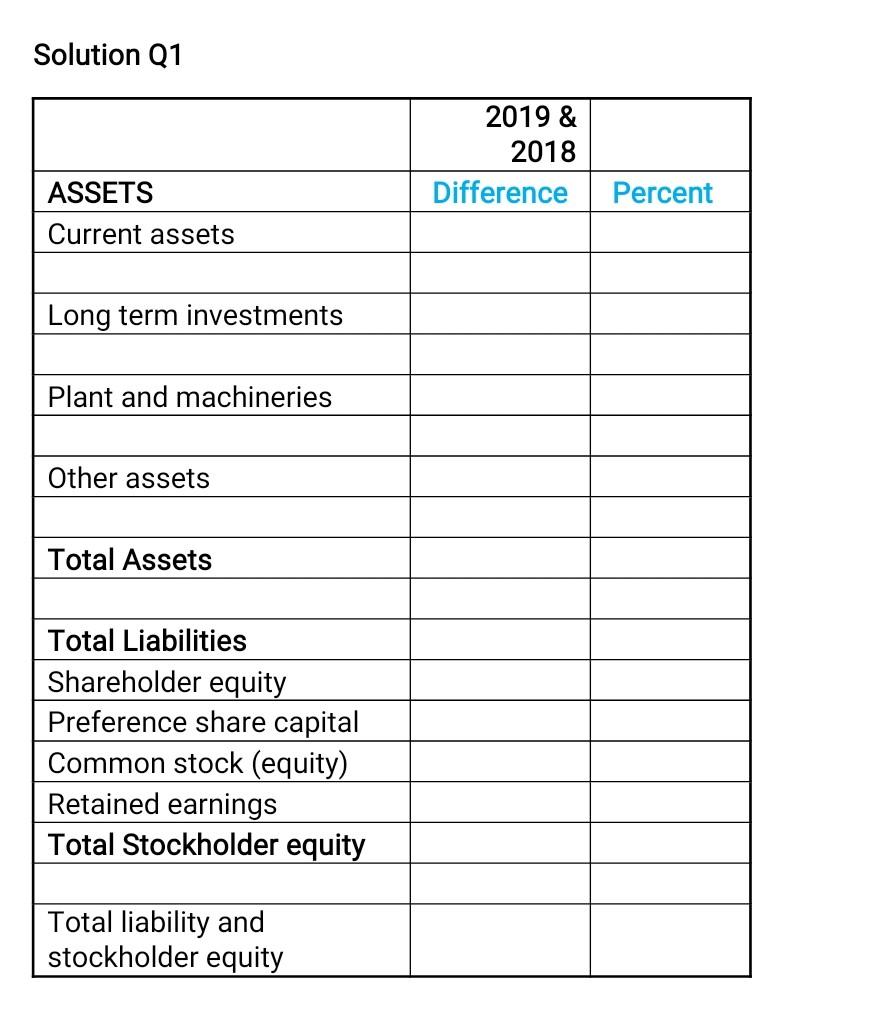

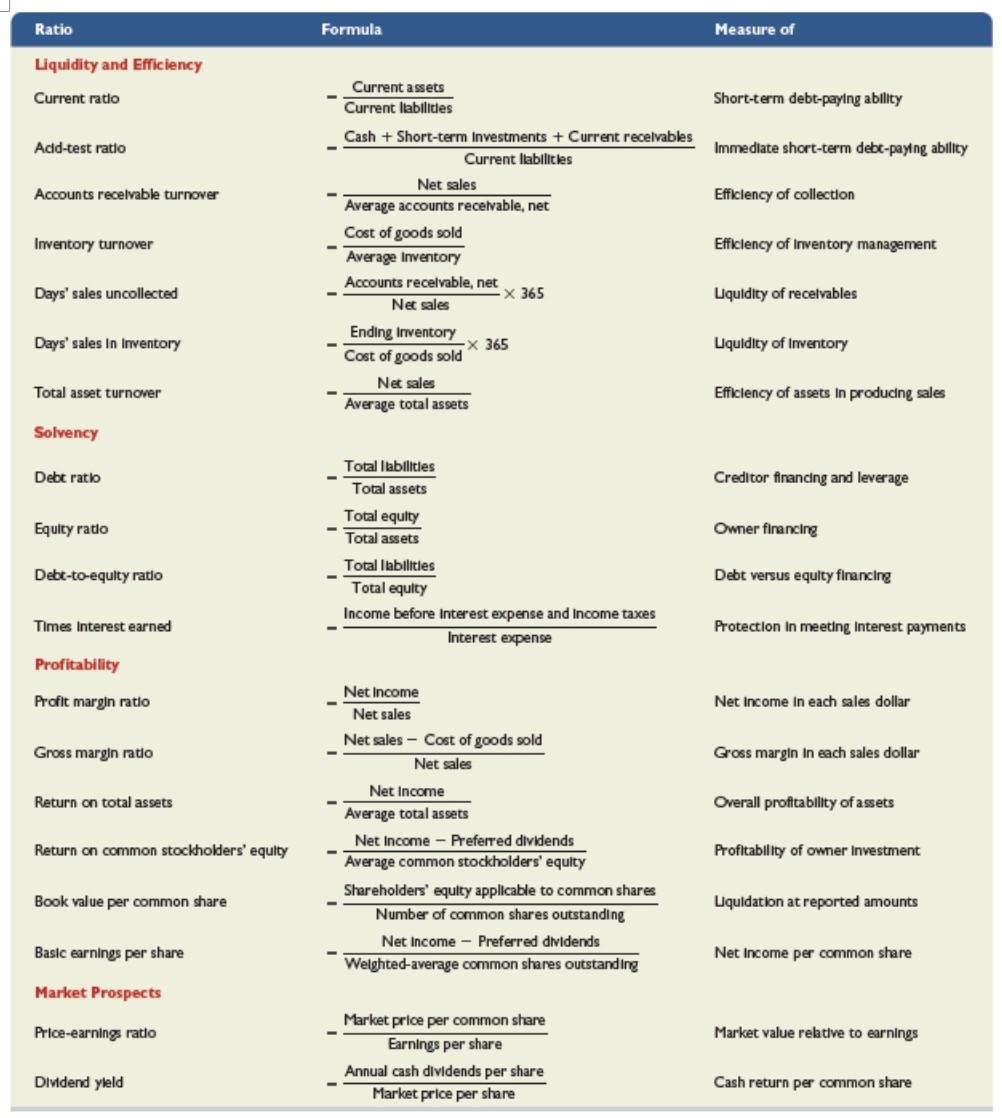

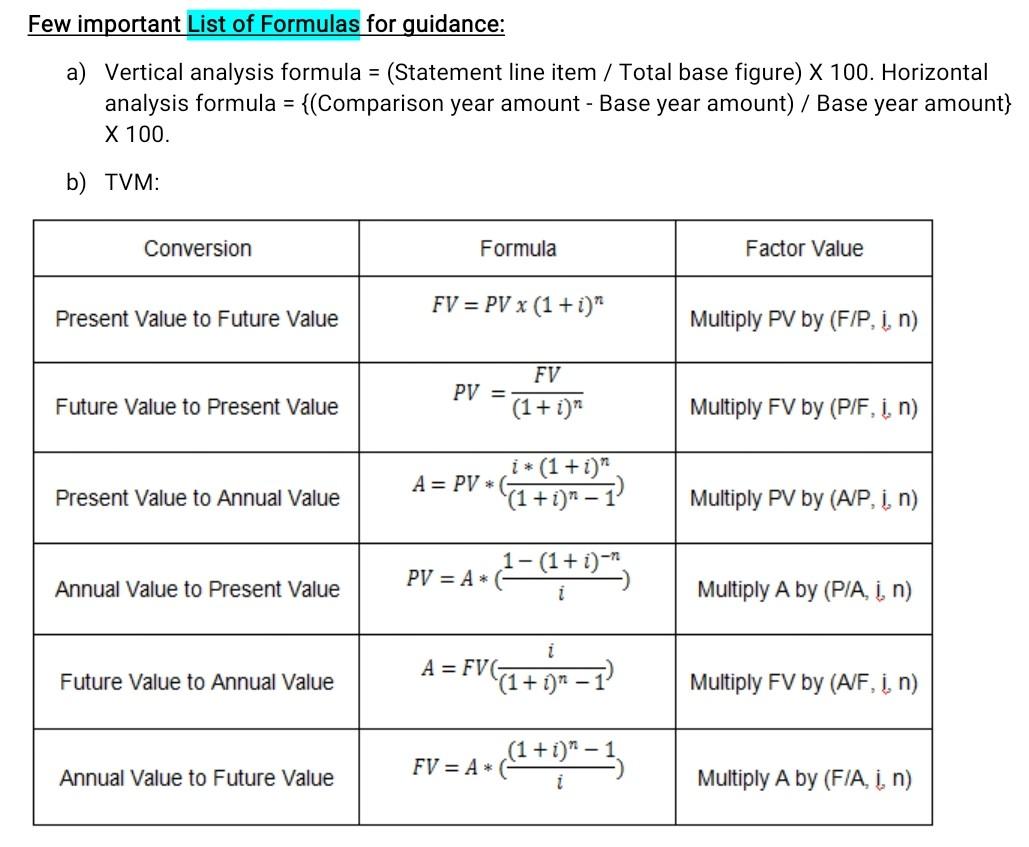

1. You are asked to prepare for the Accounting for Management 'Horizontal or Trend Analysis of Financial Statements' 8 Marks Jacob&Jane Company Ltd Comparative Balance sheet 4 2019 2018 Assets $ 145,000.$ 135,400. 00 00 Current assets $ 75,890. 00 $ 32,800. 00 Long term investments $ 450,450. $ 355,000. 00 00 Plant and machineries $ 29,000. 00 $ 12,500. 00 Other Assets $ 700,340. $ 535,700. 00 00 Total Assets $ 394,340. 00 $360,200. 00 Total Liabilities 7,500. 7,500. Shareholder equity $ 00 $ 00 Preference Share capital $ 125,000. 00 $ 50,000 00 Common Stock (equity Share) $ 150,000. 00 $ 100,000. 00 $ 23,500. 00 Retained earnings $ 18,000. 00 Total Stockholder equity $ 306,000. 00 $ 175,500. 00 Total liability and Stockholder equity $ 700,340 $ 535,700. 00 00 Solution Q1 2019 & 2018 Difference Percent ASSETS Current assets Long term investments Plant and machineries Other assets Total Assets Total Liabilities Shareholder equity Preference share capital Common stock (equity) Retained earnings Total Stockholder equity Total liability and stockholder equity Ratio Formula Measure of Liquidity and Efficiency Current ratio Current assets Current liabilities Short-term debt-paying ability Add-test ratio Immediate short-term debe-paying ability Accounts receivable turnover Efficiency of collection Inventory turnover Efficiency of Inventory management Cash + Short-term Investments + Current receivables Current liabilities Net sales Average accounts receivable, net Cost of goods sold Average Inventory Accounts recelvable, net X 365 Net sales Ending Inventory X 365 Cost of goods sold Net sales Average total assets Days' sales uncollected Liquidity of receivables Days' sales In Inventory Liquidity of Inventory Total asset turnover Efficiency of assets in producing sales Solvency Debt ratio Total llabilities Total assets Creditor financing and leverage Equity ratio Owner financing Debt-to-equlty ratio Total equity Total assets Total abilities Total equity Income before Interest expense and Income taxes Interest expense Debt versus equity financing Times Interest earned Protection in meeting Interest payments Profitability Profit margin ratio Net Income in each sales dollar Gross margin ratio Gross margin in each sales dollar Return on total assets Overall profitability of assets Net Income Net sales Net sales - Cost of goods sold Net sales Net Income Average total assets Net Income - Preferred dividends Average common stockholders' equity Shareholders' equity applicable to common shares Number of common shares outstanding Net Income - Preferred dividends Weighted average common shares outstanding Return on common stockholders' equity Profitability of owner Investment Book value per common share Liquidation at reported amounts Basic earnings per share Net Income per common share Market Prospects Price-earnings ratio Market value relative to earnings Market price per common share Earnings per share Annual cash dividends per share Market price per share Dividend yleld Cash return per common share Few important List of Formulas for guidance: a) Vertical analysis formula = (Statement line item / Total base figure) X 100. Horizontal analysis formula = {(Comparison year amount - Base year amount) / Base year amount} X 100. b) TVM: Conversion Formula Factor Value FV = PV x (1 + i)" Present Value to Future Value Multiply PV by (F/P, i, n) PV = FV (1+i)" Future Value to Present Value Multiply FV by (P/F, I, n) i*(1+i)" A = PV * (1+i)n-1 Present Value to Annual Value Multiply PV by (AIP, i, n) 1-(1+i)* PV = A* Annual Value to Present Value i Multiply A by (PIA, I, n) i Future Value to Annual Value A = FV(+1+01 Multiply FV by (A/F, 1, n) FV = A. (4+4)* 3 Annual Value to Future Value i Multiply A by (FIA, i, n)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts