Question: please do it in 30 minutes will upvote use Excel Question #2 (20 points total) You are evaluating two risky stocks, A and B, with

please do it in 30 minutes will upvote use Excel

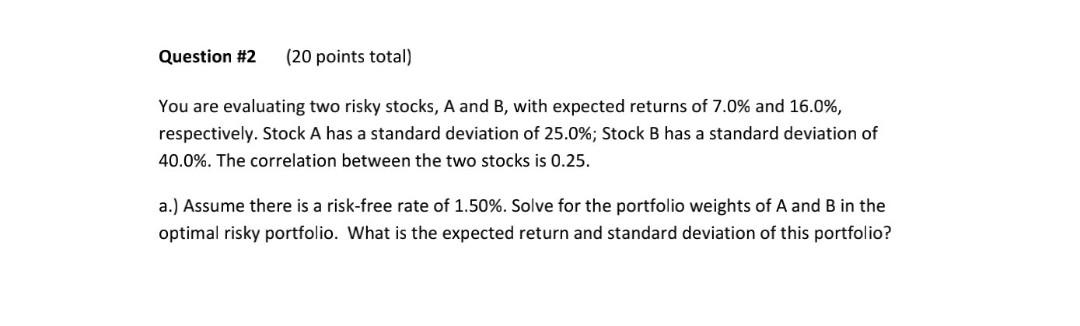

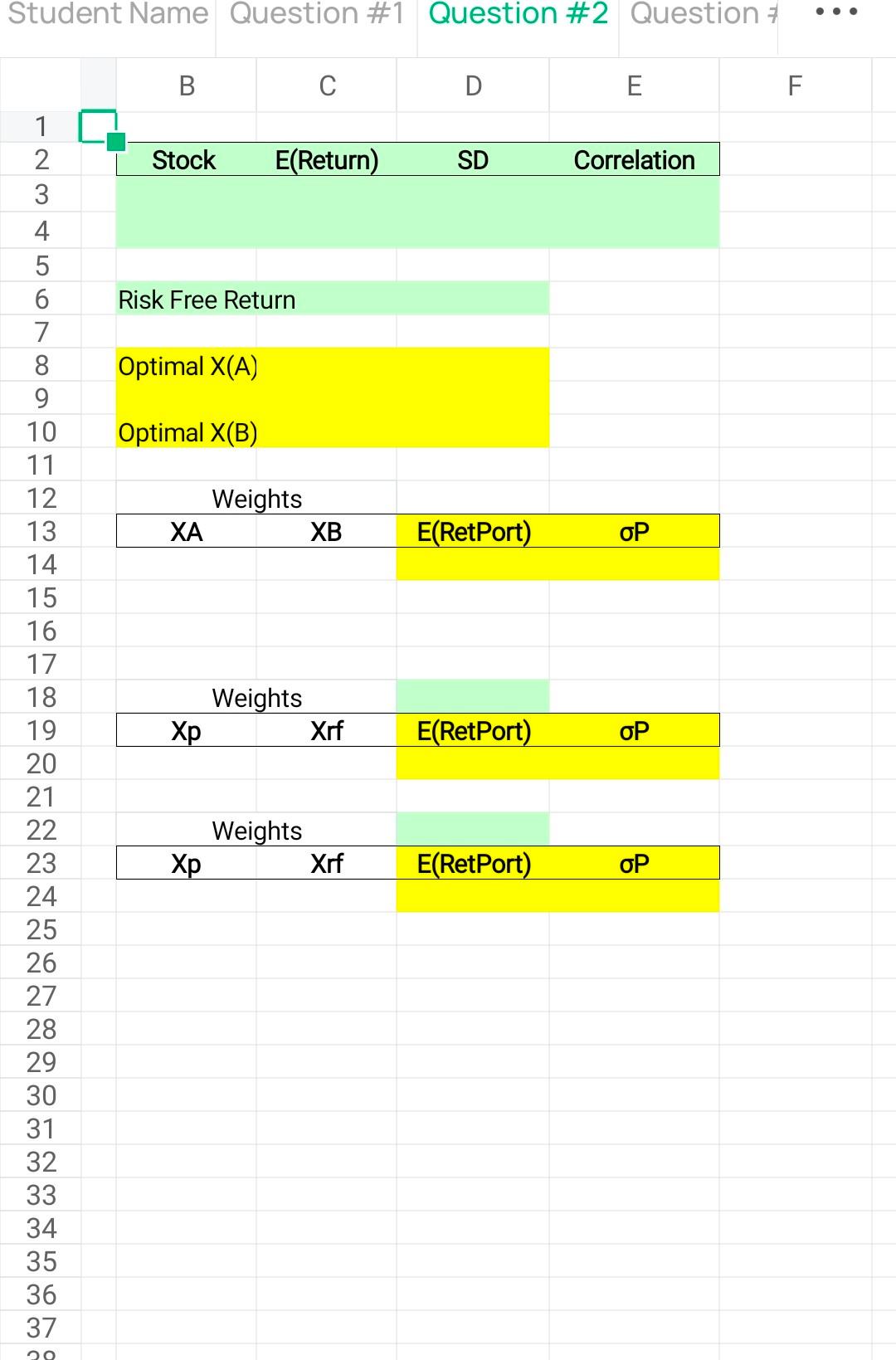

Question #2 (20 points total) You are evaluating two risky stocks, A and B, with expected returns of 7.0% and 16.0%, respectively. Stock A has a standard deviation of 25.0%; Stock B has a standard deviation of 40.0%. The correlation between the two stocks is 0.25. a.) Assume there is a risk-free rate of 1.50%. Solve for the portfolio weights of A and B in the optimal risky portfolio. What is the expected return and standard deviation of this portfolio? Student Name Question #1 Question #2 Question B D E F Stock E(Return) SD Correlation Risk Free Return Optimal X(A) Optimal X(B) 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 Weights XA XB E(RetPort) OP Weights Xrf E(RetPort) OP 22 Weights Xp Xrf E(RetPort) OP 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 DO

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts