Question: PLEASE DO IT IN EXCEL AND SHOW FORMULAS THANK YOU!! Input area: Assets Total debt and equity Current assets $ 125,000,000 Total debt $ $

PLEASE DO IT IN EXCEL AND SHOW FORMULAS

THANK YOU!!

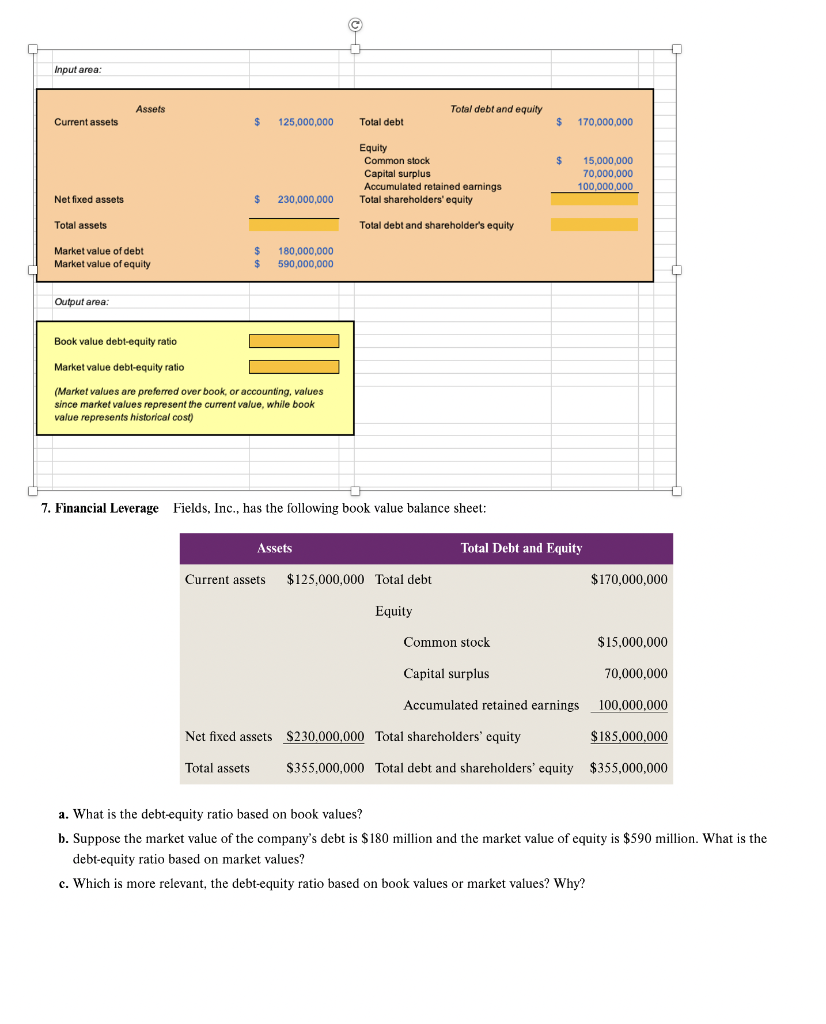

Input area: Assets Total debt and equity Current assets $ 125,000,000 Total debt $ $ 170,000,000 $ Equity Common stock Capital surplus Accumulated retained earnings Total shareholders' equity 15,000,000 70,000,000 100,000,000 Net fixed assets $ 230,000,000 Total assets Total debt and shareholder's equity Market value of debt Market value of equity $ $ $ 180,000,000 590,000,000 Output area: Book value debt-equity ratio Market value debl-equity ratio (Market values are preferred over book, or accounting, values since market values represent the current value, while book value represents historical cost) 7. Financial Leverage Fields, Inc., has the following book value balance sheet: Assets Total Debt and Equity Current assets $125,000,000 Total debt $170,000,000 Equity Common stock $15,000,000 Capital surplus 70,000,000 Accumulated retained earnings 100,000,000 Net fixed assets $230,000,000 Total shareholders' equity $185,000,000 Total assets $355,000,000 Total debt and shareholders' equity $355,000,000 a. What is the debt-equity ratio based on book values? b. Suppose the market value of the company's debt is $180 million and the market value of equity is $590 million. What is the debt-equity ratio based on market values? c. Which is more relevant, the debt-equity ratio based on book values or market values? Why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts