Question: PLEASE DO IT IN EXCEL FLE Then can you send the excel file to my email MY MAL: ufuk-olcan20000@hotmail.com2 THANK YOU Please create the Excel

PLEASE DO IT IN EXCEL FLE

Then can you send the excel file to my email

MY MAL: ufuk-olcan20000@hotmail.com2

THANK YOU

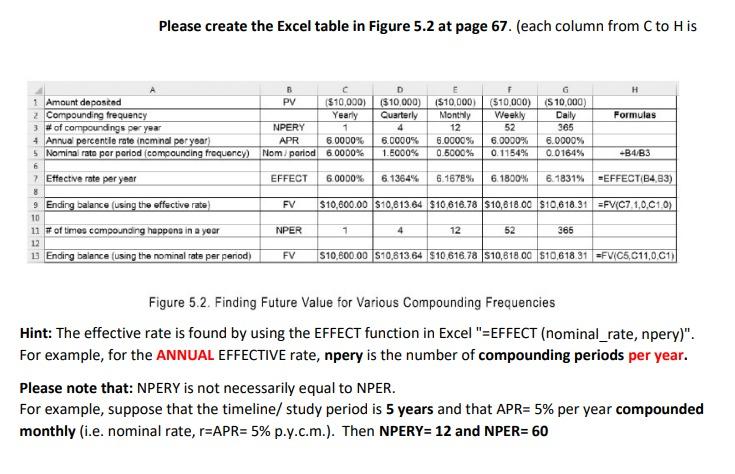

Please create the Excel table in Figure 5.2 at page 67. (each column from C to His H Formulas 1 Amount deposted 2 Compounding frequency 3 # of compoundings per year 4 Annual percentle rate inomnal per year) 5 Nominal rato per period compounding frequency) B G PV ($10,000) ($10,000) $10.000 (510,000) $10,000) Yearly Cuarterly Monthly Weekly Daily NPERY 1 4 12 52 365 6 0000% 6.0000% 6.0000% 6.0000% 6.0000% Nom parlod 600D0% 1.6000% 0.5000% 0.1154% 0.0164% APR -B4B3 EFFECT 60000% 6.1364% 6.1678% 6.1800% 6.1831% =EFFECT B4.83) 7 Effective rate per year 8 9 Ending balance (using the effective rate) 10 11 # of times compounding happens in a year FV $10,600.00 $10,613.64 $10.616.78 $10,616.00 $10,618.31 =FV(C7.1.0.C1.0) NPER 1 4 12 52 365 12 1 Ending balance (using the nominal rate per period) FV $10,800.00 $10,613.64 S10 616.78 510,618 00 510.618 31 =FV/C5,C11,0.01) Figure 5.2. Finding Future Value for Various Compounding Frequencies Hint: The effective rate is found by using the EFFECT function in Excel "=EFFECT (nominal_rate, npery)". For example, for the ANNUAL EFFECTIVE rate, npery is the number of compounding periods per year. Please note that: NPERY is not necessarily equal to NPER. For example, suppose that the timeline/ study period is 5 years and that APR= 5% per year compounded monthly (i.e. nominal rate, r=APR= 5% p.y.c.m.). Then NPERY= 12 and NPER= 60 Please create the Excel table in Figure 5.2 at page 67. (each column from C to His H Formulas 1 Amount deposted 2 Compounding frequency 3 # of compoundings per year 4 Annual percentle rate inomnal per year) 5 Nominal rato per period compounding frequency) B G PV ($10,000) ($10,000) $10.000 (510,000) $10,000) Yearly Cuarterly Monthly Weekly Daily NPERY 1 4 12 52 365 6 0000% 6.0000% 6.0000% 6.0000% 6.0000% Nom parlod 600D0% 1.6000% 0.5000% 0.1154% 0.0164% APR -B4B3 EFFECT 60000% 6.1364% 6.1678% 6.1800% 6.1831% =EFFECT B4.83) 7 Effective rate per year 8 9 Ending balance (using the effective rate) 10 11 # of times compounding happens in a year FV $10,600.00 $10,613.64 $10.616.78 $10,616.00 $10,618.31 =FV(C7.1.0.C1.0) NPER 1 4 12 52 365 12 1 Ending balance (using the nominal rate per period) FV $10,800.00 $10,613.64 S10 616.78 510,618 00 510.618 31 =FV/C5,C11,0.01) Figure 5.2. Finding Future Value for Various Compounding Frequencies Hint: The effective rate is found by using the EFFECT function in Excel "=EFFECT (nominal_rate, npery)". For example, for the ANNUAL EFFECTIVE rate, npery is the number of compounding periods per year. Please note that: NPERY is not necessarily equal to NPER. For example, suppose that the timeline/ study period is 5 years and that APR= 5% per year compounded monthly (i.e. nominal rate, r=APR= 5% p.y.c.m.). Then NPERY= 12 and NPER= 60

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts