Question: Please do it in excel, thank you. Question #3 (40 marks) The condensed comparative statement of financial position and income statement (statements not in proper

Please do it in excel, thank you.

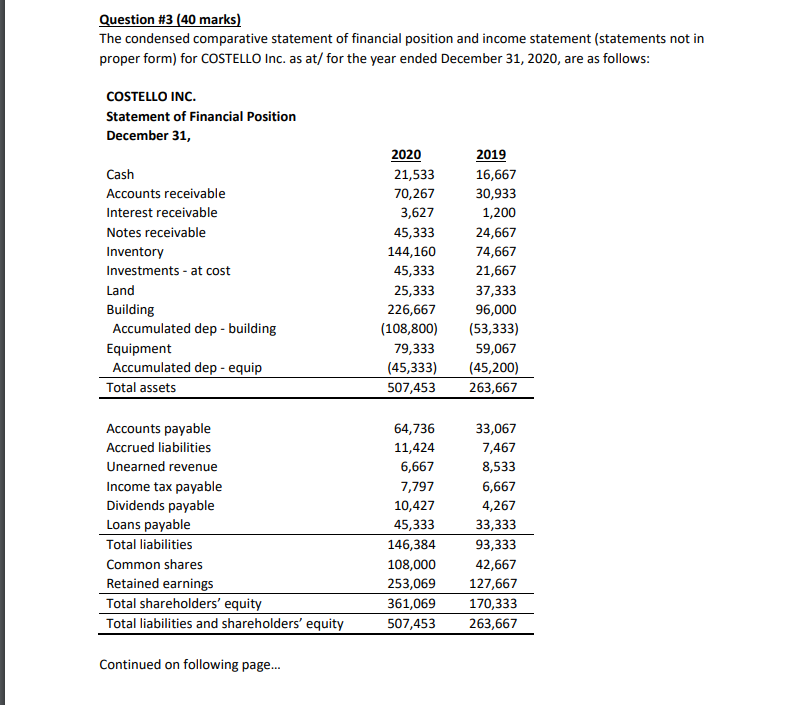

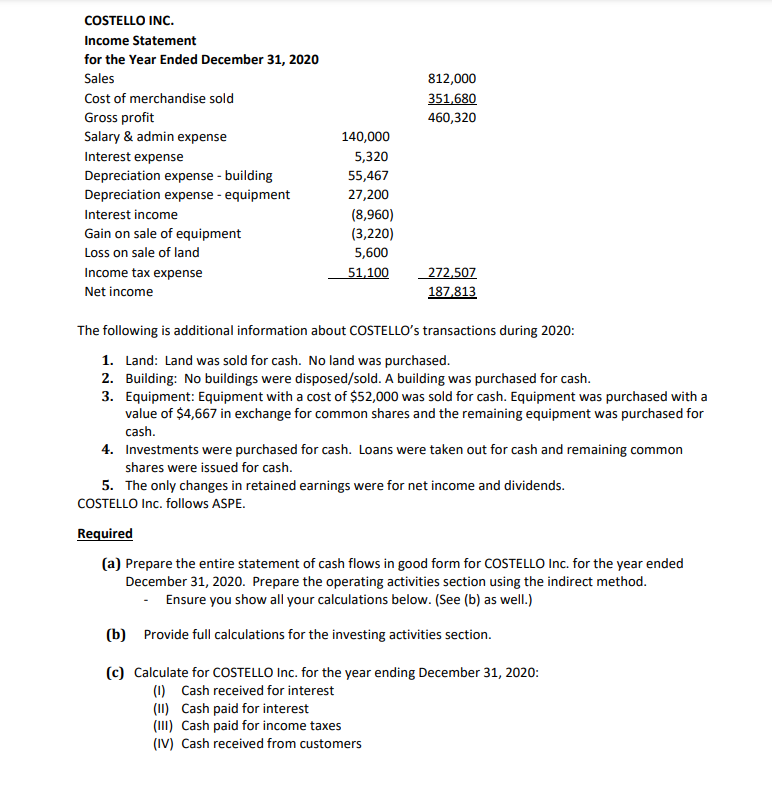

Question #3 (40 marks) The condensed comparative statement of financial position and income statement (statements not in proper form) for COSTELLO Inc. as at/ for the year ended December 31, 2020, are as follows: COSTELLO INC. Statement of Financial Position December 31, Cash Accounts receivable Interest receivable Notes receivable Inventory Investments - at cost Land Building Accumulated dep - building Equipment Accumulated dep-equip Total assets 2020 21,533 70,267 3,627 45,333 144,160 45,333 25,333 226,667 (108,800) 79,333 (45,333) 507,453 2019 16,667 30,933 1,200 24,667 74,667 21,667 37,333 96,000 (53,333) 59,067 (45,200) 263,667 Accounts payable Accrued liabilities Unearned revenue Income tax payable Dividends payable Loans payable Total liabilities Common shares Retained earnings Total shareholders' equity Total liabilities and shareholders' equity 64,736 11,424 6,667 7,797 10,427 45,333 146,384 108,000 253,069 361,069 507,453 33,067 7,467 8,533 6,667 4,267 33,333 93,333 42,667 127,667 170,333 263,667 Continued on following page... 812,000 351,680 460,320 COSTELLO INC. Income Statement for the Year Ended December 31, 2020 Sales Cost of merchandise sold Gross profit Salary & admin expense Interest expense Depreciation expense - building Depreciation expense - equipment Interest income Gain on sale of equipment Loss on sale of land Income tax expense Net income 140,000 5,320 55,467 27,200 (8,960) (3,220) 5,600 51,100 272,507 187,813 The following is additional information about COSTELLO's transactions during 2020: 1. Land: Land was sold for cash. No land was purchased. 2. Building: No buildings were disposed/sold. A building was purchased for cash. 3. Equipment: Equipment with a cost of $52,000 was sold for cash. Equipment was purchased with a value of $4,667 in exchange for common shares and the remaining equipment was purchased for cash. 4. Investments were purchased for cash. Loans were taken out for cash and remaining common shares were issued for cash. 5. The only changes in retained earnings were for net income and dividends. COSTELLO Inc. follows ASPE. Required (a) Prepare the entire statement of cash flows in good form for COSTELLO Inc. for the year ended December 31, 2020. Prepare the operating activities section using the indirect method. - Ensure you show all your calculations below. (See (b) as well.) (6) Provide full calculations for the investing activities section. (c) Calculate for COSTELLO Inc. for the year ending December 31, 2020: (1) Cash received for interest (11) Cash paid for interest (III) Cash paid for income taxes (IV) Cash received from customers

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts