Question: Please do it in excel with formulas Dewey Cheetham & Howe Accounting firm is considering the purchase of a $1,000 New Haven Municipal Bond. The

Please do it in excel with formulas

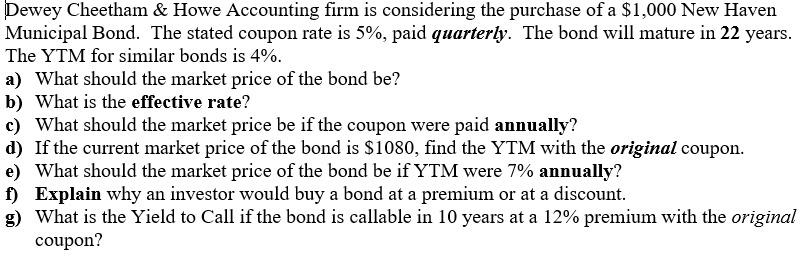

Dewey Cheetham & Howe Accounting firm is considering the purchase of a $1,000 New Haven Municipal Bond. The stated coupon rate is 5%, paid quarterly. The bond will mature in 22 years. The YTM for similar bonds is 4%. a) What should the market price of the bond be? b) What is the effective rate? c) What should the market price be if the coupon were paid annually? d) If the current market price of the bond is $1080, find the YTM with the original coupon. e) What should the market price of the bond be if YTM were 7% annually? f) Explain why an investor would buy a bond at a premium or at a discount. g) What is the Yield to Call if the bond is callable in 10 years at a 12% premium with the original coupon

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts