Question: Please Do it in Microsoft Excel. (Provide Excel File if possible) You are planning to purchase a house which will cost $400,000. You plan to

Please Do it in Microsoft Excel. (Provide Excel File if possible)

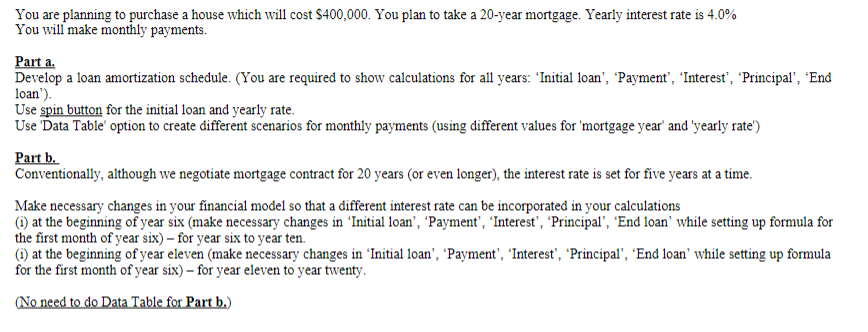

You are planning to purchase a house which will cost $400,000. You plan to take a 20-year mortgage. Yearly interest rate is 4.0% You will make monthly payments. Part a. Develop a loan amortization schedule. (You are required to show calculations for all years: 'Initial loan, Payment', 'Interest, Principal', 'End loan). Use spin button for the initial loan and yearly rate. Use 'Data Table' option to create different scenarios for monthly payments (using different values for 'mortgage year' and 'yearly rate') Part b. Conventionally, although we negotiate mortgage contract for 20 years or even longer), the interest rate is set for five years at a time. Make necessary changes in your financial model so that a different interest rate can be incorporated in your calculations (1) at the beginning of year six (make necessary changes in 'Initial loan', 'Payment', 'Interest', 'Principal', 'End loan' while setting up formula for the first month of year six) - for year six to year ten. (1) at the beginning of year eleven (make necessary changes in 'Initial loan', 'Payment', 'Interest', 'Principal', 'End loan' while setting up formula for the first month of year six) for year eleven to year twenty. (No need to do Data Table for Part b.) You are planning to purchase a house which will cost $400,000. You plan to take a 20-year mortgage. Yearly interest rate is 4.0% You will make monthly payments. Part a. Develop a loan amortization schedule. (You are required to show calculations for all years: 'Initial loan, Payment', 'Interest, Principal', 'End loan). Use spin button for the initial loan and yearly rate. Use 'Data Table' option to create different scenarios for monthly payments (using different values for 'mortgage year' and 'yearly rate') Part b. Conventionally, although we negotiate mortgage contract for 20 years or even longer), the interest rate is set for five years at a time. Make necessary changes in your financial model so that a different interest rate can be incorporated in your calculations (1) at the beginning of year six (make necessary changes in 'Initial loan', 'Payment', 'Interest', 'Principal', 'End loan' while setting up formula for the first month of year six) - for year six to year ten. (1) at the beginning of year eleven (make necessary changes in 'Initial loan', 'Payment', 'Interest', 'Principal', 'End loan' while setting up formula for the first month of year six) for year eleven to year twenty. (No need to do Data Table for Part b.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts