Question: PLEASE DO IT STEP BY STEP WITHOUT USING SHORTCUTS I WILL THUMBS UP THANK YOU. Case 2 Chaudhary Feed and Supply Company buys on terms

PLEASE DO IT STEP BY STEP WITHOUT USING SHORTCUTS I WILL THUMBS UP THANK YOU.

PLEASE DO IT STEP BY STEP WITHOUT USING SHORTCUTS I WILL THUMBS UP THANK YOU.

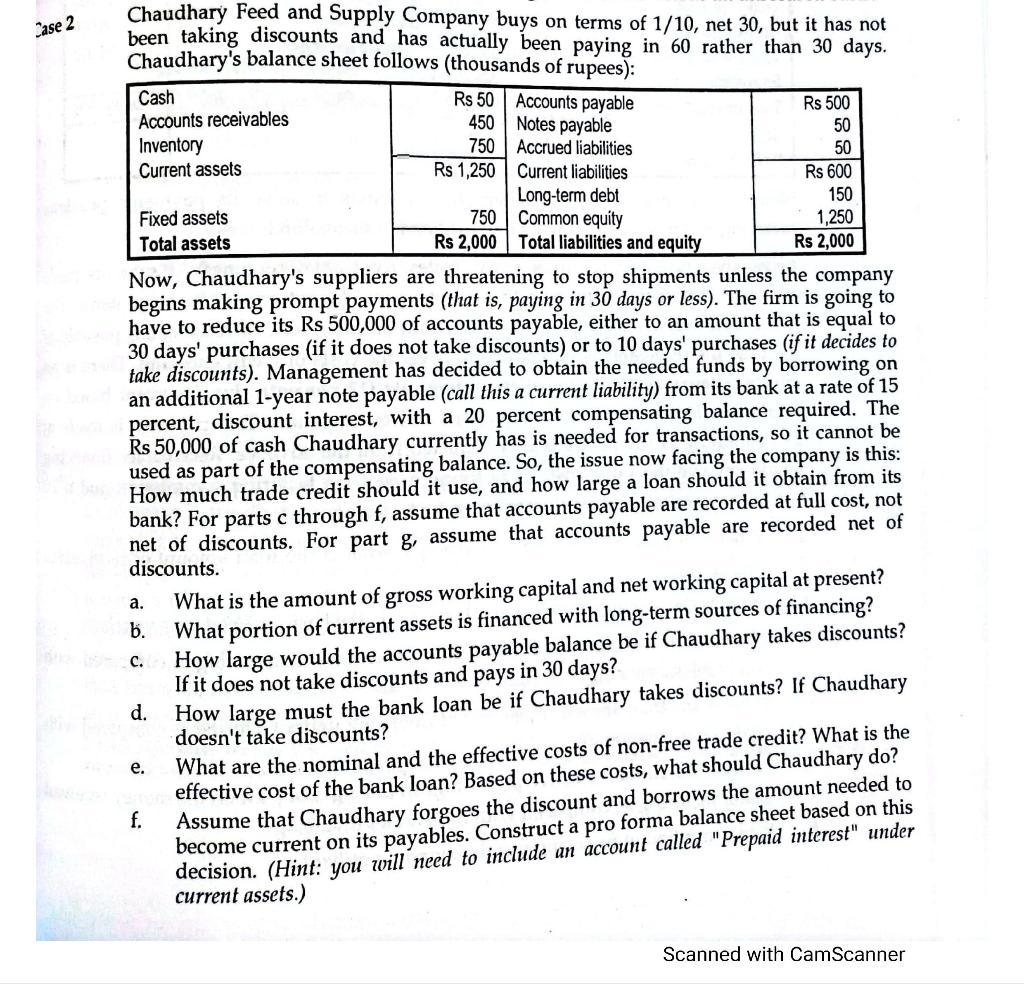

Case 2 Chaudhary Feed and Supply Company buys on terms of 1/10, net 30, but it has not been taking discounts and has actually been paying in 60 rather than 30 days. Chaudhary's balance sheet follows (thousands of rupees): Cash Rs 50 Accounts payable Rs 500 Accounts receivables 450 Notes payable 50 Inventory 750 Accrued liabilities 50 Current assets Rs 1,250 Current liabilities Rs 600 Long-term debt 150 Fixed assets 750 Common equity 1,250 Total assets Rs 2,000 Total liabilities and equity Rs 2,000 Now, Chaudhary's suppliers are threatening to stop shipments unless the company begins making prompt payments (that is, paying in 30 days or less). The firm is going to have to reduce its Rs 500,000 of accounts payable, either to an amount that is equal to 30 days' purchases (if it does not take discounts) or to 10 days' purchases (if it decides to take discounts). Management has decided to obtain the needed funds by borrowing on an additional 1-year note payable (call this a current liability) from its bank at a rate of 15 percent, discount interest, with a 20 percent compensating balance required. The Rs 50,000 of cash Chaudhary currently has is needed for transactions, so it cannot be used as part of the compensating balance. So, the issue now facing the company is this: How much trade credit should it use, and how large a loan should it obtain from its bank? For parts c through f, assume that accounts payable are recorded at full cost, not net of discounts. For part g, assume that accounts payable are recorded net of discounts. What is the amount of gross working capital and net working capital at present? b. What portion of current assets is financed with long-term sources of financing? c. How large would the accounts payable balance be if Chaudhary takes discounts? If it does not take discounts and pays in 30 days? d. How large must the bank loan be if Chaudhary takes discounts? If Chaudhary doesn't take discounts? What are the nominal and the effective costs of non-free trade credit? What is the effective cost of the bank loan? Based on these costs, what should Chaudhary do? f. Assume that Chaudhary forgoes the discount and borrows the amount needed to become current on its payables. Construct a pro forma balance sheet based on this decision. (Hint: you will need to include an account called "Prepaid interest" under current assets.) a. e. Scanned with CamScanner Case 2 Chaudhary Feed and Supply Company buys on terms of 1/10, net 30, but it has not been taking discounts and has actually been paying in 60 rather than 30 days. Chaudhary's balance sheet follows (thousands of rupees): Cash Rs 50 Accounts payable Rs 500 Accounts receivables 450 Notes payable 50 Inventory 750 Accrued liabilities 50 Current assets Rs 1,250 Current liabilities Rs 600 Long-term debt 150 Fixed assets 750 Common equity 1,250 Total assets Rs 2,000 Total liabilities and equity Rs 2,000 Now, Chaudhary's suppliers are threatening to stop shipments unless the company begins making prompt payments (that is, paying in 30 days or less). The firm is going to have to reduce its Rs 500,000 of accounts payable, either to an amount that is equal to 30 days' purchases (if it does not take discounts) or to 10 days' purchases (if it decides to take discounts). Management has decided to obtain the needed funds by borrowing on an additional 1-year note payable (call this a current liability) from its bank at a rate of 15 percent, discount interest, with a 20 percent compensating balance required. The Rs 50,000 of cash Chaudhary currently has is needed for transactions, so it cannot be used as part of the compensating balance. So, the issue now facing the company is this: How much trade credit should it use, and how large a loan should it obtain from its bank? For parts c through f, assume that accounts payable are recorded at full cost, not net of discounts. For part g, assume that accounts payable are recorded net of discounts. What is the amount of gross working capital and net working capital at present? b. What portion of current assets is financed with long-term sources of financing? c. How large would the accounts payable balance be if Chaudhary takes discounts? If it does not take discounts and pays in 30 days? d. How large must the bank loan be if Chaudhary takes discounts? If Chaudhary doesn't take discounts? What are the nominal and the effective costs of non-free trade credit? What is the effective cost of the bank loan? Based on these costs, what should Chaudhary do? f. Assume that Chaudhary forgoes the discount and borrows the amount needed to become current on its payables. Construct a pro forma balance sheet based on this decision. (Hint: you will need to include an account called "Prepaid interest" under current assets.) a. e. Scanned with CamScanner

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts