Question: please do it with the numbers provided and a good explanation please (e) Post Adjusting Journal Entries to T-Accounts ( Ledgers) Post the adjusting entries

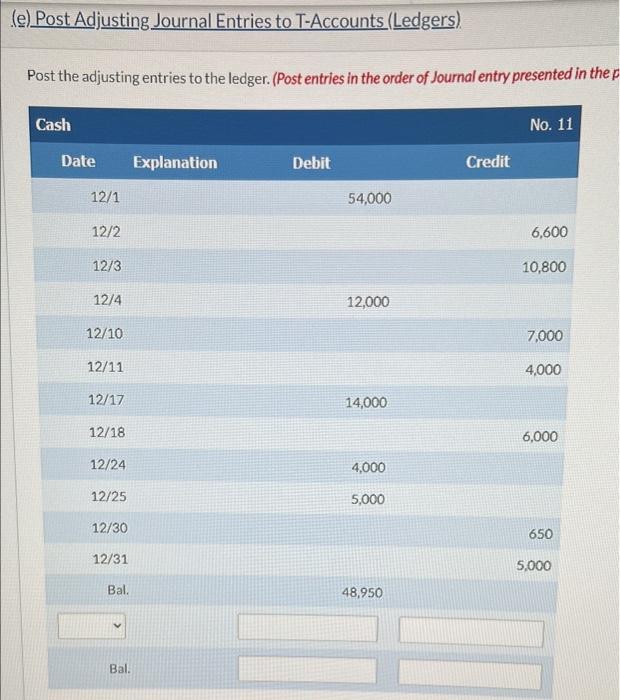

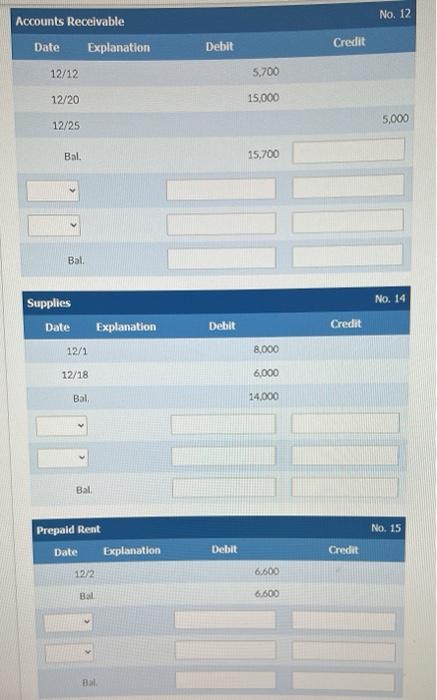

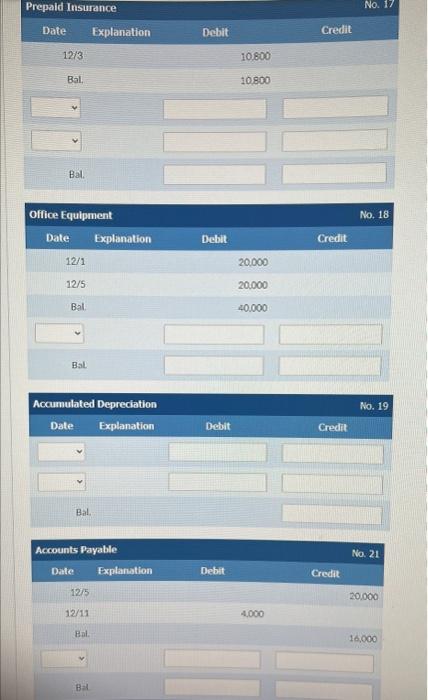

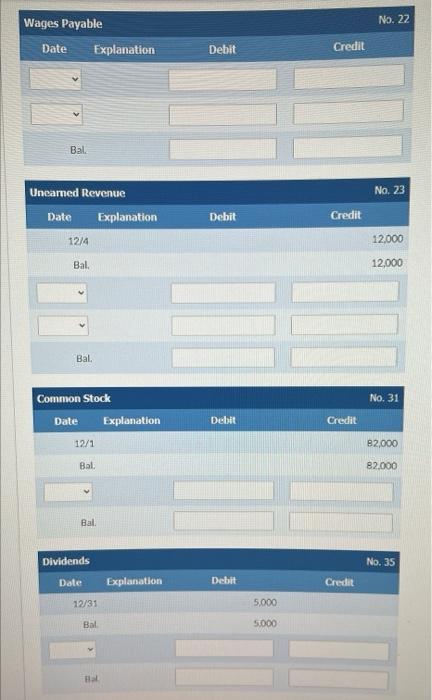

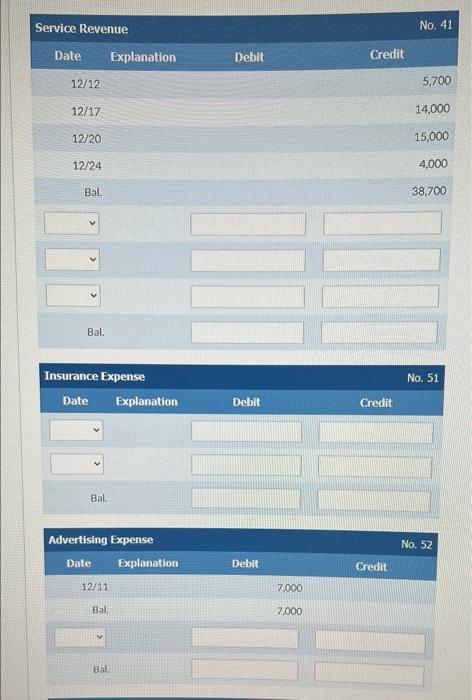

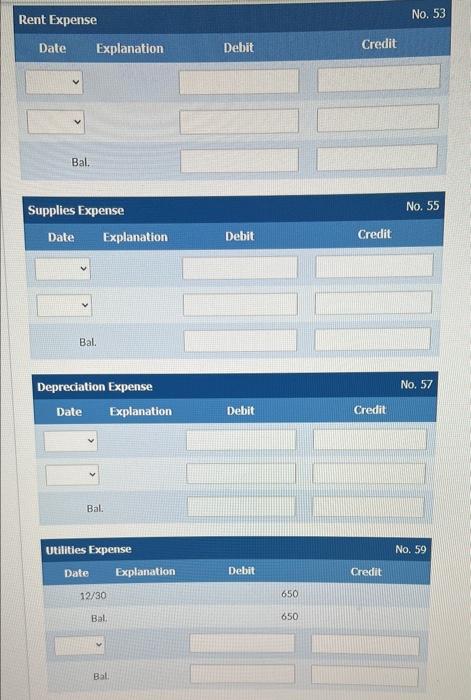

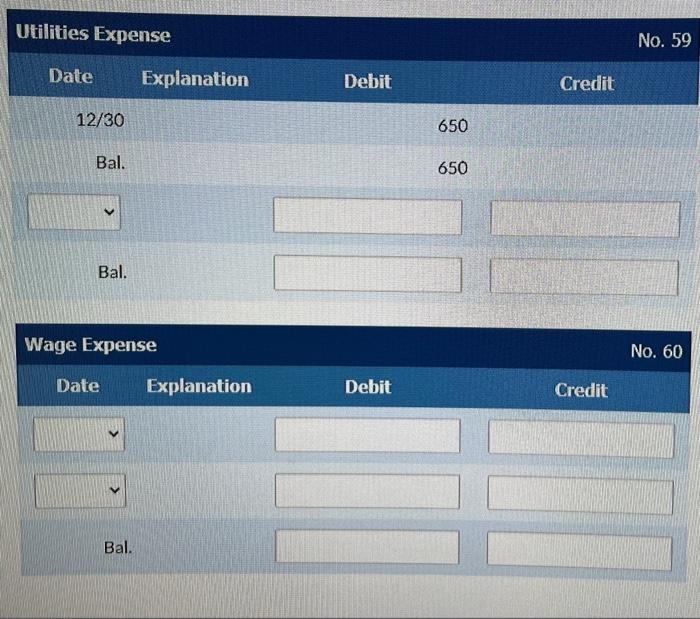

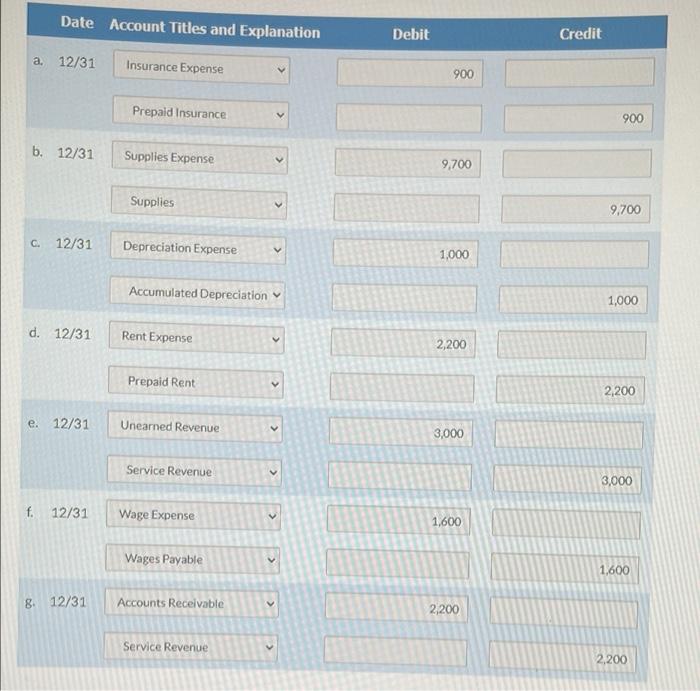

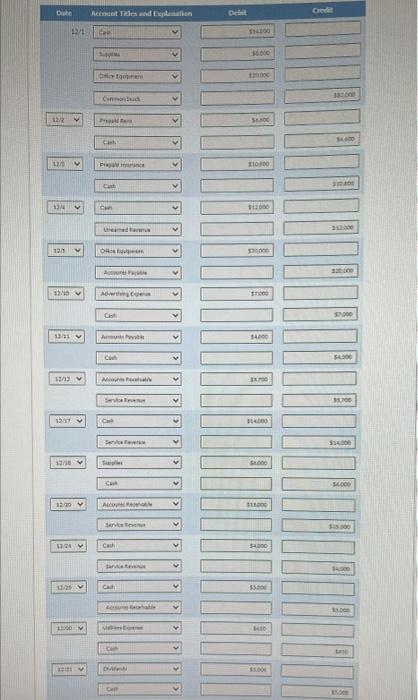

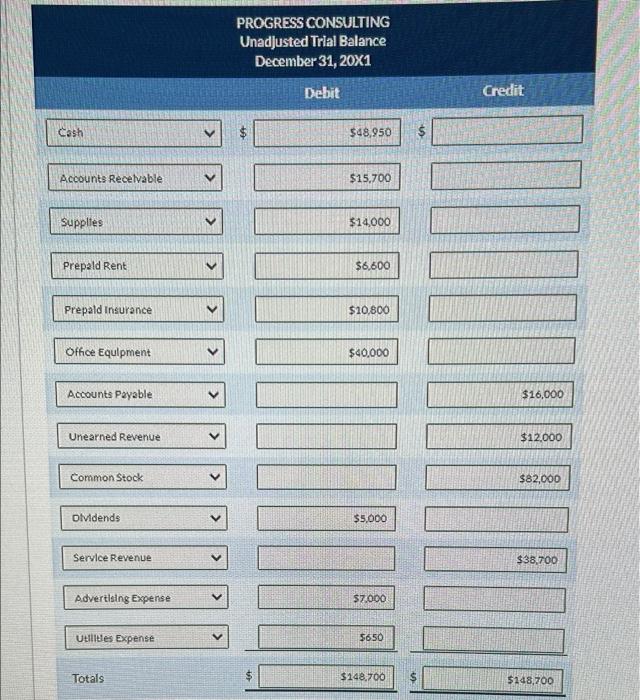

(e) Post Adjusting Journal Entries to T-Accounts ( Ledgers) Post the adjusting entries to the ledger. (Post entries in the order of Journal entry presented in the p Cash No. 11 Date Explanation Debit Credit 12/1 54,000 12/2 6,600 12/3 10,800 12/4 12,000 12/10 7,000 12/11 4,000 12/17 14,000 12/18 6,000 12/24 4,000 12/25 5,000 12/30 650 12/31 5,000 Bal. 48,950 Bal. No. 12 Accounts Receivable Date Explanation Debit Credit 12/12 5,700 12/20 15.000 5,000 12/25 Bal. 15.700 Bal Supplies No. 14 Date Explanation Debit Credit 12/1 8.000 12/18 6,000 Bal 14,000 Bal Prepaid Rent No. 15 Date Explanation Debit Credit 12/2 6,600 Bal 6600 Prepaid Insurance No. 17 Date Explanation Debit Credit 12/3 10.800 Bal 10.800 Ball No. 18 Office Equipment Date Explanation Debit Credit 12/1 20.000 12/5 20.000 Bal 40.000 Bal No. 19 Accumulated Depreciation Date Explanation Debit Credit Bal Accounts Payable No. 21 Date Explanation Debit Credit 1275 20.000 12/11 4.000 Bal 16,000 Bat No. 22 Wages Payable Date Explanation Debit Credit Bal. No. 23 Uncamed Revenue Date Explanation Debit Credit 12/4 12.000 Bal 12,000 Bal. Common Stock No. 31 Date Explanation Debit Credit 12/1 82,000 Bal 82.000 Bal Dividends No. 35 Date Explanation Debit Credit 12/31 5,000 Bal S1000 Service Revenue No. 41 Date Explanation Debit Credit 12/12 5,700 12/17 14,000 12/20 15,000 12/24 4,000 Bal. 38,700 > Bal. No. 51 Insurance Expense Date Explanation Debit Credit Bal Advertising Expense Date Explanation No. 52 Debit Credit 12/11 7.000 Bal 7.000 Bal Rent Expense No. 53 Date Explanation Debit Credit Bal. Supplies Expense No. 55 Date Explanation Debit Credit Bal. No. 57 Depreciation Expense Date Explanation Debit Credit Bal. Utilities Expense No. 59 Date Explanation Debit Credit 12/30 650 Bal 650 Bal Utilities Expense No. 59 Date Explanation Debit Credit 12/30 650 Bal. 650 Bal. Wage Expense No. 60 Date Explanation Debit Credit $10,800 Office Equipment $40,000 Accounts Payable $16,000 Unearned Revenue $12.000 Common Stock $82,000 Dividends $5,000 Service Revenue $38,700 Advertising Expense $7.000 Uullites Expense 5650 Totals $148,700 $148,700 (e) Post Adjusting Journal Entries to T-Accounts ( Ledgers) Post the adjusting entries to the ledger. (Post entries in the order of Journal entry presented in the p Cash No. 11 Date Explanation Debit Credit 12/1 54,000 12/2 6,600 12/3 10,800 12/4 12,000 12/10 7,000 12/11 4,000 12/17 14,000 12/18 6,000 12/24 4,000 12/25 5,000 12/30 650 12/31 5,000 Bal. 48,950 Bal. No. 12 Accounts Receivable Date Explanation Debit Credit 12/12 5,700 12/20 15.000 5,000 12/25 Bal. 15.700 Bal Supplies No. 14 Date Explanation Debit Credit 12/1 8.000 12/18 6,000 Bal 14,000 Bal Prepaid Rent No. 15 Date Explanation Debit Credit 12/2 6,600 Bal 6600 Prepaid Insurance No. 17 Date Explanation Debit Credit 12/3 10.800 Bal 10.800 Ball No. 18 Office Equipment Date Explanation Debit Credit 12/1 20.000 12/5 20.000 Bal 40.000 Bal No. 19 Accumulated Depreciation Date Explanation Debit Credit Bal Accounts Payable No. 21 Date Explanation Debit Credit 1275 20.000 12/11 4.000 Bal 16,000 Bat No. 22 Wages Payable Date Explanation Debit Credit Bal. No. 23 Uncamed Revenue Date Explanation Debit Credit 12/4 12.000 Bal 12,000 Bal. Common Stock No. 31 Date Explanation Debit Credit 12/1 82,000 Bal 82.000 Bal Dividends No. 35 Date Explanation Debit Credit 12/31 5,000 Bal S1000 Service Revenue No. 41 Date Explanation Debit Credit 12/12 5,700 12/17 14,000 12/20 15,000 12/24 4,000 Bal. 38,700 > Bal. No. 51 Insurance Expense Date Explanation Debit Credit Bal Advertising Expense Date Explanation No. 52 Debit Credit 12/11 7.000 Bal 7.000 Bal Rent Expense No. 53 Date Explanation Debit Credit Bal. Supplies Expense No. 55 Date Explanation Debit Credit Bal. No. 57 Depreciation Expense Date Explanation Debit Credit Bal. Utilities Expense No. 59 Date Explanation Debit Credit 12/30 650 Bal 650 Bal Utilities Expense No. 59 Date Explanation Debit Credit 12/30 650 Bal. 650 Bal. Wage Expense No. 60 Date Explanation Debit Credit $10,800 Office Equipment $40,000 Accounts Payable $16,000 Unearned Revenue $12.000 Common Stock $82,000 Dividends $5,000 Service Revenue $38,700 Advertising Expense $7.000 Uullites Expense 5650 Totals $148,700 $148,700

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts