Question: please do it with your best effort if u can if you can't do then leave it for some one else please do it with

please do it with your best effort if u can if you can't do then leave it for some one else please do it with your best way so that you get upvote

Accounting question!!!

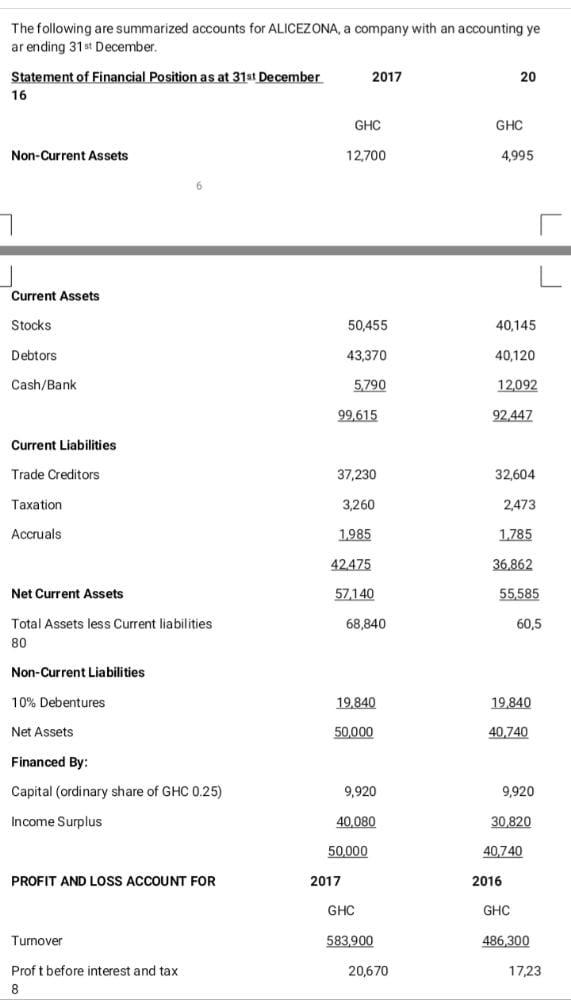

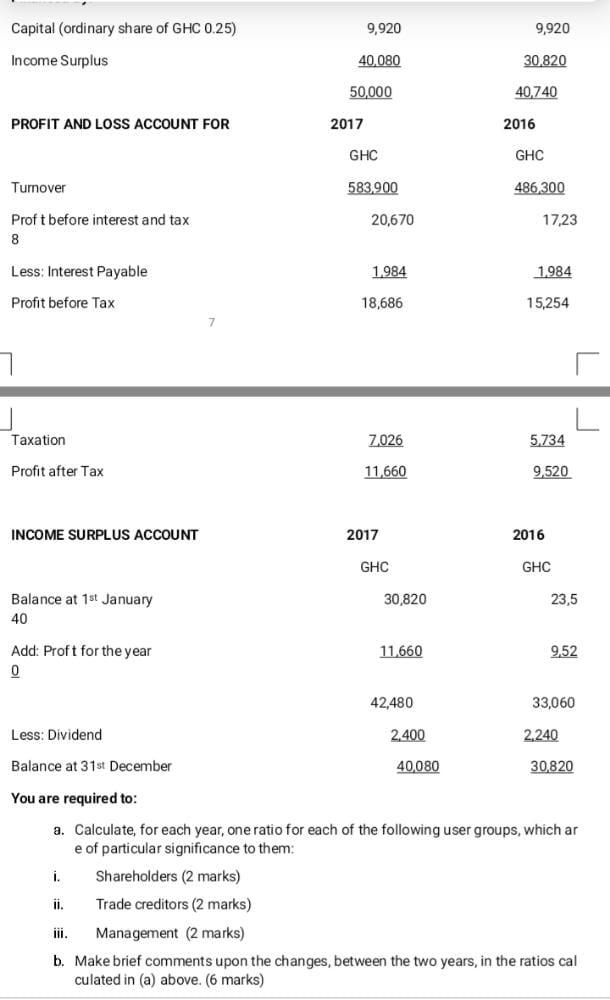

The following are summarized accounts for ALICEZONA, a company with an accounting ye ar ending 31st December 2017 20 Statement of Financial Position as at 31st December 16 GHC GHC Non-Current Assets 12,700 4,995 - Current Assets Stocks 50,455 40,145 Debtors 43,370 40,120 Cash/Bank 5790 12092 99,615 92.447 Current Liabilities Trade Creditors 37,230 32,604 Taxation 3,260 2,473 Accruals 1985 1.785 42475 36,862 Net Current Assets 57140 55585 68,840 60,5 Total Assets less Current liabilities 80 Non-Current Liabilities 10% Debentures 19.840 19,840 Net Assets 50,000 40,740 Financed By: Capital (ordinary share of GHC 0.25) 9,920 9,920 Income Surplus 40,080 30,820 50,000 40.740 PROFIT AND LOSS ACCOUNT FOR 2017 2016 GHC GHC Turnover 583,900 486,300 20,670 17,23 Proft before interest and tax 8 Capital (ordinary share of GHC 0.25) 9,920 9,920 Income Surplus 40,080 30.820 50,000 40,740 PROFIT AND LOSS ACCOUNT FOR 2017 2016 GHC GHC Turnover 583.900 486,300 20,670 17,23 Proft before interest and tax 8 Less: Interest Payable 1984 1984 Profit before Tax 18,686 15,254 7 L. L Taxation 2026 5,734 Profit after Tax 11,660 9,520 INCOME SURPLUS ACCOUNT 2017 2016 GHC GHC 30,820 23,5 Balance at 1st January 40 11,660 9.52 Add: Proft for the year 0 42,480 33,060 Less: Dividend 2.400 2.240 Balance at 31st December 40080 30,820 You are required to: a. Calculate for each year, one ratio for each of the following user groups, which ar e of particular significance to them: i. Shareholders (2 marks) ii. Trade creditors (2 marks) iii. Management (2 marks) b. Make brief comments upon the changes, between the two years, in the ratios cal culated in (a) above. (6 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts