Question: PLEASE DO J, K, L, & M be adjusted? I so, i. Does it appear that inventories could In 2014, the company paid its suppliers

PLEASE DO J, K, L, & M

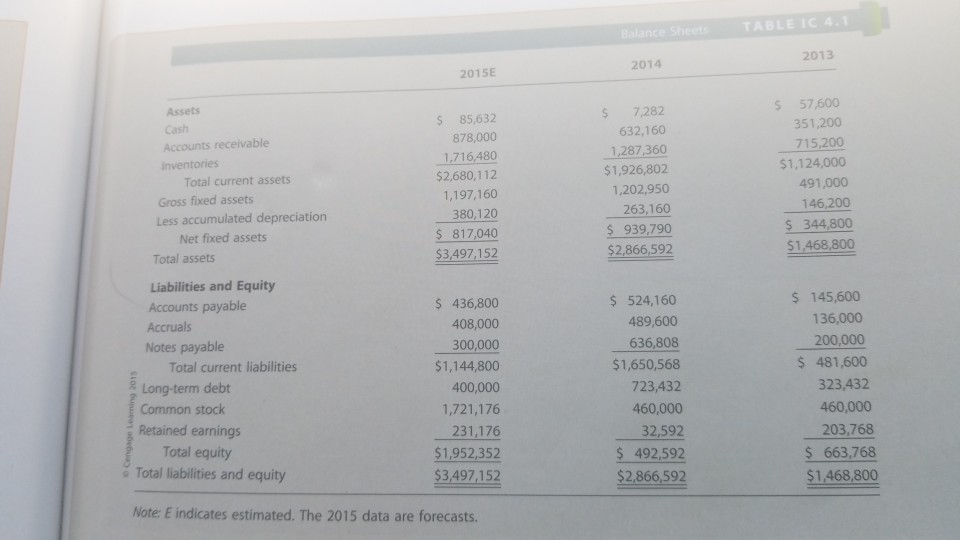

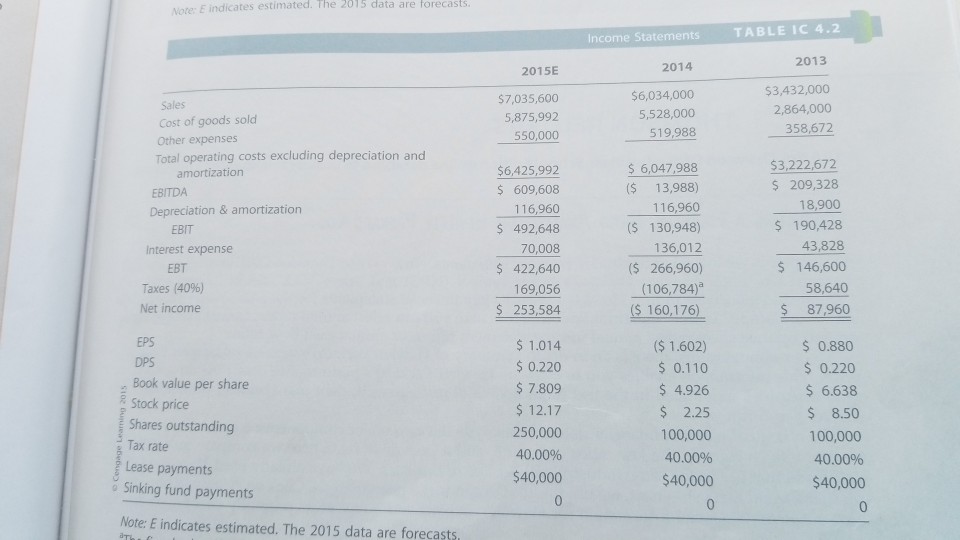

be adjusted? I so, i. Does it appear that inventories could In 2014, the company paid its suppliers much later than the due dates; also, it was not maintaining financial ratios at levels called for in its bank loan agreements. Therefore, suppliers could cut the company off, and its bank could refuse to renew the loan when it comes due in 90 days. On the basis of data provided, would you, as a cred sell on terms of COD-but that might cause D'Leon to stop buying from your company.) Similarly, if you were the bank loan officer, would you recommend renewing the loan or demanding its repayment? Would your actions be influenced if, in early 2015, D'Leon showed you its 2015 projections along with proof that it was going to raise more than $1.2 million of new equity? profitability and stock price? i. and cash on delivery-that is, it manager, continue to sell to D'Leon on credit? (You could dem k. In hindsight, what should D'Leon have done in 2013? L. What are some potential problems and limitations of financial ratio analysis? m. What are some qualitative factors that analysts should consider when evaluating a company's likely future financial performance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts