Question: please do line wise 1) The income statement debit column exceeds the income statement credit column on a worksheet. This indicates: A) a net income

please do line wise

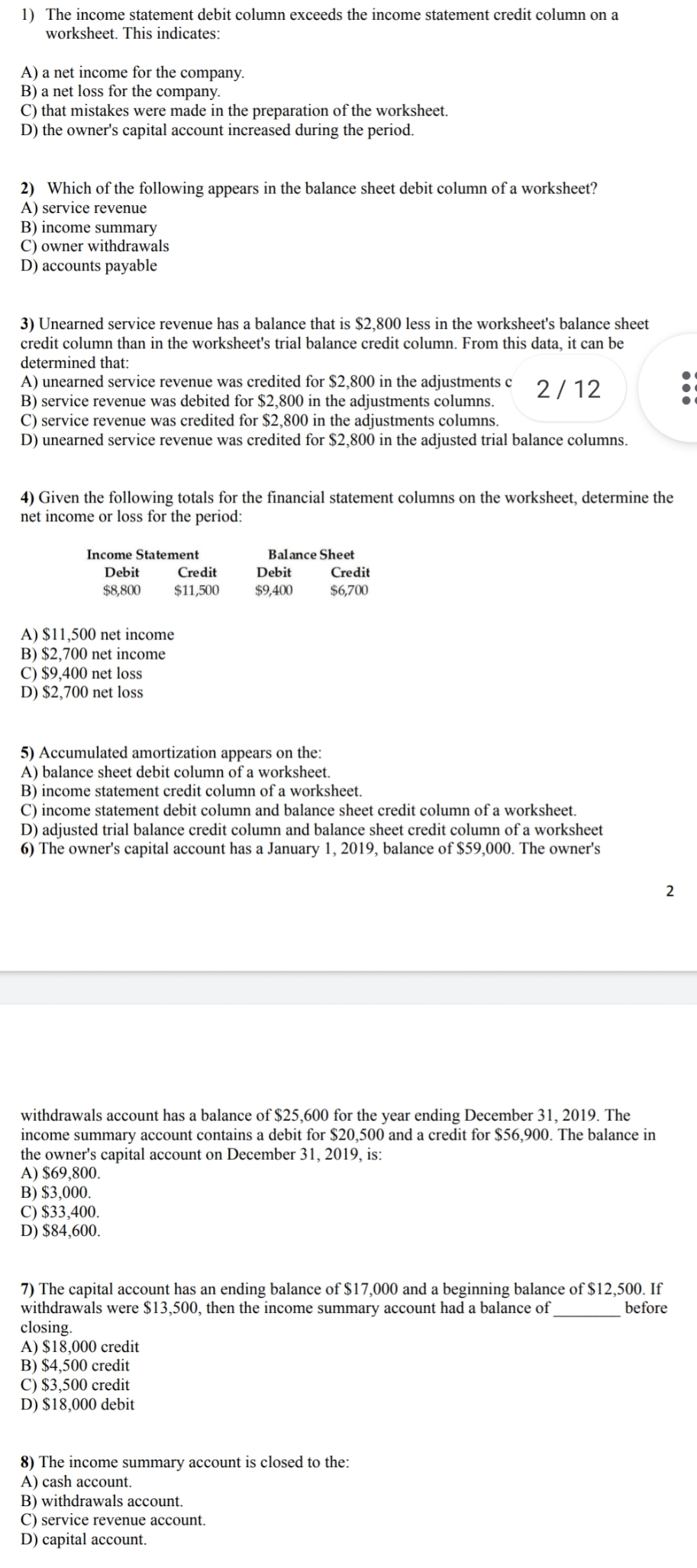

1) The income statement debit column exceeds the income statement credit column on a worksheet. This indicates: A) a net income for the company. B) a net loss for the company. C) that mistakes were made in the preparation of the worksheet. D) the owner's capital account increased during the period 2) Which of the following appears in the balance sheet debit column of a worksheet? A) service revenue B) income summary C) owner withdrawals D) accounts payable 3) Unearned service revenue has a balance that is $2,800 less in the worksheets balance sheet credit column than in the worksheets trial balance credit column. From this data, it can be determined that: A) unearned service revenue was credited for $2,800 in the adjustments c 2 / 1 2 :1 B) service revenue was debited for $2,800 in the adjustments columns. 0! C) service revenue was credited for $2,800 in the adjustments columns. D) unearned service revenue was credited for $2,800 in the adjusted trial balance columns. 4) Given the following totals for the nancial statement columns on the worksheet, determine the net income or loss for the period: Income Statement Balance Sheet Debit Credit Debit Credit \"SC\" $11,530 $9.400 56.70:) A) $1 1,500 net income B) $2,700 net income C) $9,400 net loss D) $2,700 net loss 5) Accumulated amortization appears on the: A) balance sheet debit column of a worksheet. B) income statement credit column of a worksheet. C) income statement debit column and balance sheet credit column of a worksheet. D) adjusted trial balance credit column and balance sheet credit column of a worksheet 6) The owner's capital account has a January 1, 20l9, balance of $59,000. The owner's withdrawals account has a balance of $25,600 for the year ending December 31, 2019. The income summary account contains a debit for $20,500 and a credit for $56,900. The balance in the owner's capital account on December 31, 2019, is: A) $69,800. B) $3,000. C) $33,400. D] $84,600. 7) The capital account has an ending balance of $17,000 and a beginning balance of $12,500. If withdrawals were $13,500, then the income summary account had a balance of before closing. A) $18,000 credit B) $4,500 credit C) $3,500 credit D) $18,000 debit 8) The income summary account is closed to the: A) cash account. B) withdrawals account. C) service revenue account. D) capital account