Question: Please do not answer by handwriting I will upvote it if your answer meets my requirements, thank you Question 1 Dragon LTD is a private

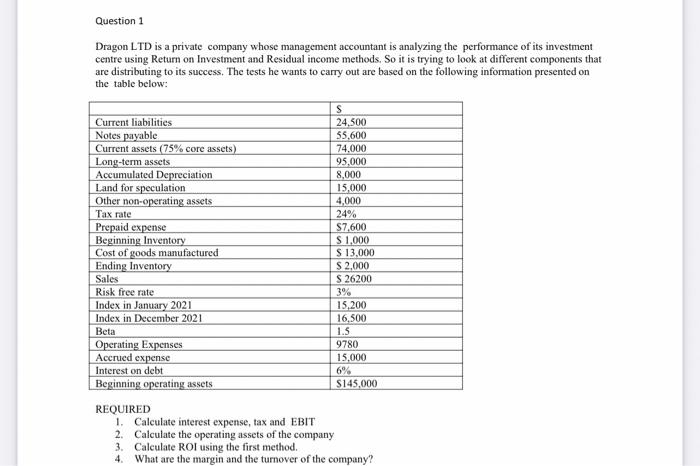

Question 1 Dragon LTD is a private company whose management accountant is analyzing the performance of its investment centre using Return on Investment and Residual income methods. So it is trying to look at different components that are distributing to its success. The tests he wants to carry out are based on the following information presented on the table below: S Current liabilities 24,500 Notes payable 55,600 Current assets (75% core assets) 74.000 Long-term assets 95,000 Accumulated Depreciation 8,000 Land for speculation 15,000 Other non-operating assets 4,000 Tax rate 24% Prepaid expense S7,600 Beginning Inventory S 1.000 Cost of goods manufactured $ 13,000 Ending Inventory $ 2,000 Sales S 26200 Risk free rate 3% Index in January 2021 15,200 Index in December 2021 16,500 Beta 1.5 Operating Expenses 9780 Accrued expense 15.000 Interest on debt 6% Beginning operating assets $145,000 REQUIRED 1. Calculate interest expense, tax and EBIT 2. Calculate the operating assets of the company 3. Calculate ROI using the first method. 4 What are the margin and the turnover of the company

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts