Question: Please do not answer if u can't show your calculation. Dirt-B-Gone Company manufacturers a professional grade vacuum cleaner and began operations in 2020. For 2020,

Please do not answer if u can't show your calculation.

Please do not answer if u can't show your calculation.

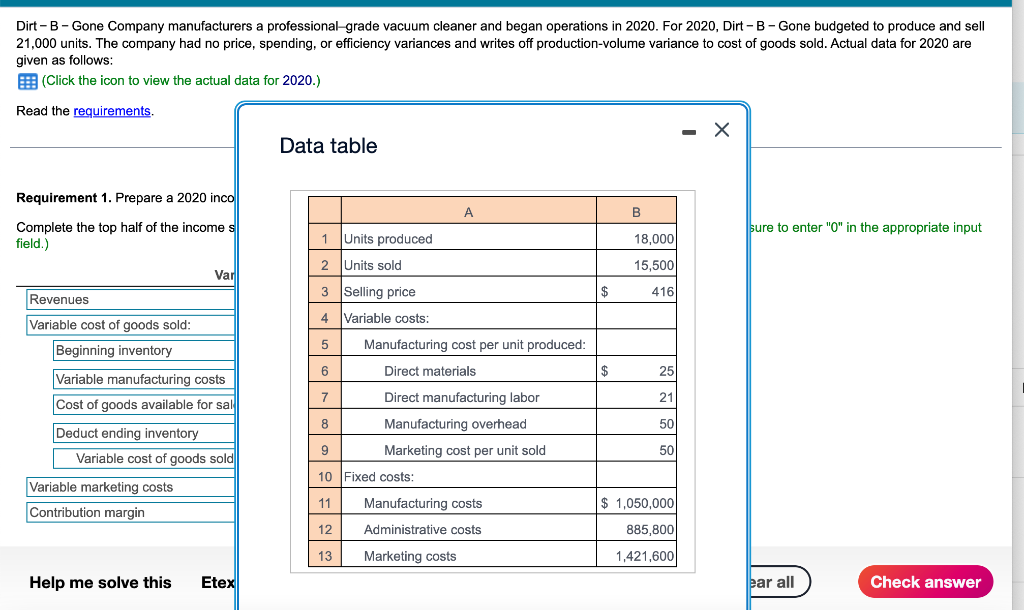

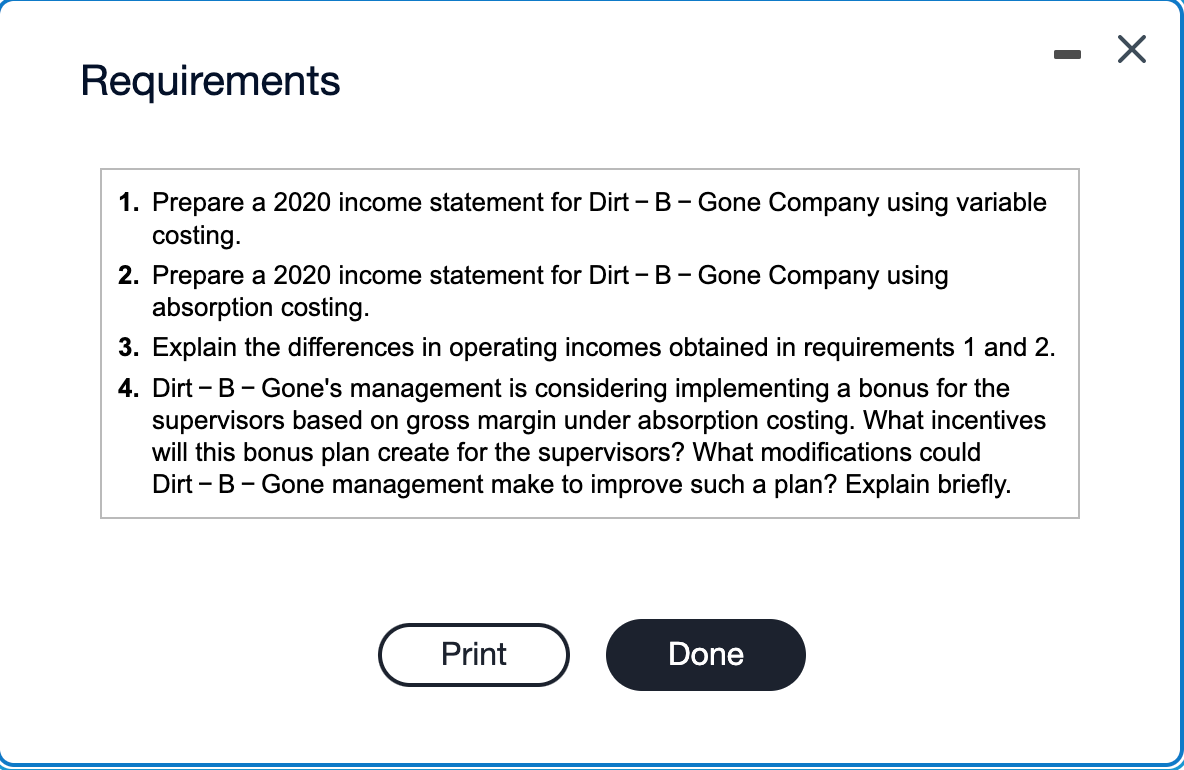

Dirt-B-Gone Company manufacturers a professional grade vacuum cleaner and began operations in 2020. For 2020, Dirt -B-Gone budgeted to produce and sell 21,000 units. The company had no price, spending, or efficiency variances and writes off production-volume variance to cost of goods sold. Actual data for 2020 are given as follows: 6 (Click the icon to view the actual data for 2020.) Read the requirements. Data table Requirement 1. Prepare a 2020 inco B Complete the top half of the incomes field.) sure to enter "O" in the appropriate input 18,000 1 Units produced 2 Units sold 15,500 Var 3 Selling price $ 416 4 Variable costs: Revenues Variable cost of goods sold: Beginning inventory 5 Manufacturing cost per unit produced: Direct materials 6 25 Variable manufacturing costs Cost of goods available for sal 7 Direct manufacturing labor 21 8 50 Deduct ending inventory Variable cost of goods sold Manufacturing overhead Marketing cost per unit sold 9 50 10 Fixed costs: Variable marketing costs Contribution margin 11 Manufacturing costs $ 1,050,000 12 Administrative costs 885,800 13 Marketing costs 1,421,600 Help me solve this Etex lear all Check answer Requirements 1. Prepare a 2020 income statement for Dirt -B-Gone Company using variable costing. 2. Prepare a 2020 income statement for Dirt - B - Gone Company using absorption costing. 3. Explain the differences in operating incomes obtained in requirements 1 and 2. 4. Dirt - B - Gone's management is considering implementing a bonus for the supervisors based on gross margin under absorption costing. What incentives will this bonus plan create for the supervisors? What modifications could Dirt - B - Gone management make to improve such a plan? Explain briefly. Print Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts