Question: PLEASE DO NOT ANSWER IF YOU ARE NOT GOING TO PROPERLY ANSWER THE QUESTION!! Construct SPREADSHEET!! BULLOCK GOLD MINING anwing 20 sercknt required retum on

PLEASE DO NOT ANSWER IF YOU ARE NOT GOING TO PROPERLY ANSWER THE QUESTION!! Construct SPREADSHEET!!

PLEASE DO NOT ANSWER IF YOU ARE NOT GOING TO PROPERLY ANSWER THE QUESTION!! Construct SPREADSHEET!!

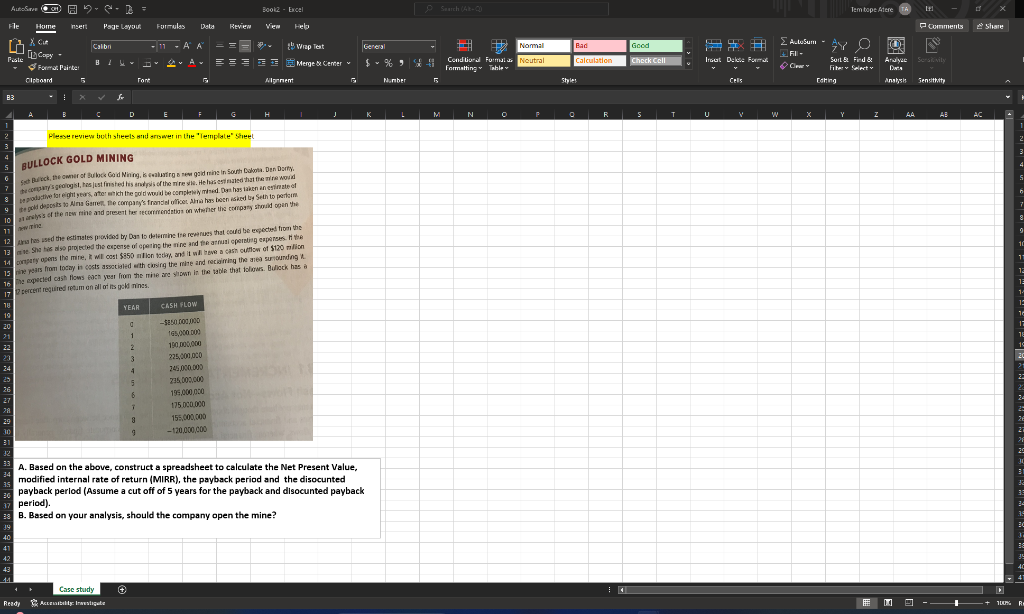

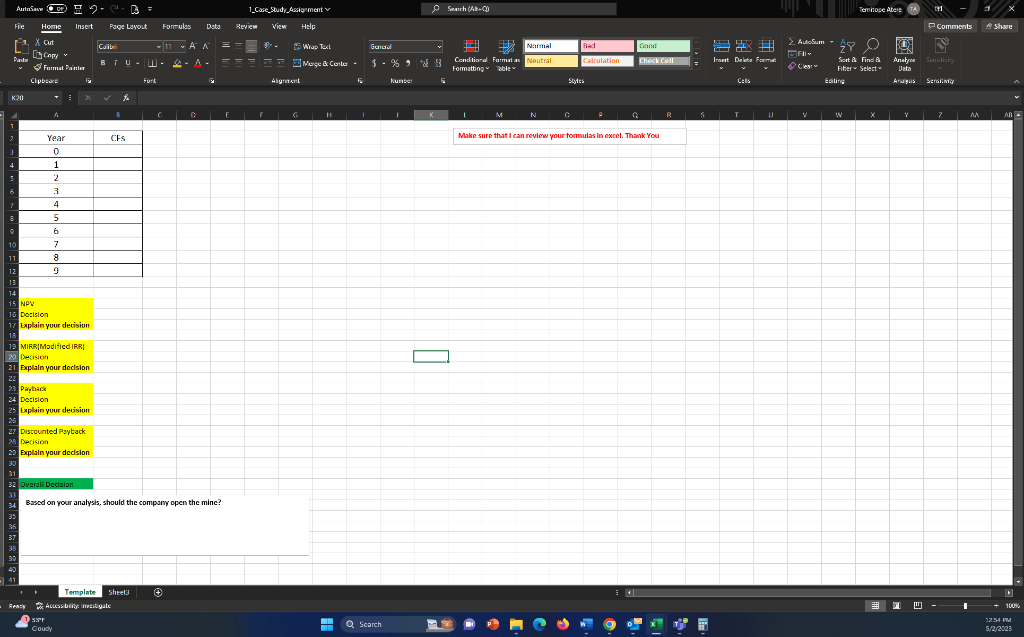

BULLOCK GOLD MINING anwing 20 sercknt required retum on all on its gabl nimes. A. Based on the above, construct a spreadsheet to calculate the Net Present Value, modified internal rate of return (MIRR), the payback period and the disocunted payback period (Assume a cut off of 5 years for the payback and disocunted payback period). B. Based on your analysis, should the company open the mine? Make sure that I can review your tomvulas in excel. Thank You NPN Dazision Explinin your detision MIRR|Modified IRR| Detision Explain your declsion Paylaack Dazision Explain your detisiun Discounted Peytack Derision Explaln your declsion Oversil Decisian Based on your analysis, should the company open the mine? BULLOCK GOLD MINING anwing 20 sercknt required retum on all on its gabl nimes. A. Based on the above, construct a spreadsheet to calculate the Net Present Value, modified internal rate of return (MIRR), the payback period and the disocunted payback period (Assume a cut off of 5 years for the payback and disocunted payback period). B. Based on your analysis, should the company open the mine? Make sure that I can review your tomvulas in excel. Thank You NPN Dazision Explinin your detision MIRR|Modified IRR| Detision Explain your declsion Paylaack Dazision Explain your detisiun Discounted Peytack Derision Explaln your declsion Oversil Decisian Based on your analysis, should the company open the mine

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts