Question: PLEASE DO NOT ANSWER IN EXCEL! PLEASE WRITE OUT OR TYPE OUT FORMULAS WITH WORK 1.) Phil & Co is evaluating a new business opportunity.

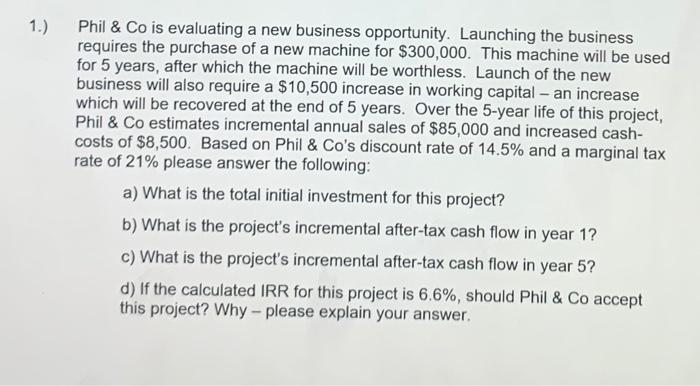

1.) Phil & Co is evaluating a new business opportunity. Launching the business requires the purchase of a new machine for $300,000. This machine will be used for 5 years, after which the machine will be worthless. Launch of the new business will also require a $10,500 increase in working capital - an increase which will be recovered at the end of 5 years. Over the 5-year life of this project, Phil & Co estimates incremental annual sales of $85,000 and increased cash- costs of $8,500. Based on Phil & Co's discount rate of 14.5% and a marginal tax rate of 21% please answer the following: a) What is the total initial investment for this project? b) What is the project's incremental after-tax cash flow in year 1? c) What is the project's incremental after-tax cash flow in year 5? d) If the calculated IRR for this project is 6.6%, should Phil & Co accept this project? Why - please explain your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts