Question: Please do not answer the first question. There are several afterwards. I need help with those. Bb Module 2: Investments-19SP.X AOL Mail (731) C U3

Please do not answer the first question. There are several afterwards. I need help with those.

Please do not answer the first question. There are several afterwards. I need help with those.

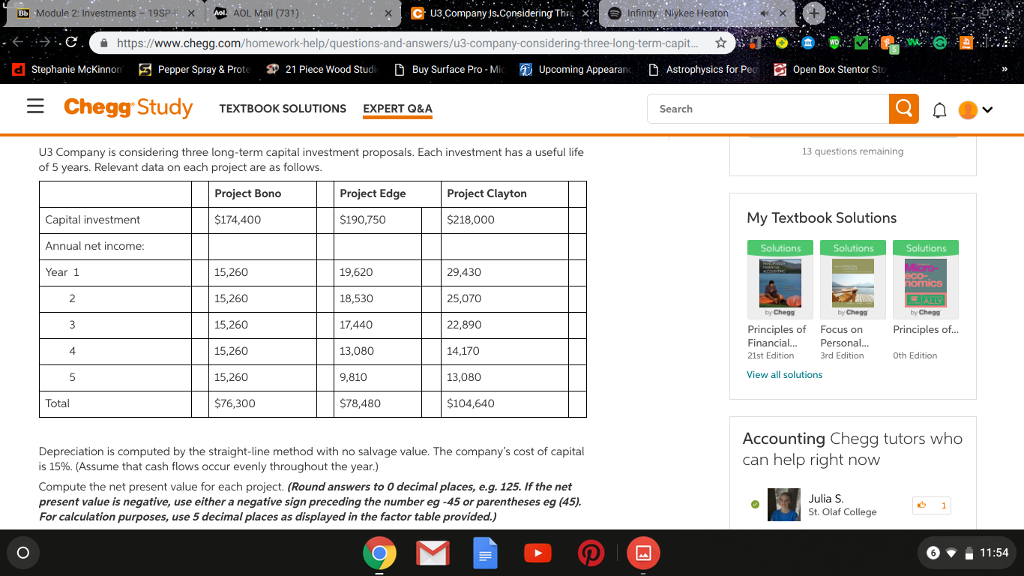

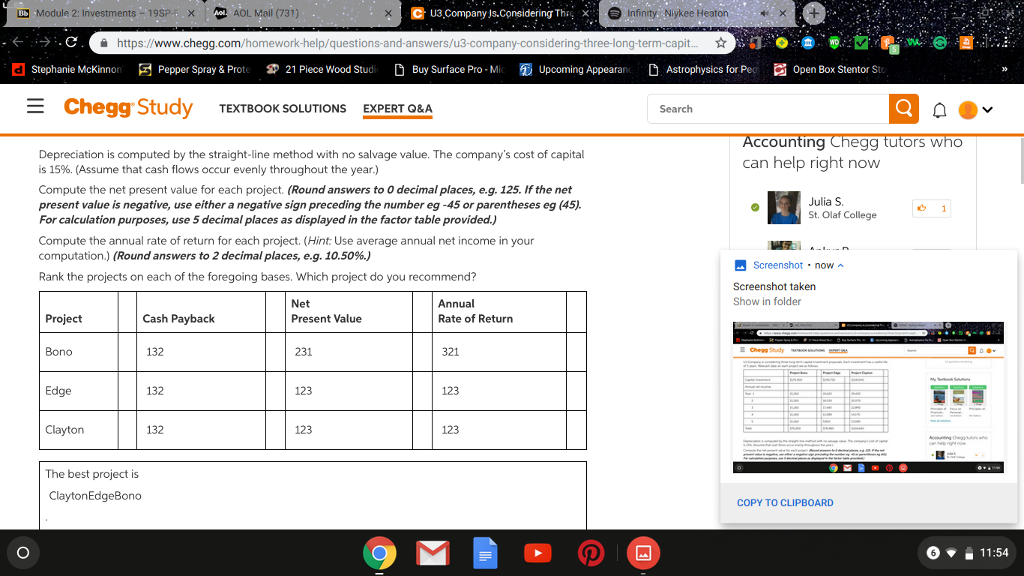

Bb Module 2: Investments-19SP.X AOL Mail (731) C U3 Company Js.Considering Thi x S Infinity. Niykee Heaton , Chttps://www.chegg.com/homework-help/questions-and-answers/u3-company-considering-three-long-term-capit. Stephanie McKinno Pepper Spray & Prot 21 Piece Wood Stud Buy Surface Pro Mi Upcoming Appeara D Astrophysics for Pe 0pen Box Stentor St Chegg Study TEXTBOOK SOLUTIONS EXPERT Q&A Search U3 Company is considering three long-term capital investment proposals. Each investment has a useful life of 5 years. Relevant data on each project are as follows. 13 questions remaining Project Bono Project Edge Project Clayton My Textbook Solutions Capital investment Annual net income: Year 1 $174,400 $190,750 $218,000 15,260 15,260 15,260 15,260 15,260 $76,300 19,620 18,530 17,440 13,080 9,810 $78,480 29,430 25,070 22,890 14,170 13,080 $104,640 by Chegg by Chegg by Chegg Principles of Focus onPrinciples of.. Financia... Personal... 21st Edition 4 rd Edition Oth Edition View all solutions Total Accounting Chegg tutors who can help right now Depreciation is computed by the straight-line method with no salvage value. The company's cost of capital is 15%. (Assume that cash flows occur evenly throughout the year.) Compute the net present value for each project. (Round answers to o decimal places, e.g. 125. If the net present value is negative, use either a negative sign preceding the number eg -45 or parentheses eg (45) For calculation purposes, use 5 decimal places as displayed in the factor table provided.,) Julia S St. Olaf College 611:54 Bb Module 2: Investments-19SP.X x AOL Mail (731) C U3 Company Js.Considering Thi x S Infinity. Niykee Heaton Chttps://www.chegg.com/homework-help/questions-and-answers/u3-company-considering-three-long-term-capit. Stephanie McKinno Pepper Spray & Prot 21 Piece Wood Stud Buy Surface Pro Mi Upcoming Appeara D Astrophysics for Pe 0pen Box Stentor St E Chegg Study TEXTBOOK SOLUTIONS EXPERT Q&A Search ccounting Chegg tutors who can help right now Depreciation is computed by the straight-line method with no salvage value. The company's cost of capital is 15%. (Assume that cash flows occur evenly throughout the year.) Compute the net present value for each project. (Round answers to O decimal places, e.g. 125. If the net present value is negative, use either a negative sign preceding the number eg -45 or parentheses eg (45) For calculation purposes, use 5 decimal places as displayed in the factor table provided.,) Compute the annual rate of return for each project. (Hint: Use average annual net income in your computation) (Round answers to 2 decimal places, e.g. 10.50%.) Rank the projects on each of the foregoing bases. Which project do you recommend? Julia S. St. Olaf College Screenshot now Screenshot taken Show in folder Net Present Value Annual Rate of Return Project Cash Payback Bono 132 231 321 Edge 132 123 123 Clayton 132 123 123 The best project is ClaytonEdgeBono COPY TO CLIPBOARD o . 11:54 Bb Module 2: Investments-19SP.X AOL Mail (731) C U3 Company Js.Considering Thi x S Infinity. Niykee Heaton , Chttps://www.chegg.com/homework-help/questions-and-answers/u3-company-considering-three-long-term-capit. Stephanie McKinno Pepper Spray & Prot 21 Piece Wood Stud Buy Surface Pro Mi Upcoming Appeara D Astrophysics for Pe 0pen Box Stentor St Chegg Study TEXTBOOK SOLUTIONS EXPERT Q&A Search U3 Company is considering three long-term capital investment proposals. Each investment has a useful life of 5 years. Relevant data on each project are as follows. 13 questions remaining Project Bono Project Edge Project Clayton My Textbook Solutions Capital investment Annual net income: Year 1 $174,400 $190,750 $218,000 15,260 15,260 15,260 15,260 15,260 $76,300 19,620 18,530 17,440 13,080 9,810 $78,480 29,430 25,070 22,890 14,170 13,080 $104,640 by Chegg by Chegg by Chegg Principles of Focus onPrinciples of.. Financia... Personal... 21st Edition 4 rd Edition Oth Edition View all solutions Total Accounting Chegg tutors who can help right now Depreciation is computed by the straight-line method with no salvage value. The company's cost of capital is 15%. (Assume that cash flows occur evenly throughout the year.) Compute the net present value for each project. (Round answers to o decimal places, e.g. 125. If the net present value is negative, use either a negative sign preceding the number eg -45 or parentheses eg (45) For calculation purposes, use 5 decimal places as displayed in the factor table provided.,) Julia S St. Olaf College 611:54 Bb Module 2: Investments-19SP.X x AOL Mail (731) C U3 Company Js.Considering Thi x S Infinity. Niykee Heaton Chttps://www.chegg.com/homework-help/questions-and-answers/u3-company-considering-three-long-term-capit. Stephanie McKinno Pepper Spray & Prot 21 Piece Wood Stud Buy Surface Pro Mi Upcoming Appeara D Astrophysics for Pe 0pen Box Stentor St E Chegg Study TEXTBOOK SOLUTIONS EXPERT Q&A Search ccounting Chegg tutors who can help right now Depreciation is computed by the straight-line method with no salvage value. The company's cost of capital is 15%. (Assume that cash flows occur evenly throughout the year.) Compute the net present value for each project. (Round answers to O decimal places, e.g. 125. If the net present value is negative, use either a negative sign preceding the number eg -45 or parentheses eg (45) For calculation purposes, use 5 decimal places as displayed in the factor table provided.,) Compute the annual rate of return for each project. (Hint: Use average annual net income in your computation) (Round answers to 2 decimal places, e.g. 10.50%.) Rank the projects on each of the foregoing bases. Which project do you recommend? Julia S. St. Olaf College Screenshot now Screenshot taken Show in folder Net Present Value Annual Rate of Return Project Cash Payback Bono 132 231 321 Edge 132 123 123 Clayton 132 123 123 The best project is ClaytonEdgeBono COPY TO CLIPBOARD o . 11:54

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts