Question: please do not answer using excel Please show the full steps (keep six decimal places for the final answer) An Italian bank holds a large

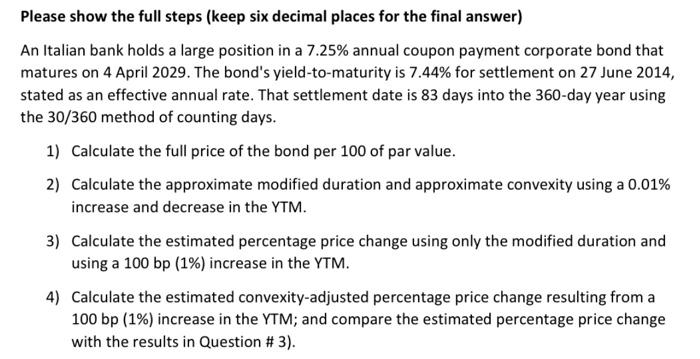

Please show the full steps (keep six decimal places for the final answer) An Italian bank holds a large position in a 7.25% annual coupon payment corporate bond that matures on 4 April 2029. The bond's yield-to-maturity is 7.44% for settlement on 27 June 2014, stated as an effective annual rate. That settlement date is 83 days into the 360-day year using the 30/360 method of counting days. 1) Calculate the full price of the bond per 100 of par value. 2) Calculate the approximate modified duration and approximate convexity using a 0.01% increase and decrease in the YTM. 3) Calculate the estimated percentage price change using only the modified duration and using a 100 bp (1%) increase in the YTM. 4) Calculate the estimated convexity-adjusted percentage price change resulting from a 100 bp (1%) increase in the YTM; and compare the estimated percentage price change with the results in Question # 3). Please show the full steps (keep six decimal places for the final answer) An Italian bank holds a large position in a 7.25% annual coupon payment corporate bond that matures on 4 April 2029. The bond's yield-to-maturity is 7.44% for settlement on 27 June 2014, stated as an effective annual rate. That settlement date is 83 days into the 360-day year using the 30/360 method of counting days. 1) Calculate the full price of the bond per 100 of par value. 2) Calculate the approximate modified duration and approximate convexity using a 0.01% increase and decrease in the YTM. 3) Calculate the estimated percentage price change using only the modified duration and using a 100 bp (1%) increase in the YTM. 4) Calculate the estimated convexity-adjusted percentage price change resulting from a 100 bp (1%) increase in the YTM; and compare the estimated percentage price change with the results in Question # 3)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts