Question: please DO NOT answer using excel, use hand written formuals instead and show all work. thank you! Problem 2 (15 points) The four alternatives described

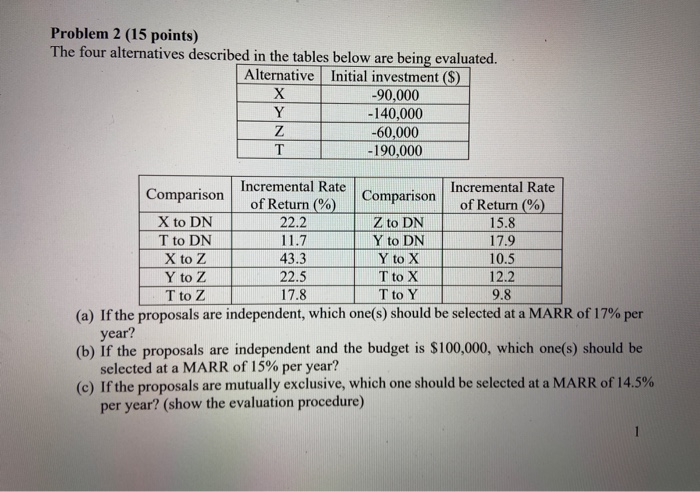

Problem 2 (15 points) The four alternatives described in the tables below are being evaluated. Alternative Initial investment ($) x | -90,000 Y -140,000 Z -60,000 -190,000 Comparison Incremental Rate Comparison on Incremental Rate of Return (%) of Return (%) X to DN 22.2 Z to DN 15.8 T to DN 11.7 Y to DN 17.9 X to Z 43.3 Y to X 10.5 Y to Z 22.5 T to X 12.2. T to Z 17.8 T to Y 9.8 (a) If the proposals are independent, which one(s) should be selected at a MARR of 17% per year? (b) If the proposals are independent and the budget is $100,000, which one(s) should be selected at a MARR of 15% per year? (c) If the proposals are mutually exclusive, which one should be selected at a MARR of 14.5% per year? (show the evaluation procedure) Problem 2 (15 points) The four alternatives described in the tables below are being evaluated. Alternative Initial investment ($) x | -90,000 Y -140,000 Z -60,000 -190,000 Comparison Incremental Rate Comparison on Incremental Rate of Return (%) of Return (%) X to DN 22.2 Z to DN 15.8 T to DN 11.7 Y to DN 17.9 X to Z 43.3 Y to X 10.5 Y to Z 22.5 T to X 12.2. T to Z 17.8 T to Y 9.8 (a) If the proposals are independent, which one(s) should be selected at a MARR of 17% per year? (b) If the proposals are independent and the budget is $100,000, which one(s) should be selected at a MARR of 15% per year? (c) If the proposals are mutually exclusive, which one should be selected at a MARR of 14.5% per year? (show the evaluation procedure)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts