Question: please do not answer using excell. - The project requires use of an existing warehouse that the firm acquired 4 years ago for $2.2 million

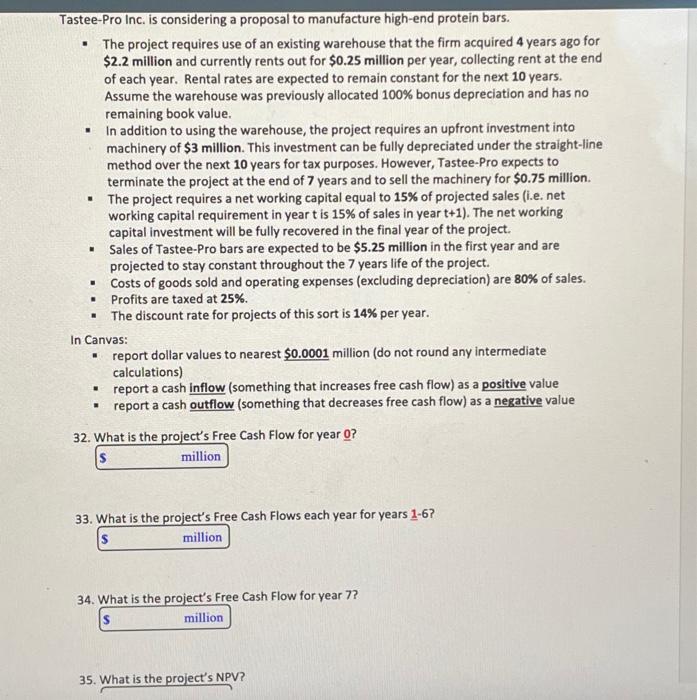

- The project requires use of an existing warehouse that the firm acquired 4 years ago for $2.2 million and currently rents out for $0.25 million per year, collecting rent at the end of each year. Rental rates are expected to remain constant for the next 10 years. Assume the warehouse was previously allocated 100% bonus depreciation and has no remaining book value. - In addition to using the warehouse, the project requires an upfront investment into machinery of $3 million. This investment can be fully depreciated under the straight-line method over the next 10 years for tax purposes. However, Tastee-Pro expects to terminate the project at the end of 7 years and to sell the machinery for $0.75 million. - The project requires a net working capital equal to 15% of projected sales (i.e. net working capital requirement in year t is 15% of sales in year t+1 ). The net working capital investment will be fully recovered in the final year of the project. - Sales of Tastee-Pro bars are expected to be $5.25 million in the first year and are projected to stay constant throughout the 7 years life of the project. - Costs of goods sold and operating expenses (excluding depreciation) are 80% of sales. - Profits are taxed at 25%. - The discount rate for projects of this sort is 14% per year. In Canvas: - report dollar values to nearest $0.0001 million (do not round any intermediate calculations) - report a cash inflow (something that increases free cash flow) as a positive value - report a cash outflow (something that decreases free cash flow) as a negative value 32. What is the project's Free Cash Flow for year ? ? 33. What is the project's Free Cash Flows each year for years 16 ? 34. What is the project's Free Cash Flow for year 7 ? 35. What is the project's NPV? - The project requires use of an existing warehouse that the firm acquired 4 years ago for $2.2 million and currently rents out for $0.25 million per year, collecting rent at the end of each year. Rental rates are expected to remain constant for the next 10 years. Assume the warehouse was previously allocated 100% bonus depreciation and has no remaining book value. - In addition to using the warehouse, the project requires an upfront investment into machinery of $3 million. This investment can be fully depreciated under the straight-line method over the next 10 years for tax purposes. However, Tastee-Pro expects to terminate the project at the end of 7 years and to sell the machinery for $0.75 million. - The project requires a net working capital equal to 15% of projected sales (i.e. net working capital requirement in year t is 15% of sales in year t+1 ). The net working capital investment will be fully recovered in the final year of the project. - Sales of Tastee-Pro bars are expected to be $5.25 million in the first year and are projected to stay constant throughout the 7 years life of the project. - Costs of goods sold and operating expenses (excluding depreciation) are 80% of sales. - Profits are taxed at 25%. - The discount rate for projects of this sort is 14% per year. In Canvas: - report dollar values to nearest $0.0001 million (do not round any intermediate calculations) - report a cash inflow (something that increases free cash flow) as a positive value - report a cash outflow (something that decreases free cash flow) as a negative value 32. What is the project's Free Cash Flow for year ? ? 33. What is the project's Free Cash Flows each year for years 16 ? 34. What is the project's Free Cash Flow for year 7 ? 35. What is the project's NPV

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts