Question: Please do not answer with screenshots, Please provide work and answers in spreadsheet format, Thank you! 2.Use the information from Exercise 12 - 11.Assume the

Please do not answer with screenshots, Please provide work and answers in spreadsheet format, Thank you!

2.Use the information from Exercise 12 - 11.Assume the lease is correctly classified as a financing lease.

a.Prepare the journal entry to recognize the right to use asset and lease liability at commencement of the lease

b.Prepare the amortization table showing the annual interest expense and principal reduction.

c.What amount of amortization expense would be recognized each year for the leased asset?

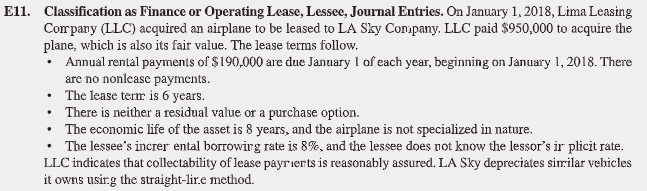

Ell. Classification as Finance or Operating Lease, Lessee, Journal Entries. On January 1, 2018, Lima Leasing Company (LLC) acquired an airplane to be leased to LA Sky Company. LLC paid $950,000 to acquire the plane, which is also its fair value. The lease terms follow. . Annual rental payments of $190,000 are due January 1 of each year, beginning on January 1, 2018. There are no nonlease payments. The lease term is 6 years. There is neither a residual value or a purchase option. The economic life of the asset is 8 years, and the airplane is not specialized in nature. . The lessee's increr ental borrowing rate is $%, and the lessee does not know the lessor's ir plicit rate. LLC indicates that collectability of lease payrierts is reasonably assured. LA Sky depreciates similar vehicles it owns using the straight-line method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts