Question: Please do not copy and paste from other Chegg account's answers. I need answers or formulas to questions #1-6 and #1-2 of analyzing the balance

Please do not copy and paste from other Chegg account's answers. I need answers or formulas to questions #1-6 and #1-2 of analyzing the balance sheets.

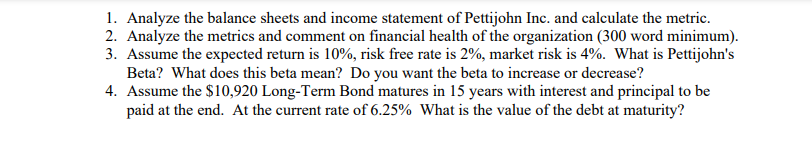

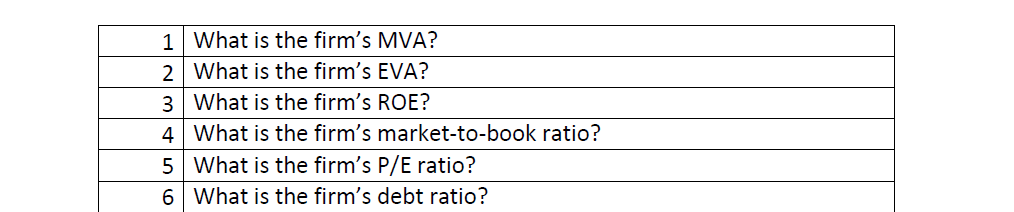

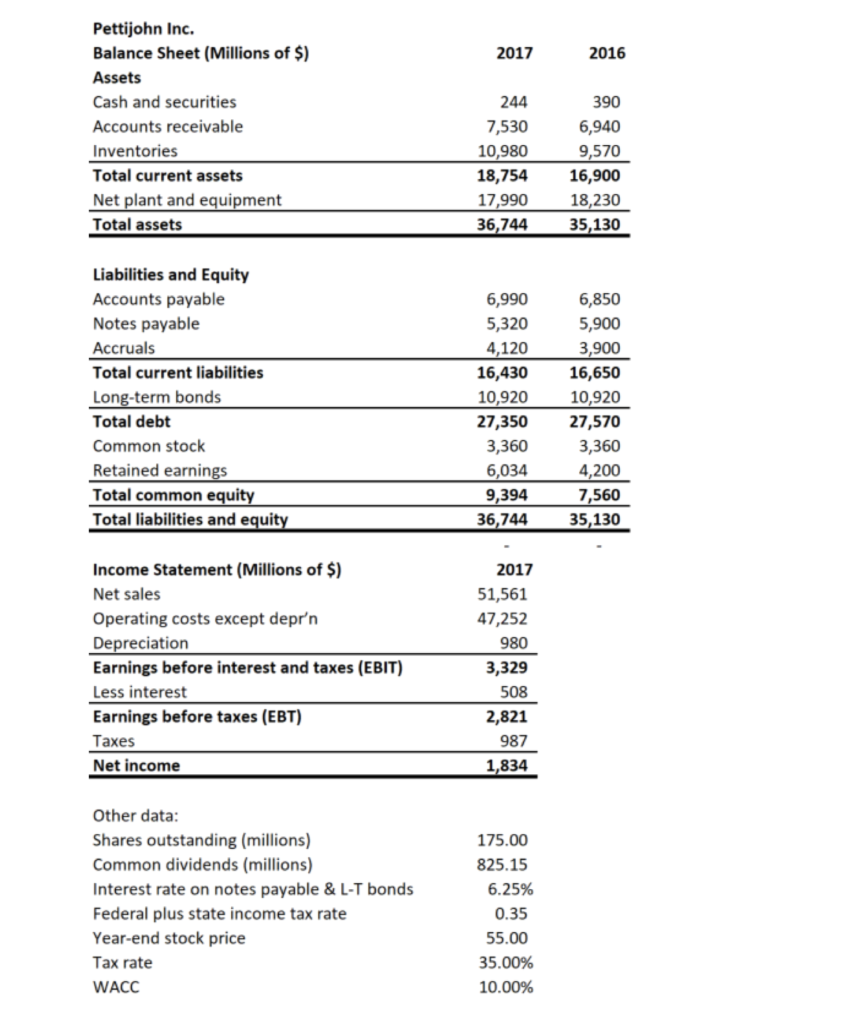

1. Analyze the balance sheets and income statement of Pettijohn Inc. and calculate the metric. 2. Analyze the metrics and comment on financial health of the organization (300 word minimum). 3. Assume the expected return is 10%, risk free rate is 2%, market risk is 4%. What is Pettijohn's Beta? What does this beta mean? Do you want the beta to increase or decrease? 4. Assume the $10,920 Long-Term Bond matures in 15 years with interest and principal to be paid at the end. At the current rate of 6.25% What is the value of the debt at maturity? 1 What is the firm's MVA? 2 What is the firm's EVA? 3 What is the firm's ROE? 4 What is the firm's market-to-book ratio? 5 What is the firm's P/E ratio? 6 What is the firm's debt ratio? 2017 2016 Pettijohn Inc. Balance Sheet (Millions of $) Assets Cash and securities Accounts receivable Inventories Total current assets Net plant and equipment Total assets 244 7,530 10,980 18,754 17,990 36,744 390 6,940 9,570 16,900 18,230 35,130 Liabilities and Equity Accounts payable Notes payable Accruals Total current liabilities Long-term bonds Total debt Common stock Retained earnings Total common equity Total liabilities and equity 6,990 5,320 4,120 16,430 10,920 27,350 3,360 6,034 9,394 36,744 6,850 5,900 3,900 16,650 10,920 27,570 3,360 4,200 7,560 35,130 Income Statement (Millions of $) Net sales Operating costs except depr'n Depreciation Earnings before interest and taxes (EBIT) Less interest Earnings before taxes (EBT) Taxes Net income 2017 51,561 47,252 980 3,329 508 2,821 987 1,834 Other data: Shares outstanding (millions) Common dividends (millions) Interest rate on notes payable & L-T bonds Federal plus state income tax rate Year-end stock price Tax rate WACC 175.00 825.15 6.25% 0.35 55.00 35.00% 10.00% 1. Analyze the balance sheets and income statement of Pettijohn Inc. and calculate the metric. 2. Analyze the metrics and comment on financial health of the organization (300 word minimum). 3. Assume the expected return is 10%, risk free rate is 2%, market risk is 4%. What is Pettijohn's Beta? What does this beta mean? Do you want the beta to increase or decrease? 4. Assume the $10,920 Long-Term Bond matures in 15 years with interest and principal to be paid at the end. At the current rate of 6.25% What is the value of the debt at maturity? 1 What is the firm's MVA? 2 What is the firm's EVA? 3 What is the firm's ROE? 4 What is the firm's market-to-book ratio? 5 What is the firm's P/E ratio? 6 What is the firm's debt ratio? 2017 2016 Pettijohn Inc. Balance Sheet (Millions of $) Assets Cash and securities Accounts receivable Inventories Total current assets Net plant and equipment Total assets 244 7,530 10,980 18,754 17,990 36,744 390 6,940 9,570 16,900 18,230 35,130 Liabilities and Equity Accounts payable Notes payable Accruals Total current liabilities Long-term bonds Total debt Common stock Retained earnings Total common equity Total liabilities and equity 6,990 5,320 4,120 16,430 10,920 27,350 3,360 6,034 9,394 36,744 6,850 5,900 3,900 16,650 10,920 27,570 3,360 4,200 7,560 35,130 Income Statement (Millions of $) Net sales Operating costs except depr'n Depreciation Earnings before interest and taxes (EBIT) Less interest Earnings before taxes (EBT) Taxes Net income 2017 51,561 47,252 980 3,329 508 2,821 987 1,834 Other data: Shares outstanding (millions) Common dividends (millions) Interest rate on notes payable & L-T bonds Federal plus state income tax rate Year-end stock price Tax rate WACC 175.00 825.15 6.25% 0.35 55.00 35.00% 10.00%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts